VietinBank has experienced significant growth and development, earning recognition from investors and analysts alike for its professionalism. This has contributed to enhancing the value of the VietinBank brand as well as its stock symbol, CTG.

IMPORTANT MILESTONES

On December 25, 2008, in line with the government’s policy to equitize state-owned commercial banks, VietinBank successfully issued its initial public offering. On July 16, 2009, VietinBank officially listed and traded its shares on the Ho Chi Minh City Stock Exchange (HOSE) under the stock symbol CTG.

Since its initial public offering, VietinBank has grown from a medium-sized bank to a leading financial institution. By the end of 2023, its total assets had reached over 2 million billion VND (an eightfold increase), with credit balances exceeding 1.47 million billion VND (a ninefold increase). During this period, the bank also witnessed a sixfold increase in pre-tax profits, reaching over 24.99 thousand billion VND. VietinBank’s network has expanded to cover all 63 provinces and cities in Vietnam, including 01 Head Office, 02 Representative Offices, 08 Business Units, 155 Branches, and nearly 1,000 Transaction Offices. Additionally, the bank has established 07 subsidiaries and affiliated companies, successfully integrated into the international financial market with 02 branches in Germany, 01 Representative Office in Myanmar, and a 100%-owned bank in Laos.

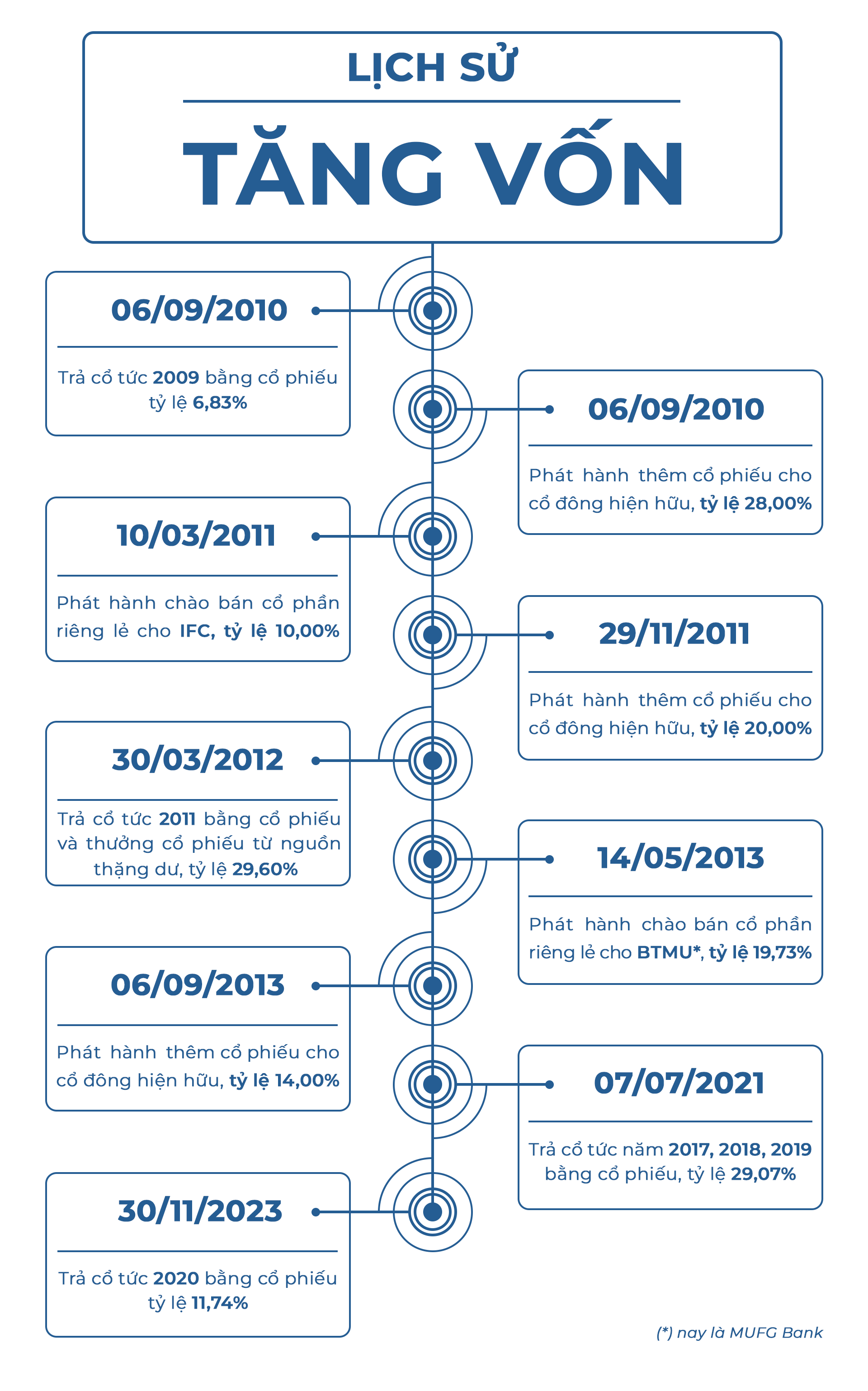

VietinBank has not only focused on business efficiency and network expansion but has also worked to enhance its financial capacity. The bank has consistently met and exceeded regulatory requirements for safety in banking operations, striving towards international standards and practices. Since its listing on the stock exchange, VietinBank has conducted 09 capital increases, resulting in a nearly 4.8-fold increase in charter capital. By the end of 2023, its charter capital reached 53.7 thousand billion VND, and owner’s equity increased more than tenfold, from 12.5 thousand billion VND to 125.9 thousand billion VND.

VietinBank’s capital increase journey has been marked by strong participation and support from its shareholders and foreign strategic partners, reflecting the bank’s leading role in Vietnam’s banking industry. VietinBank was the first state-owned joint-stock commercial bank to have a foreign strategic partner.

In 2011, VietinBank increased its charter capital by selling a 10% stake to the strategic partner IFC. In May 2013, the bank sold an additional 19.73% stake to the strategic investor BTMU (now MUFG Bank). As a result, the foreign ownership limit for CTG shares was adjusted from 12.79% to 30%. VietinBank also set a precedent in the Vietnamese financial system by being the first bank to have two foreign strategic investors with strong financial capabilities and global reputations as its shareholders, actively involved in the management and operations of the bank.

