The Lumen Vietnam Fund (LVF) ended the month with a growth rate of 1.55%, bringing its year-to-date return to an impressive 8.66%. This performance outshines the Vietnam All-Share Market Index (VNAS), which recorded a monthly increase of 1.32% and a year-to-date gain of 5.3%.

VN-INDEX SHOWCASES RESILIENCE COMPARED TO REGIONAL MARKETS

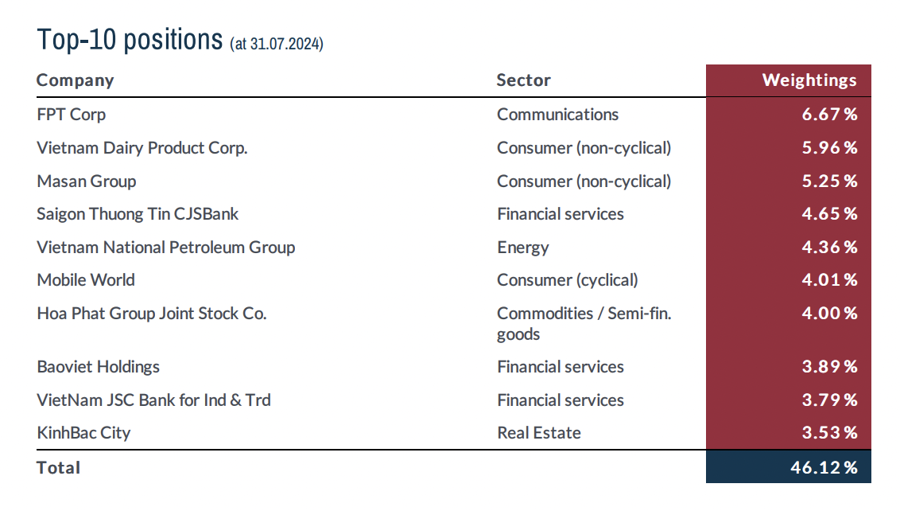

LVF attributes its outstanding performance to its strategic allocation towards mid and small-cap stocks, as well as successful stock selection in sectors such as Energy, Financials, Consumer, and Industrials.

The Energy sector, in particular, witnessed an impressive rebound, emerging as the top-performing sector for the month with an 11.4% increase. Several companies within this sector reported their highest profits since the second quarter of 2022, and this growth trajectory is expected to continue as energy demand improves.

The Financials sector also recorded a positive outcome with a 4.05% increase, driven by the strong performance of private banks and an acceleration in lending activities across the industry. Second-quarter data for 2024 revealed that most listed banks experienced moderate to strong credit growth. Despite a slight decrease in net interest margin (NIM) and operating expenses (OPEX), reduced loan loss provisions contributed to improved profitability.

The Non-essential and Essential Consumer sectors also fared well in July, achieving growth rates of 2.9% and 3.3%, respectively, as consumer demand recovered. Lastly, the Industrials sector posted a 2.1% increase, thanks to the recovery of airlines from a low base.

Reflecting on the past month, LVF representatives noted that July 2024 was a period of volatility, optimism, and caution for the Vietnamese stock market. Despite some challenging trading sessions, the VN-Index concluded the month with a modest 0.5% gain, closing at 1,251.5 points. This marked a 10.8% increase since the beginning of the year. Mid-month, the VN-Index climbed by 3.1% due to positive economic data from June and the first half of 2024. However, this upward momentum was interrupted mid-July by profit-taking activities and the downturn in global markets, including the Nasdaq and Nikkei 225.

Market liquidity decreased by 26.7% compared to the previous month, reflecting investor caution amidst ongoing economic and political uncertainties. Nonetheless, net foreign selling was significantly lower than in May and June, indicating continued interest in stocks with promising and stable prospects.

In comparison to other regional markets, the VN-Index demonstrated resilience and robust performance. Its growth outpaced the PCOMP of the Philippines (+2.6%), the JCI of Indonesia (-0.2%), and the SET of Thailand (-6.7%).

The second-quarter financial reports of listed companies brought further good news, as post-tax profits surged by 16.4% year-over-year, reaching nearly 50% of the full-year 2024 target.

FUND INCREASES CASH POSITION TO SEIZE OPPORTUNITIES DURING MARKET CORRECTIONS

Looking ahead to the second half of 2024, the fund identifies several key drivers that will influence market performance, including Vietnam’s economic outlook, which remains optimistic for 2024 and beyond. This optimism is bolstered by strong GDP growth of 6.42% in the first half, surpassing the government’s initial target.

Several international financial institutions have adjusted their GDP growth forecasts for Vietnam upward. For instance, HSBC has increased its projection from 6% to 6.5%, while Citibank and Shinhan Bank have both raised their estimates to 6.4% and above 6%, respectively. This positive macroeconomic trend is expected to favorably impact the business performance of companies in the next one to two quarters.

Pressure on the foreign exchange market has eased. In the first half of 2024, the State Bank of Vietnam implemented flexible monetary policies to support economic growth and stabilize exchange rates. Deposit interest rates were raised by 50-100 basis points from their lows in March and April, while short-term lending rates remained low to stimulate economic activity. The lending interest rate for 3-year home loans was also slightly adjusted to 7.5%, up from 6-7%.

The Vietnamese government is taking measures to restructure and upgrade the financial market. The State Securities Commission (SSC) has released a draft circular amending circulars on securities trading regulations, with a particular focus on margin requirements and information disclosure. This proposal has received positive feedback from foreign investors, and it is expected to be approved in August and implemented soon after.

The SSC is also considering merging the IPO and listing processes, which would shorten the time for companies to enter the market and encourage more businesses to participate. These efforts underscore the government’s commitment to enhancing market efficiency, potentially making the market upgrade by FTSE in September 2025 more feasible.

Selling pressure from foreign investors has eased, as their ownership in the Vietnamese stock market is now primarily held by institutional investment funds and strategic shareholders with long-term investment horizons. Therefore, should the US Federal Reserve signal a rate cut, foreign investment flows are expected to return to emerging markets, including Vietnam’s stock market, boosting investor confidence and supporting the market’s sustainable growth.

While the market outlook remains positive, the fund cautions that there are some risks to consider. Inflation may rise as the economy recovers, potentially impacting price stability. Additionally, volatility in international markets and geopolitical instability could affect Vietnam’s market. Global trade tensions, particularly US trade policies, may lead to higher tariffs and protectionist measures, making Vietnam’s exports more challenging. The real estate market and the quality of bank assets also warrant close monitoring.

Currently, the Lumen Vietnam Fund maintains a reasonable cash position of 15.38%, providing flexibility in the event of a market downturn. “The adjustment will present a good opportunity to invest in quality stocks at more attractive prices for long-term gains,” the fund emphasized.