The main concern this afternoon was that the low-priced bottom-fishing stocks from the nearly 49-point collapse on Monday would be sold for profit. However, the extremely low liquidity indicated that these stocks had been retained. This allowed hundreds of stocks to reverse course easily, with the VN-Index also closing above the reference level, nearing the day’s high.

Today’s market was not very vibrant in terms of both points and prices. Nonetheless, given the fragile investor sentiment following the recent sharp declines, this could be considered a positive signal. Notably, there was no T+ wave trading, reflecting confident holding.

The HoSE floor this afternoon only matched 6,041 billion VND, a slight increase of 8% from the morning session. The VN30 basket even saw a 5.2% decrease in trading value, reaching 3,412 billion VND. With such low liquidity, the breadth showed a broad-based recovery.

Specifically, the VN-Index fell further in the short term at the beginning of the afternoon session, losing 5.2 points at the bottom, with a poor breadth of 106 gainers and 299 losers. Around 2 pm, the HoSE still had 174 gainers and 247 losers. However, in the last 30 minutes and the ATC session, the situation reversed with 228 gainers and 182 losers.

This trend indicates a slow but steady recovery. The main psychological pressure in the afternoon session was the concern about possible selling of the volume at the bottom. Trading was very cautious and slow, but with a very small increase in liquidity, the concern subsided, and demand became more proactive towards the end. Compared to the breadth at the bottom, hundreds of stocks reversing above the reference level is a clear indication.

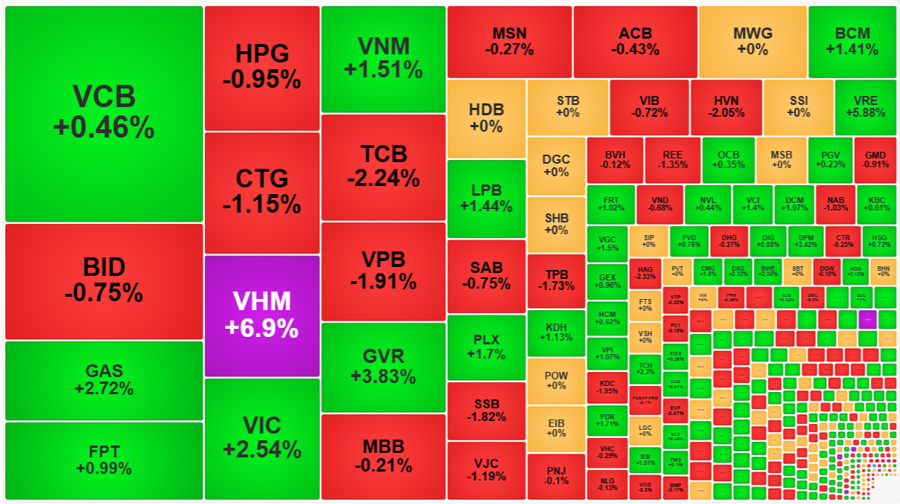

The VN-Index closed up 0.46%, or 5.6 points, just shy of the intraday high earlier in the morning. The VN30-Index rose 0.06% with 10 gainers and 14 losers. Smallcap gained 0.28%, while Midcap rose 0.41%. The pace of the VN-Index’s increase was slowed by the performance of the blue-chip group. The largest caps recovered within a narrow range. VHM, VIC, and VRE fluctuated but ended the session unchanged from their morning closing prices. VCB edged up by around 0.46%, while CTG gained slightly by 0.33% but still closed in the red. BID followed a similar pattern, rising 0.65% from the morning session but still down 0.75% from the reference price. HPG and MSN were among the other pillars that improved but lacked clarity.

A notable strong performer this afternoon was BCM, which reversed course to gain nearly 3.6%. At the end of the morning session, BCM was still down 2.11%, the largest loss in the basket, but it closed above the reference level by 1.41%. GVR broke out, adding another 3% to close 3.83% above the reference price. PLX rose 2.69% in the afternoon alone, reversing into a 1.7% gain at the close. VNM also showed strength, adding another 1.23%, expanding its daily gain to 1.51%. According to statistics, 19 stocks in the VN30 basket this afternoon rose higher than in the morning session. Unfortunately, the healthiest stocks were not the largest caps.

The recovery pace on the HoSE floor this afternoon was generally slow. At the end of the morning session, only 47 stocks on the exchange had risen more than 1% from the reference price, the majority of which had very low liquidity. This number increased to 96 in the afternoon, with many stocks attracting good liquidity. Apart from the trio of VHM, VIC, and VRE, notable performers included TCH, up 2.3% with a liquidity of 157.9 billion VND; DCM, up 1.97% with 147.8 billion; HAH, up 1.54% with 123.8 billion; PDR, up 1.71% with 122.7 billion; HDG, up 2.12% with 87.8 billion; and VCI, up 1.4% with 65.2 billion…

The small gain range and slow recovery were due to the continued high caution. Investors were both buying and closely monitoring prices as they were unsure about the extent of T+ selling demand. Furthermore, as mentioned earlier, there was no surge in points due to the limited increase range of the pillar group. Impressive point surges or reversals often have a significant impact on market sentiment before spreading widely.

A positive signal from the very low liquidity in the afternoon was that successful bottom fishers were not eager to sell immediately. The strong reversal in the previous session and the afternoon recovery helped many stocks gain good profits when they entered accounts. If the mentality of taking quick profits prevailed, investors would have taken profits to avoid losses in case the market returned to a downward trend. The total matched value on the two exchanges today was just under 12,360 billion VND, the lowest in seven sessions.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.