On the stock market, CTG is recognized by shareholders, investors, and analysts, both domestic and foreign, as one of the large-cap stocks in the banking industry, consistently offering strong growth potential. On February 6, 2012, the Ho Chi Minh City Stock Exchange officially launched the VN30-Index, a basket of 30 stocks selected based on market capitalization, free-float ratio, and trading value. Since its inception, VietinBank’s CTG shares have consistently been included in this prestigious index, with average trading values increasing twentyfold, from 6.8 billion VND per session on the first trading day to 137.8 billion VND per session in 2023.

LEADING THE WAY IN NATIONAL DEVELOPMENT, DELIVERING OPTIMAL VALUE TO CUSTOMERS, SHAREHOLDERS, EMPLOYEES, PARTNERS, AND THE COMMUNITY

VietinBank has a well-defined dividend policy, as outlined in its Articles of Association, and consistently distributes dividends or bonus shares from surplus profits, subject to the approval of the General Meeting of Shareholders based on the proposal of the Board of Directors.

Throughout its 36-year history, including 15 years of listing on the stock exchange, VietinBank has not only focused on business efficiency and profit growth but has also actively contributed to the socio-economic development of the country. The bank has supported businesses and individuals affected by the pandemic in resuming their operations, developed flexible policies and products for green projects, and prioritized financing for projects in the fields of environmental protection, climate change response, and sustainable development.

Moreover, VietinBank has been a pioneer in social security activities, spreading positive values and fulfilling its responsibilities to the community.

Guided by its mission “to be a pioneer in national development by delivering optimal value to customers, shareholders, employees, partners, and the community,” VietinBank is committed to increasing its contributions to the economy and the stock market. This commitment was emphasized by Chairman of the Board of Directors, Tran Minh Binh, who stated, “We pledge to dedicate our best efforts and resources to becoming a responsible bank that serves the interests of the country, shareholders, partners, customers, the community, and our employees.”

Customers, shareholders, and investors are invited to vote for CTG shares to be among the Top 3 Listed Companies with the Best Investor Relations in 2024 (IR Awards 2024) at https://ir.vietstock.vn/binh-chon-dai-chung.htm. Attractive prizes are awaiting lucky voters (including 1 special prize, 10 first prizes, 20 second prizes, and 30 third prizes)

Voting period: From August 1, 2024, to August 14, 2024.