RDP stock price movement over the past year Source: Fireant

Rạng Đông Holding JSC (stock code: RDP), well-known for its Rang Dong Plastic brand, has recently reported changes in its senior management to the Ho Chi Minh City Stock Exchange (HoSE).

Specifically, the company’s Board of Directors has decided to relieve Mr. Ha Thanh Thien from his positions as General Director and legal representative of the company, effective August 5th. Prior to this decision, Mr. Thien had submitted his resignation, citing family reasons for his inability to continue in the role.

Mr. Huynh Kim Ngan, who has not previously held any positions at Rang Dong Holding and currently does not own any RDP shares, has been appointed as the new General Director.

It is worth noting that Mr. Ngan is currently the Director of two companies: Vietnam Entrepreneur Law Company Limited and Hung Dai Sanh Trading Company Limited.

In related news, the company’s Chairman, Mr. Ho Duc Lam, reported to HoSE that on August 1st, his holding of 1.17 million RDP shares was sold by a securities company as collateral.

As a result of this transaction, Mr. Lam’s ownership in Rang Dong Holding decreased from 8.48% to 6.09% (equivalent to 2.9 million RDP shares).

Since the beginning of 2024, Mr. Lam has sold and had sold off approximately 19 million RDP shares, reducing his stake in the company from 45% to 6.09%. Despite this, he remains the largest shareholder.

The continuous sale of RDP shares by the Chairman comes amidst the company’s poor financial performance and weak capital position.

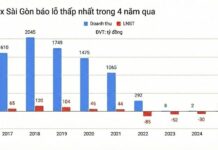

In the second quarter of 2024, Rang Dong Holding’s revenue plummeted by 68% year-on-year to VND 247 billion. Financial income also decreased by 54% to VND 2.5 billion.

After deducting expenses, the company incurred a loss of VND 66 billion for the quarter, compared to a profit of over VND 10 billion in the same period last year. This was the heaviest loss in the company’s history.

For the first six months of 2024, the company recorded a revenue of VND 753 billion, a decrease of 45% year-on-year, and a net loss of VND 64 billion (compared to a profit of VND 11 billion in the previous year).

The company has only achieved about 28% of its revenue target and is far from its annual after-tax profit goal of nearly VND 23 billion.

As of the end of June 2024, Rang Dong Holding’s equity stood at VND 279.3 billion, an 18.7% decline from the beginning of the year.

Meanwhile, the company’s total liabilities amounted to VND 1,716 billion, with financial debt accounting for 77% (VND 1,323 billion). This is six times higher than its equity. The company’s cash and cash equivalents also decreased by over VND 10 billion compared to the beginning of the year, standing at VND 21.1 billion.

On the stock market, RDP is currently in the warning zone, trading at VND 2,250 per share, a decline of over 75% since the beginning of 2024.

Flexible Mechanisms and Solutions to Enhance the Stock Market in Vietnam

There is a real-life example of the flexibility in handling HOSE order congestion incidents that demonstrates the concentration, collaboration, technology investment, and resources of the company… can accelerate the stock market to meet the criteria of FTSE and MSCI in the upcoming evaluation periods.

Forced seizure of 6.2 million CCL shares by “oil tycoon” Trinh Suong

The Civil Execution Department of District 1, Ho Chi Minh City, will seize 6.27 million shares of CCL, owned by the “oil tycoon” Trinh Suong, with an estimated value of over 57 billion VND.