Mr. Luu Trung Thai, Chairman of MB Bank, chaired the Investor Conference, updating business results and growth prospects of MB Bank in 2024, which was held online in the afternoon of August 5th, with many questions about loans to enterprises.

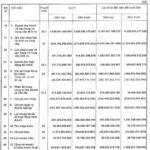

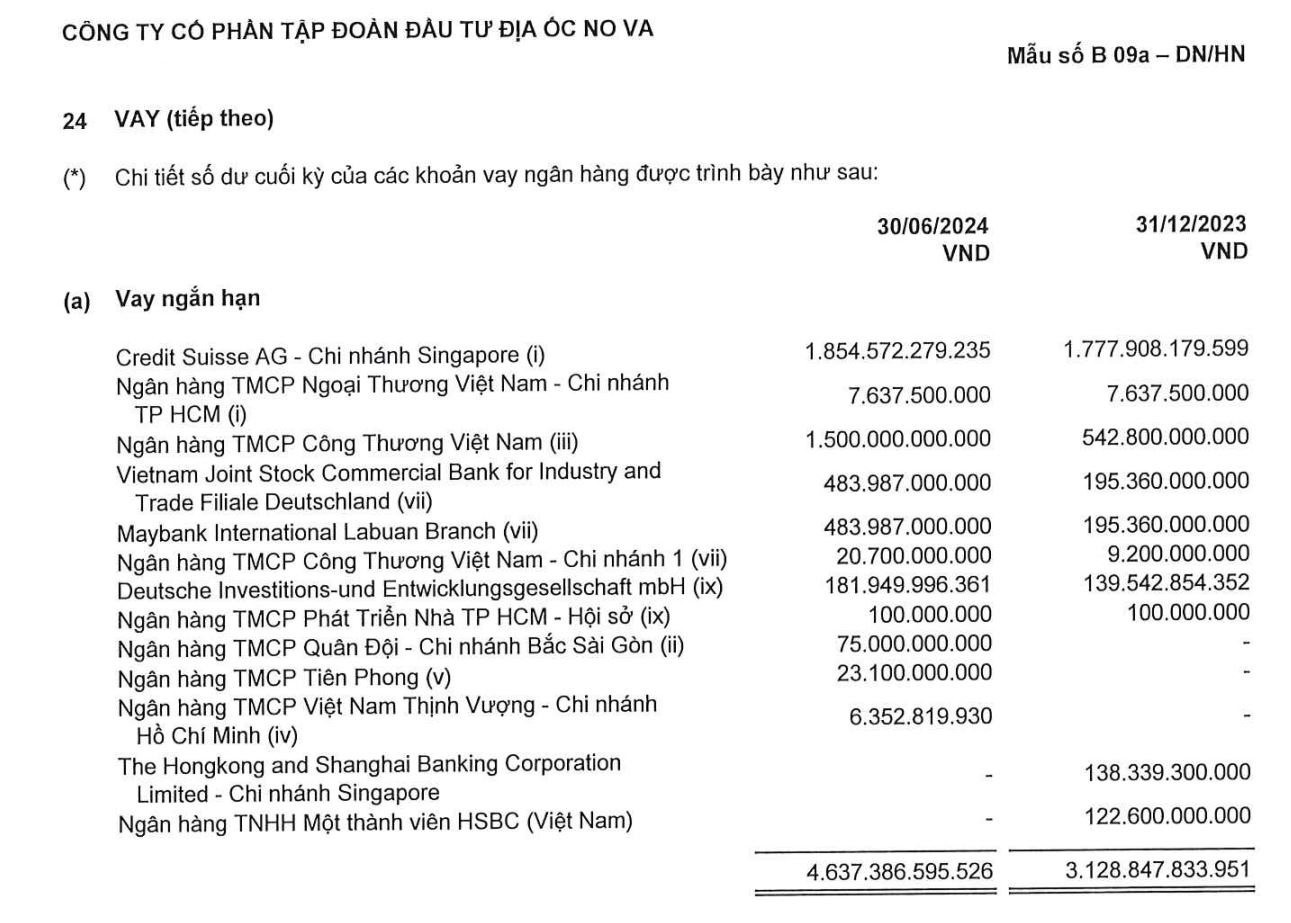

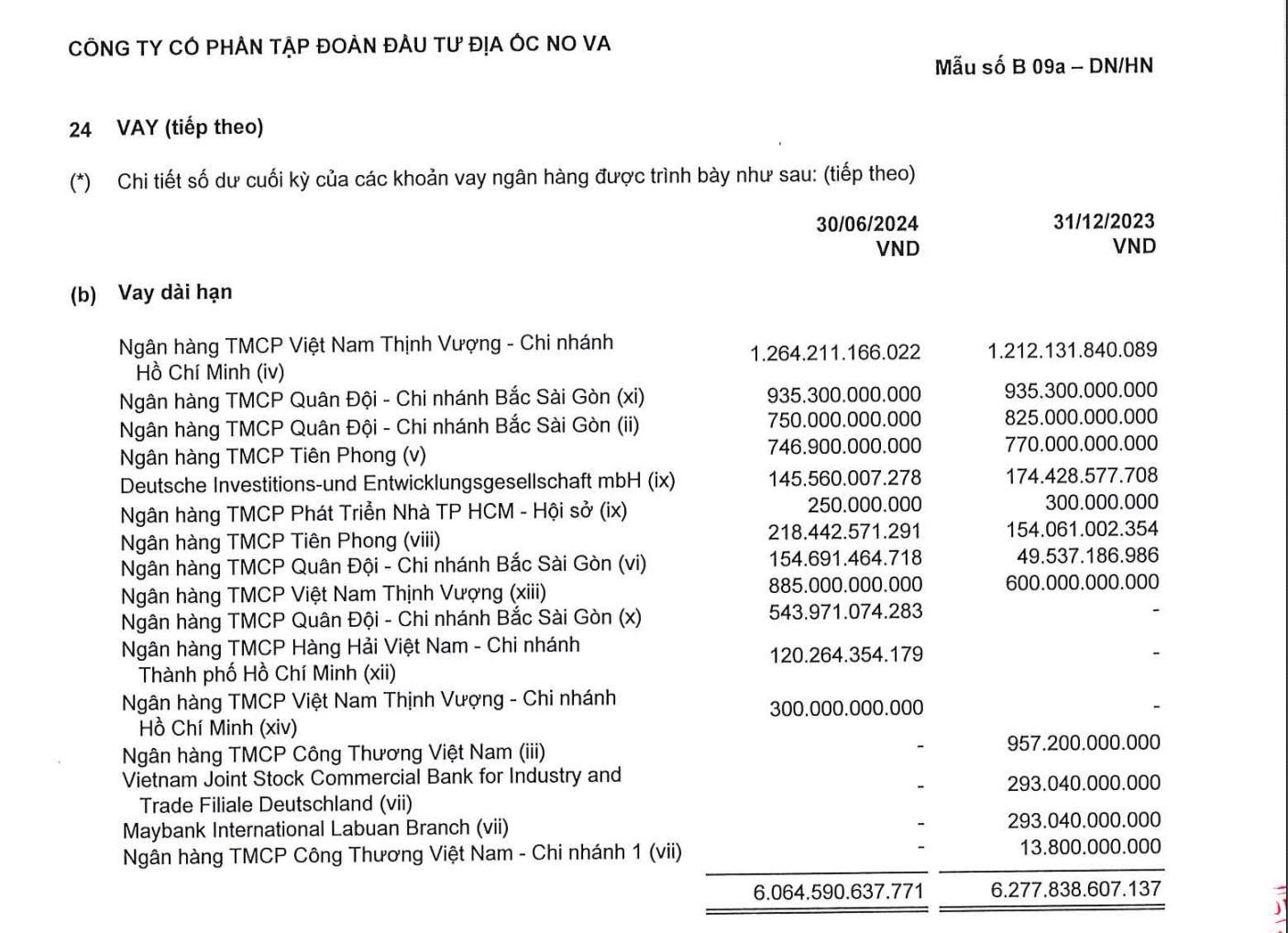

Specifically, according to the Consolidated Financial Statements for the second quarter of 2024 published by Novaland, as of June 30, 2024, Novaland’s short-term debt at MB Bank was VND 75 billion. This is an amount of principal debt that is about to fall due under a VND 1,500 billion loan contract between MB Bank – Saigon North Branch and Novaland. This loan is secured by Novaland’s entire capital contribution in the subsidiary and land use rights of a project in Xuyen Moc district, Ba Ria – Vung Tau province. The project is commercially known as Novaworld Ho Tram.

