The market ended the August 6 session on a positive note, with all three indices closing in the green. The VN-Index gained 22.21 points to close at 1,210.28, while the HNX and UPCoM indices rose 3.75 and 1.43 points, respectively, to finish at 226.46 and 92.22.

|

Source: VietstockFinance

|

Total trading value reached nearly VND 18,281 billion, with financial stocks (TCB, SSI, MBB, VCB, etc.) and real estate stocks (VHM, TCH, DIG, VRE, etc.) continuing to attract strong cash flow, along with essential consumer goods stocks (VNM, MSN, DBC, etc.) and non-essential consumer goods stocks (MWG, PNJ, FRT, etc.).

The number of advancing stocks far outpaced declining stocks, with 588 stocks in the green, including 29 at the maximum daily limit, compared to only 190 stocks in the red and 17 at the minimum daily limit. Among the stocks that hit the daily limit, TCH, BSI, LDG, HNG, and L14 stood out. Additionally, many large-cap stocks contributed significantly to the market’s gains, with VNM and GVR adding over 1.7 and 1.2 points to the VN-Index, respectively.

Foreign investors net sold nearly VND 810 billion, with a significant spike in net selling towards the end of the session driven by net selling of nearly VND 358 billion in VJC. Notably, VJC also witnessed a large block trade of VND 348 billion during the session, far exceeding the matching value of nearly VND 42 billion. This suggests that foreign investors likely offloaded a substantial amount of VJC shares through block trades.

The net selling value in VJC far exceeded that of other stocks, despite significant net selling in MWG and FPT, which both saw net outflows of over VND 114 billion, and AGG, which recorded net selling of nearly VND 113 billion.

On the other side, VNM was net bought for over VND 204 billion, but the rest of the market saw relatively small net buying, resulting in an overall net selling position.

| Top 10 stocks with the highest foreign net buying and net selling on August 6 |

14:05: Green Dominates, Will the Market Close Above 1,200 Points?

The green color spread across many industry groups, pushing the VN-Index up by 19.89 points to 1,207.96, widening the gap with the strong psychological threshold of 1,200. Positive dynamics were also observed in the HNX and UPCoM indices.

Out of the 24 industries classified by VS-SECTOR, only four industries declined, including Media & Entertainment (down 1.75%), Transportation (down 1.65%), Hardware (down 0.81%), and Specialized Services (down 0.05%).

Among the large number of industries that posted gains, several industries recorded impressive increases of over 2%, including Materials; Food & Beverage and Tobacco; Health Care; Financial Services; Household & Personal Products; and especially Food & Essential Retail, which rose the most by over 13%.

As the market rebounded, foreign investors continued to increase their net selling to nearly VND 580 billion, focusing on MWG with net selling of over VND 142 billion, far exceeding the net selling in VPB and FPT. Overall, foreign investors’ net selling was spread across many stocks, making the net buying of over VND 178 billion in VNM less significant.

Morning session: Strong bottom-fishing demand, VN-Index rebounds over 10 points

The market showed signs of recovery after the sharp decline in the previous session, with the VN-Index gaining 10.22 points to 1,198.29, the HNX index rising 0.67 points to 223.38, and the UPCoM index climbing 0.41 points to 91.20. Trading volume also increased significantly, indicating the presence of bottom-fishing demand.

By the end of the morning session, the total trading value on the three exchanges reached nearly VND 8.3 trillion, higher than the same period in the previous session and slightly above the 5-session average, suggesting the emergence of buying interest as stock prices became more attractive.

Large-cap stocks made significant contributions to the rebound, with VNM, GVR, GAS, FPT, and VCB among the top performers. VNM led the gains, adding nearly 1.7 points to the index, while the top 10 stocks contributed a total of over 7.1 points.

| Top 10 stocks with the most significant impact on the VN-Index in the morning session of August 6 (as of 11:30 am) |

However, the fact that large-cap stocks played a significant role in the market’s gains also raised concerns among investors, as they expected a more balanced recovery across the market.

In terms of industry groups, Food & Essential Retail posted the strongest gain of over 13%, followed by Household & Personal Products, which rose nearly 3%. Industries with high weightings in the index, such as Real Estate and Banking, also recorded modest gains.

During the upward movement, foreign investors net sold nearly VND 415 billion, with the strongest net selling in MWG and SSI, both recording net outflows of nearly VND 70 billion. On the other hand, VNM was net bought for over VND 170 billion, but this was not enough to offset the net selling in other stocks.

10:40: Recovery Faces Challenges

After a strong start, the VN-Index faced several challenges, leading to a significant reduction in its gains and even briefly turning negative.

As of 10:30 am, the VN-Index was up 4.28 points at 1,192.35, while the UPCoM index rose 0.29 points to 91.07. In contrast, the HNX index edged slightly lower by 0.02 points to 222.69.

Trading volume on the VN-Index was higher than the previous session, with a value of nearly VND 6 trillion. The sharp decline in stock prices over a short period has likely caused uncertainty and selling pressure, but it has also attracted bottom-fishing demand.

In a market where the number of advancing stocks (295) and stocks hitting the maximum daily limit (14) matched the number of declining stocks (300) and stocks hitting the minimum daily limit (14), large-cap stocks played a crucial role in driving the market’s gains.

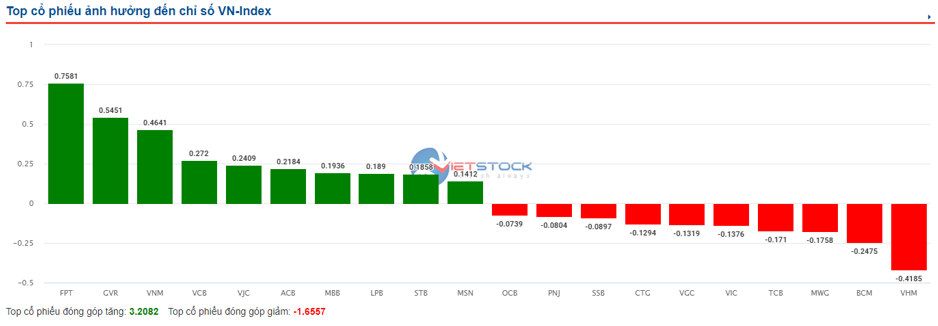

On the VN-Index, the top 10 stocks with the most positive impact on the index, led by FPT, GVR, and VNM, contributed over 3.2 points, doubling the 1.6 points taken away by the top 10 stocks with the most negative impact.

Source: VietstockFinance

|

Opening: Regaining Green After Sharp Decline

Market sentiment showed signs of stabilization after the brutal sell-off on August 5, with the VN-Index opening sharply higher by over 12 points before paring some gains.

Green dominated the market at the opening bell. Financial stocks, construction materials stocks, and information technology stocks were among the gainers, contributing to the rise in the VN-Index.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.