In the aforementioned period, RDP stock prices plummeted with four consecutive floor sessions from July 25, before hitting the ceiling on July 31 and rising slightly by 2% on August 01.

| RDP stock price movement since the beginning of July 2024 |

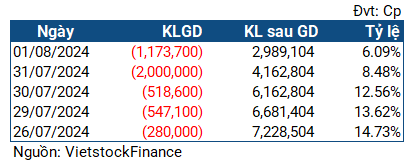

Despite the two price hikes, Mr. Ho Duc Lam, Chairman of RDP, was unable to salvage his account. From July 25 to August 01, Mr. Lam underwent five forced sales, totaling over 4.5 million shares. The largest sale occurred on July 31, when he sold 2 million shares, reducing his ownership from 12.56% to 8.48%, equivalent to approximately 4.2 million shares. Based on the closing price of VND 2,390 per share, the transaction value was approximately VND 4.8 billion.

On August 01, Mr. Lam was forced to sell over 1.17 million shares, reducing his ownership to 6.09%, equivalent to nearly 3 million shares. At the closing price of VND 2,440 per share, he is estimated to have earned approximately VND 2.9 billion.

|

Mr. Ho Duc Lam’s forced sales transactions

|

With these developments, Mr. Lam has experienced a total of 16 forced sales so far this year. In the previous sale, the most recent occurrence was on July 24, involving 60,000 shares, reducing his ownership to 15.3%. From holding 45.04% of the charter capital at the beginning of the year, he now only holds 6.09%.

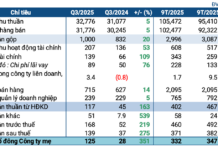

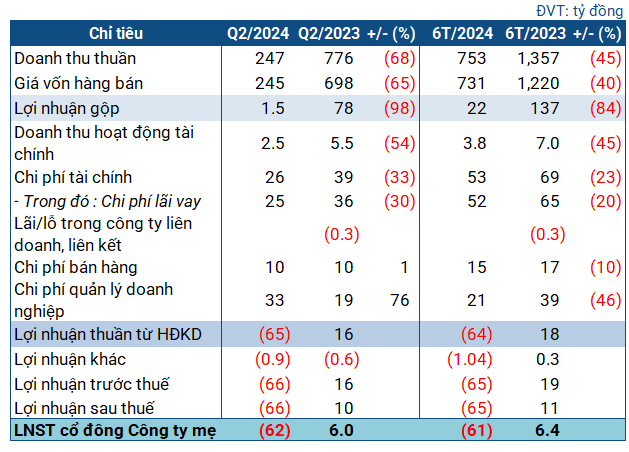

Record loss in Q2

The recent string of forced sales experienced by the Chairman of RDP appears to have been exacerbated by the company’s Q2/2024 financial statement disclosure.

|

RDP’s business performance in Q2/2024

|

Source: VietstockFinance

Specifically, in Q2, RDP’s revenue reached VND 247 billion, a 68% decrease compared to the same period last year. After deducting the cost of goods sold, gross profit plummeted to VND 1.5 billion.

Both financial income and expenses decreased significantly, but selling and management expenses soared or remained unchanged. Ultimately, RDP incurred a loss of VND 62 billion (a profit of VND 6 billion in the same period last year), making it the heaviest quarterly loss in the last 15 years.

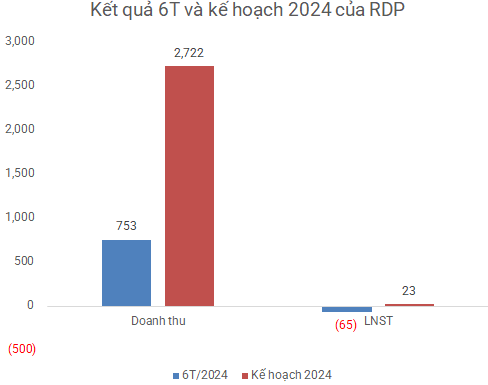

The Q2 loss significantly impacted RDP’s semi-annual results. In the first six months, the company achieved VND 753 billion in revenue, a 45% decrease compared to the same period last year, with a net loss of VND 61 billion (a profit of VND 6.4 billion in the same period last year). Compared to the 2024 plan, the company has accomplished nearly 28% of its revenue target and has a long way to go to achieve its annual after-tax profit goal (VND 23 billion).

Source: VietstockFinance

|

On the balance sheet, RDP held nearly VND 2,000 billion in total assets at the end of Q2, a 7% decrease from the beginning of the year, with over VND 1,350 billion in short-term assets (-8.5%). Cash and cash equivalents stood at VND 62 billion, a 36% decrease, while inventory reached over VND 781 billion, a 7% drop.

On the liabilities side, short-term debt accounted for the majority of the company’s total debt, exceeding VND 1,500 billion, a slight decrease from the beginning of the year. Both the current and quick ratios were below 1, indicating financial risks in the company’s ability to fulfill its short-term debt obligations.

In terms of borrowings, the company had over VND 1,000 billion in short-term debt, a 12% decrease from the beginning of the year, while long-term debt remained unchanged at VND 198 billion.

RDP’s business operations also witnessed negative developments. Earlier in July, the company decided to temporarily suspend the operations of two branches for one year without providing specific reasons. These branches were located in Thanh Xuan District, Hanoi, and in Cu Chi District, Ho Chi Minh City, and the suspension will last until July 12, 2025, and July 19, 2025, respectively.

In the latest development, on August 05, 2024, RDP’s Board of Directors approved the resignation of Mr. Ha Thanh Thien (born in 1974) from his position as General Director and legal representative of the company due to family reasons.

His replacement is Mr. Huynh Kim Ngan, who is not a shareholder and previously held no positions within RDP. However, he currently serves as the Director of two other companies: Cong Ty Luat TNHH Doanh Nhan Viet Nam and Cong Ty TNHH Thuong Mai Hung Dai Sanh.

“The Insider’s Scoop: Chairman of Prominent Listed Company Sells Majority Stake, Stock Plummets 75% Since January”

The entrepreneur has been consistently sold out of stock since April 2024. A relentless force in the business world, their ventures have been subject to a series of unfortunate events, with their stock repeatedly sold off in a margin call.