Robust Trade Activities in the First Half of 2024

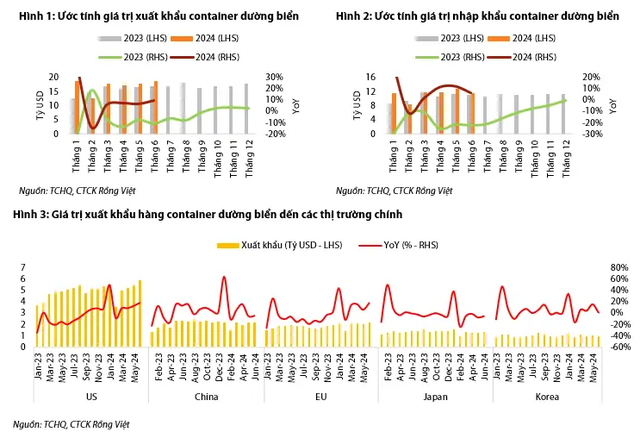

According to the latest report on the port and maritime transport sector by Rong Viet Securities (VDSC), in June 2024, the estimated value of maritime import and export containers reached US$19 billion and US$12 billion, respectively, up 10% and 6%, respectively, compared to the same period in 2023.

Specifically, product groups with low value but high contribution to container volume, such as textiles, footwear, wood, and wood products, saw double-digit growth in export value to the US and EU markets.

Meanwhile, export value to the Chinese market continued to grow by -6% YoY, but this decrease was mainly in the group of computers and electronic components, which have high value but do not contribute much to container volume.

VDSC attributed the slower growth rate of import value compared to the previous two months partly to seasonal factors. Usually, enterprises import raw materials in the first two months of the quarter for production to serve the peak season in the third quarter. China is the main supplier for Vietnamese enterprises, and the import value from this market maintained double-digit growth of 19% YoY, reaching US$4.5 billion.

Explosive Revenue Growth in the Second Quarter of 2024

In the first half of 2024, the estimated value of maritime import and export goods reached US$103 billion (+10% over the same period) and US$68 billion (+8% over the same period), respectively.

During this period, container throughput in Hai Phong and Vung Tau reached 3.5 million TEU (+20% over the same period) and 3 million TEU (+37% over the same period), respectively. VDSC’s analyst team assessed that the container volume in these two key areas of Vietnam accurately reflects the vibrant trade activities in the first half of the year.

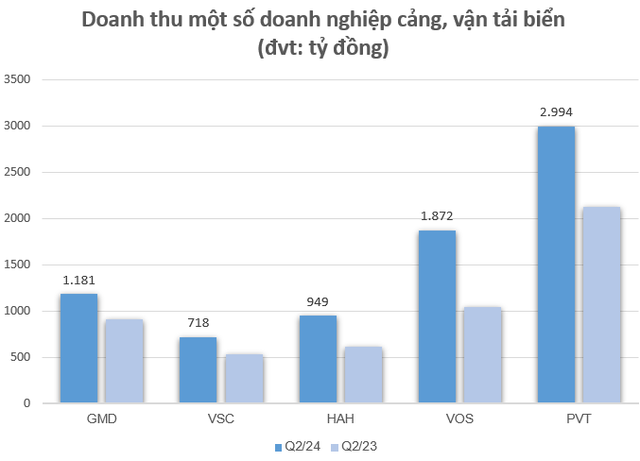

As a result, the revenue recorded in the second quarter by port and maritime transport enterprises witnessed robust growth. Specifically:

The “giant” Gemadept (GMD) recorded net revenue of VND 1,181 billion, up 29% over the same period last year. Of this, port and logistics activities accounted for VND 985 billion and VND 196 billion, respectively. The impressive growth in revenue was thanks to container handling, especially in the Southern region, which saw a leap in both volume and handling fees. It is estimated that post-tax profit attributable to the parent company reached VND 303 billion, mainly contributed by Gemalink port (+50% over the same period after excluding abnormal income from the liquidation of Nam Hai Dinh Vu port in Q2/2023)

Similarly, the revenue of Vietnam Container Shipping Joint Stock Corporation (VSC) in the second quarter reached VND 718 billion, up 20% over the same period last year. Post-tax profit attributable to the parent company reached VND 68 billion, twice that of the same period, mainly from financial revenue. Profit from the core business reached VND 143 billion, up 46% over the same period last year.

