VietinBank – CTG recently announced its consolidated financial report for the fourth quarter of 2023.

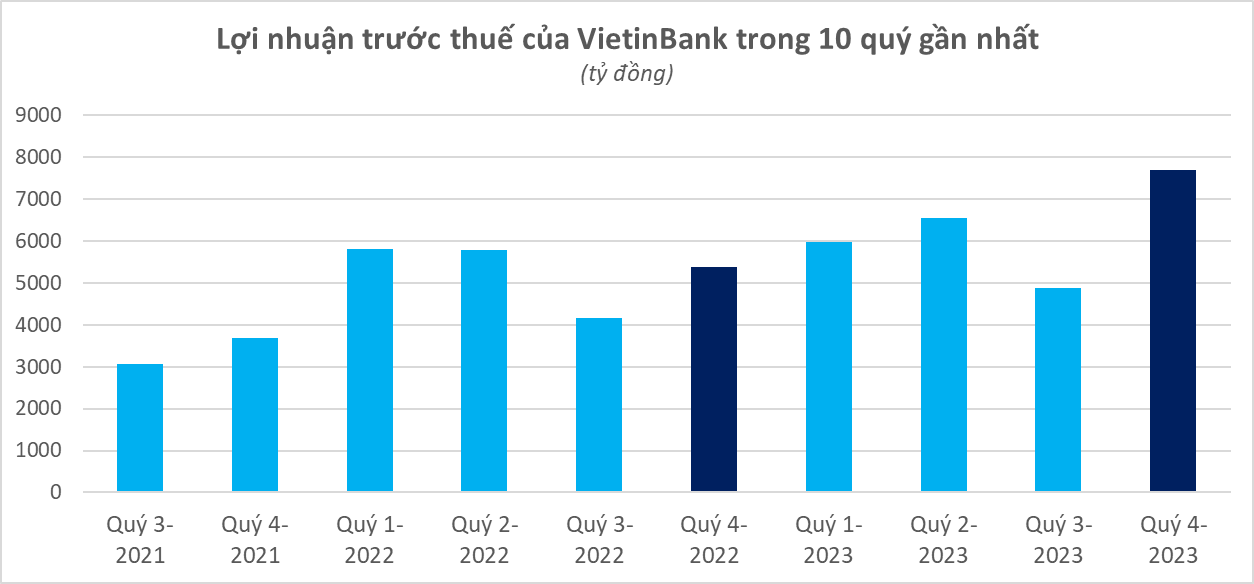

In the fourth quarter of 2023, the bank recorded a consolidated pre-tax profit of VND 7,699 billion, an increase of 43.4% compared to the fourth quarter of 2022. With the main growth driver being net interest income, VietinBank’s total operating income in the fourth quarter reached VND 18,475 billion, a 10.1% increase compared to the same period. Meanwhile, operating expenses only increased by 0.8% to VND 6,304 billion, and provisions for risk decreased by 13.3% to VND 4,473 billion.

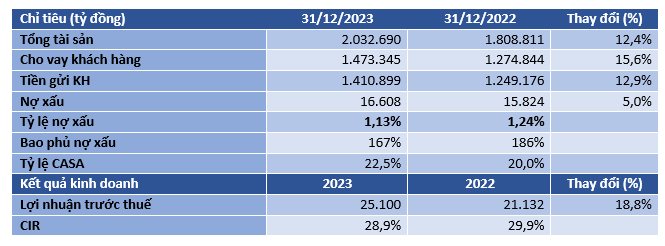

For the full year of 2023, VietinBank’s total operating income reached VND 70,658 billion, a 10.2% increase compared to 2022. Meanwhile, operating expenses increased slightly, only by 6.5% to VND 20,443 billion. As a result, the cost-to-income ratio (operating expenses/total income) continued to improve from 29.9% to 28.9%. VietinBank currently has one of the lowest cost-to-income ratios in the industry.

Most of VietinBank’s business segments have shown positive growth in the past year. Specifically, net interest income reached VND 53,083 billion, an 11% increase. Income from service activities reached VND 7,154 billion, a 22% increase. Income from foreign exchange trading reached VND 4,248 billion, a 19.5% increase. The securities trading business made a profit of VND 292 billion, compared to a loss of VND 112 billion in the previous year.

However, the securities investment business performed poorly, with a loss of VND 154 billion. Other activities (mainly debt resolution) generated a net profit of VND 5,747 billion, a 12% decrease compared to the previous year. Income from capital contribution and shareholding decreased by 43.9% to VND 287 billion.

Although provisions for risk in the fourth quarter decreased compared to the same period, the total provisions for the whole year of VietinBank reached VND 25,115 billion, an increase of 5.6% compared to 2022. Provisions for risk consumed nearly half of VietinBank’s net profit from business operations.

As a result, VietinBank achieved a pre-tax profit of VND 25,100 billion in 2023, an 18.8% increase compared to the same period and successfully met its business plan. The bank ranked 5th in terms of profitability in the industry in the past year.

As of December 31, 2023, VietinBank’s total assets exceeded VND 2 million billion, an increase of 12.4% compared to the end of 2022. VietinBank is the third bank, after BIDV and Agribank, to reach the milestone of VND 2 million billion.

The outstanding loans to customers increased by 15.6% in the past year and reached over VND 1.47 million billion. VietinBank’s credit growth was relatively stable between quarters, with a breakthrough in the fourth quarter with a growth rate of 6.28%. Short-term loans increased significantly in the past year (up 24.5%), reaching VND 961,733 billion.

VietinBank’s customer deposits increased by 12.9%, reaching over VND 1.4 million billion. Specifically, non-term deposits increased by 27.6%, reaching nearly VND 311 thousand billion. The CASA ratio (non-term deposits) improved significantly from 20% to 22.5%. According to available data, VietinBank’s CASA officially ranks in the Top 5 in the industry.

The bad debts at the end of 2023 of VietinBank were VND 16,608 billion, an increase of VND 784 billion compared to the end of 2022, but a significant decrease of VND 2,332 billion compared to the end of September 2023. As a result, the bad debt ratio improved, with only 1.13% remaining, lower than the 1.24% at the end of 2022 and 1.37% at the end of September 2023.