Source: Novaland’s Self-prepared Consolidated Financial Statements for Q2 2024

Also under the aforementioned VND 1,500 billion loan contract between MB Bank and Novaland, as of the end of Q2 2024, Novaland’s long-term debt at MB Bank under this contract was recorded at VND 750 billion.

The loan with the largest outstanding balance from MB Bank to Novaland as of June 30, 2024, worth VND 935.3 billion, also originated from MB Bank – Saigon North Branch. This is also a loan under a VND 1,500 billion loan contract between MB Bank – Saigon North Branch and Novaland. Novaland secured this loan with its entire capital contribution in the subsidiary and land use rights of a project in Tam Phuoc ward, Bien Hoa city, Dong Nai province. In addition, Novaland also used the entire project, assets belonging to the project, assets attached to the land being formed, and will be formed of the project in Tien Thanh ward, Phan Thiet city, Binh Thuan province. The project is commercially known as NovaWorld Phan Thiet.

Source: Novaland’s Self-prepared Consolidated Financial Statements for Q2 2024

In addition to the above loans, as of June 30, 2024, MB Bank – Saigon North Branch was also lending Novaland 2 loans with outstanding balances of VND 543.97 billion and VND 154.69 billion, respectively.

Notably, the loan of VND 543.97 billion recorded in Novaland’s long-term debt category is part of a loan contract worth up to VND 6,000 billion. This loan is also secured by a series of assets and property rights of the NovaWorld Phan Thiet project.

In the past time, MB Bank’s loans to large real estate enterprises have become a top concern of the bank’s shareholders.

At the Investor Conference, updating business results and growth prospects of MB Bank in 2024, which was held online in the afternoon of August 5th, one of the issues that investors were interested in and asked about was related to loans to 4 large enterprises, including Trung Nam, Novaland, Vingroup, and Sun Group.

Regarding Novaland, according to Mr. Luu Trung Thai, Chairman of MB Bank, the bank has reduced VND 1,500 billion of outstanding debt from last year to the present. The bank only lends to 3 large projects. Currently, these projects are all progressing well.”

Specifically, the Chairman of MBBank informed that NovaWorld Phan Thiet project (in Binh Thuan province) has shown positive signals, with increasing interest from customers. The project has no legal issues and is only in the process of land price determination.

Meanwhile, the NovaWorld Ho Tram project (in Ba Ria – Vung Tau province) has completed all necessary paperwork and is in the sales process.

In response to a shareholder’s question about the prospects of MB Bank’s loan health to Novaland at the 2 NovaWorld projects and the Aqua City project, Mr. Thai said: “MBBank regularly monitors and updates the situation. In 2025, the two NovaWorld projects will complete their business plans, while Aqua City will finalize its implementation procedures.”

In terms of business plan, in 2024, MB targets a 6-8% growth in pre-tax profit, reaching VND 27,884-28,411 billion.

MB aims to achieve a 13% increase in total assets by the end of 2024, reaching nearly VND 1.23 million billion, and an average growth rate of about 14%/year in the period of 2024 – 2029.

In the first 6 months of this year, MB’s revenue reached VND 22,479 billion, up 14.8% over the same period. Pre-tax profit was VND 13,168 billion, up 12.3% compared to the same period last year.

As of the end of June 2024, MB’s credit balance exceeded VND 671.1 billion, up 9.1% from the beginning of the year, while capital mobilization increased slightly by 2.8%, reaching over VND 688 thousand billion.

Deposit Interest Rate Reaches 40.1% by 2023, MB Holds Top Spot in CASA for 2nd Consecutive Year

Thanks to our pioneering efforts in digital banking, 2023 marks the third consecutive year that MB has attracted over 6 million new customers annually, bringing the total number of customers served to 27 million.