Not to be outdone, Hai An Transport and Stevedoring Joint Stock Company (HAH) also achieved impressive results, with revenue and post-tax profit attributable to the parent company reaching VND 949 billion and VND 110 billion, up 55% and 15%, respectively, over the same period last year. This remarkable growth in revenue was driven by sustained growth in container volume in both stevedoring and transport segments. In addition, Hai An also increased the proportion of import-export containers with higher unit prices than domestic ones, improving the ratio of import-export containers to 30-35% from 20% in the same period last year.

Brighter Prospects for Import and Export in the Second Half of 2024

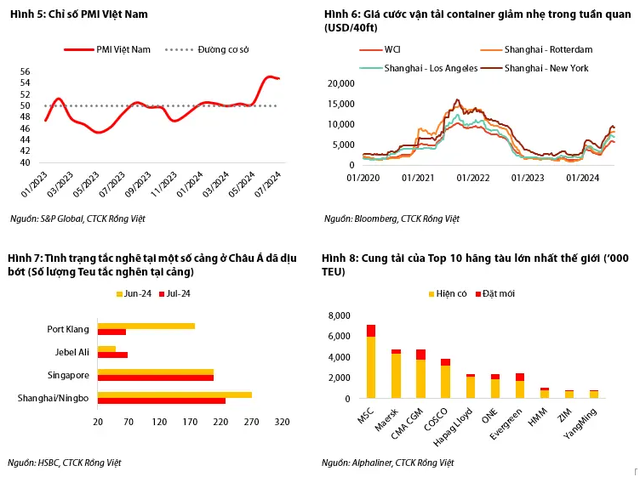

VDSC holds the view that import and export demand will continue to grow positively but at a slower pace due to the absence of the low-base effect from the previous year, as trade flows have improved since the second half of 2023.

Vietnam’s PMI for July 2024 remained unchanged from the previous month at 54.7 points, indicating a significant improvement in the business environment for the manufacturing sector. New orders increased for the fourth consecutive month, with the pace of growth only slightly slower than the near-record level in June 2024. New export orders also increased, albeit at a slower pace than total new orders. This was mainly due to the impact of high transportation costs on export demand.

In the context of no unexpected tensions in the Red Sea region, VDSC’s analyst team forecasts that international container freight rates will slightly decrease but remain stable at a high level until the end of the peak season.

In a recent update, container freight rates eased in the last week of July as congestion at some ports in Asia showed signs of easing. According to Drewry, container shipping capacity is expected to increase by 5% in August compared to July 2024.

On the other hand, in the US, the presidential election in November 2024 has prompted Donald Trump to propose a 60% tax on imports from China and a 10% tax on imports from other regions. This could stimulate import demand for certain brands before the tax takes effect. Therefore, VDSC believes that freight rates will remain high until the end of the peak season.

Vietnam maintains its position as the top exporter of rice in the Philippines market

Vietnam’s rice accounts for over 80% of the total rice imports in the Philippines. In 2023, Vietnam’s rice export market to the Philippines is projected to reach $1.75 billion, an increase of 17.6% compared to 2022…

Vietnam’s Exports Exceeded $4.72 Billion in Two Months

The General Statistics Office has recently released information that the total value of goods exports and imports in the first two months of the year reached $113.96 billion, an increase of 18.6% compared to the same period in 2023. The trade balance for goods exports exceeded $4.72 billion (compared to $3.5 billion in the previous year).

The Billion-Dollar Export Markets of Vietnam

As of May 2024, Vietnam’s cumulative trade turnover for the year reached a remarkable $238.95 billion, reflecting a significant 15.1% increase compared to the same period in 2023. This equates to an impressive $31.35 billion surge in trade value. The country’s top export markets include the economic powerhouses of the United States and China, highlighting Vietnam’s growing importance in global trade.