The Vietnamese stock market witnessed a strong rebound after a deep decline, with the VN-Index closing 6/8 with a gain of 22 points (equivalent to 1.78%) to 1,210 points. However, liquidity narrowed as the trading value on HOSE reached just over VND 16,300 billion. Foreign trading was a downside, as they net sold nearly VND 755 billion on the entire market.

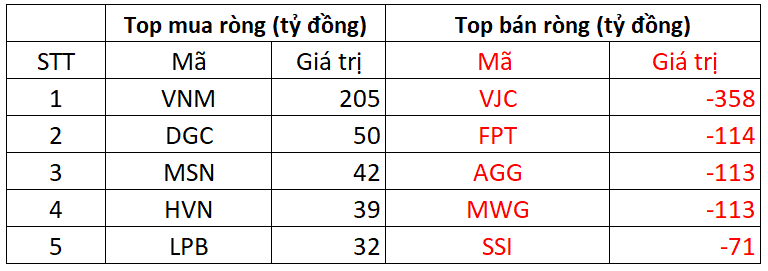

On HOSE, foreign investors net sold VND 731 billion

On the buying side, VNM shares were the focus of foreign net buying with a value of VND 205 billion. This was followed by DGC and MSN, which were also accumulated with net purchases of VND 50 billion and VND 42 billion, respectively. In addition, HVN and LPB saw net buying of VND 39 billion and VND 32 billion.

On the opposite side, VJC faced the strongest selling pressure from foreign investors, with nearly VND 358 billion in net sales, while FPT and AGG were also offloaded with net sales of VND 114 billion and VND 113 billion, respectively.

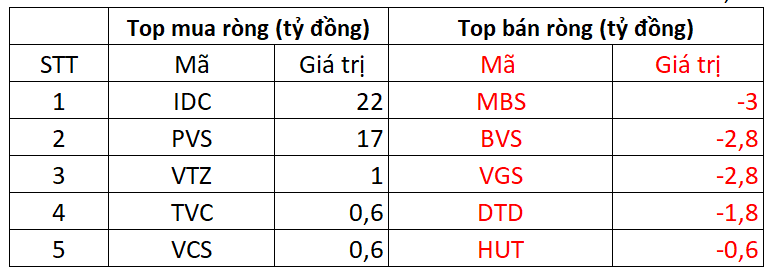

On HNX, foreign investors net bought VND 29 billion

IDC was the most net bought stock on HNX, with a value of VND 22 billion. Meanwhile, PVS was the second most net bought stock on HNX with VND 17 billion. Foreign investors also spent a few billion dong to net buy VTZ, TVC, and VCS.

On the selling side, MBS faced the most significant net selling pressure from foreign investors, with a value of nearly VND 3 billion. This was followed by BVS, VGS, and DTD, which were net sold in the range of a few hundred million dong.

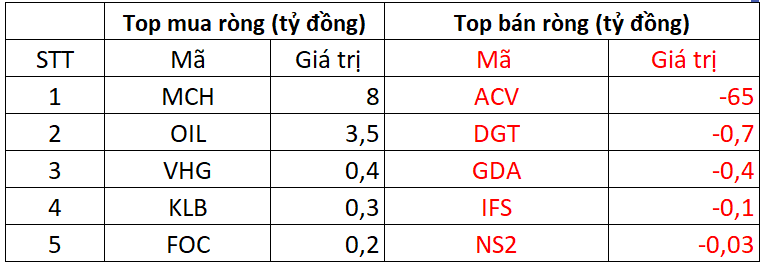

On UPCOM, foreign investors net sold VND 53 billion

On the opposite side, ACV faced net selling pressure from foreign investors, with a net sell value of nearly VND 65 billion. Additionally, foreign investors also net sold DGT, GDA, and other stocks…

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.