Source: VietstockFinance

|

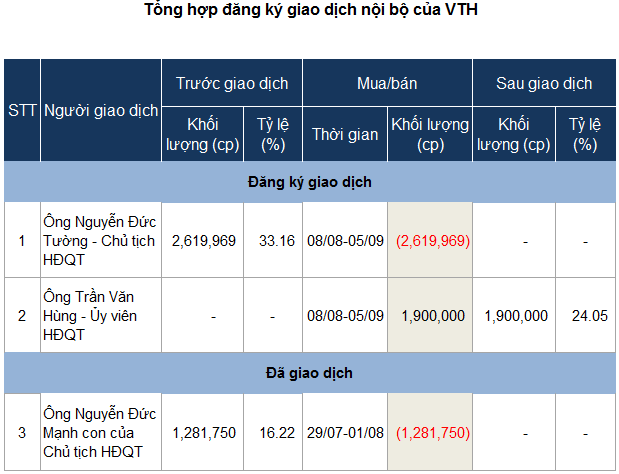

VTH Chairman, Nguyen Duc Tuong, has registered to sell his entire stake between August 8 and September 5 to reduce his ownership ratio.

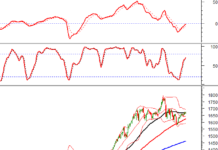

| Price movement of VTH shares from the beginning of 2024 to the session on August 7 |

During the morning session on August 7, VTH shares were at the reference price of VND7,900 per share, down nearly 16% from the beginning of 2024. Based on this price, it is estimated that Chairman Nguyen Duc Tuong could earn more than VND20 billion after no longer being a shareholder of the Company.

Previously, Nguyen Duc Manh, the son of VTH‘s Chairman, sold all of his 1.3 million VTH shares, holding 16.22% of the Company’s capital, between July 29 and August 1. Based on the closing price of VND7,700 per share of VTH on August 1, Mr. Manh might have earned VND10 billion.

If the sale is successful, Mr. Tuong and his son will no longer hold more than 49% of the Company’s capital.

On the other hand, Tran Van Hung, a member of the Board of Directors of VTH, intends to purchase 1.9 million new VTH shares between August 8 and September 5 for investment purposes. If successful, Mr. Hung will own more than 24% of the Company’s capital.

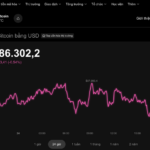

| VTH‘s business results for the first six months of 2024 |

In terms of business performance, in the first half of this year, VTH‘s net revenue increased by more than 20% over the same period last year, reaching over VND221 billion. However, the cost of goods sold increased faster than revenue, causing net profit to slightly decrease by 4% compared to the previous year, to nearly VND3 billion.

In 2024, VTH is optimistic about its target of a 67% increase in pre-tax profit compared to the previous year, reaching VND13.9 billion. Revenue is expected to reach VND588 billion, up 15%. The expected dividend ratio is 5%.

With the results of the first half, VTH has achieved 38% of its revenue target and 26% of its profit target.