After a prolonged tug-of-war, the VN-Index entered a correction phase. Continuous profit-taking pressure caused the market to continuously plunge deeply below the 1,200-point mark. As the market quickly plummeted, finding profits became challenging. So, what should investors do in this situation?

Speaking at the seminar “Catching the Money Flow in August,” Mr. Doan Minh Tuan, Head of Analysis at FIDT, opined that the overall market would continue to experience short-term adjustments. Given the negative trends across sectors and the risk of cross-margin calls at present, the expert suggested that, in a worst-case scenario, the market could drop to 1,180-1,200 points. However, it is unlikely to plunge deeply past this threshold.

The supportive force for the long-term upward trend of the index is Vietnam’s macro foundation, which will continue its growth momentum in the second half, bolstered by public investment. Additionally, the medium-term macro outlook remains stable, with reduced risks in exchange rates and interest rates.

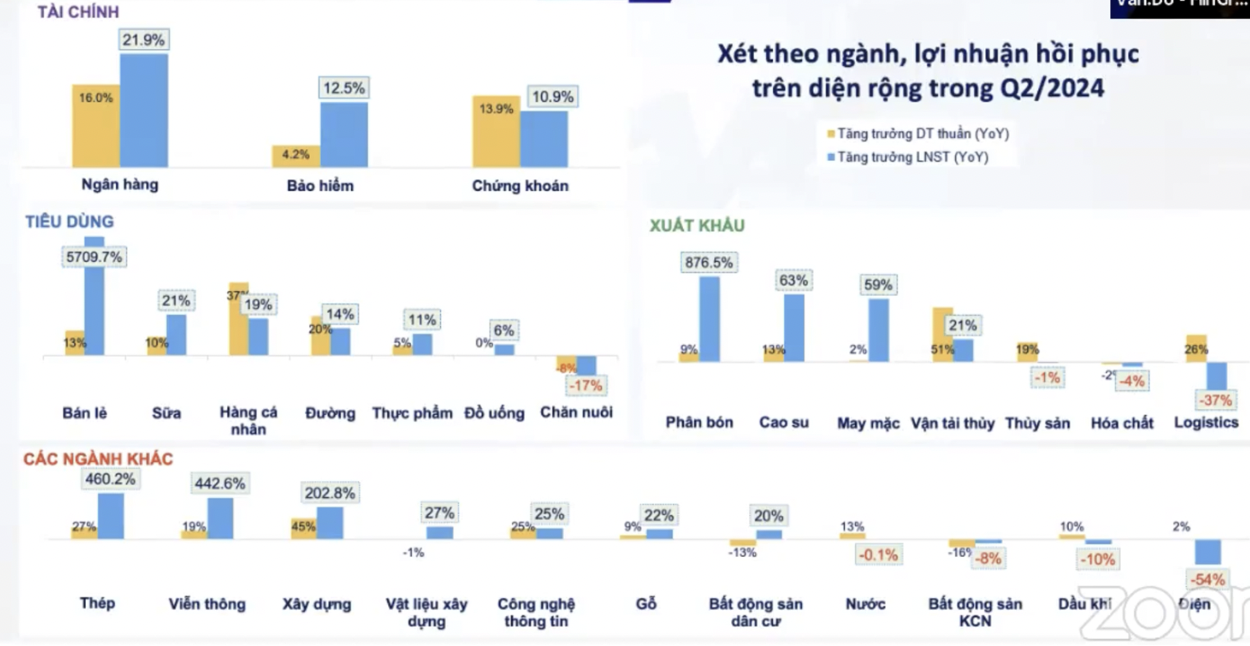

Commenting on the profit picture for Q2 2024, Ms. Do Hong Van, Head of Analysis at FiinGroup, stated that corporate profits continued their recovery, marking the third consecutive quarter of growth, achieving a 25.6% increase year-on-year. The financial group contributed more than half of the total market. This was the quarter when the overall market profits reached their highest level in the last five quarters.

According to FiinGroup’s statistics, in terms of capitalization, the VN-30 group returned to positive profit growth after a negative first quarter. The mid-cap group turned downward after the previous recovery trend, contrasting with the small-cap group, which continued its positive growth trajectory.

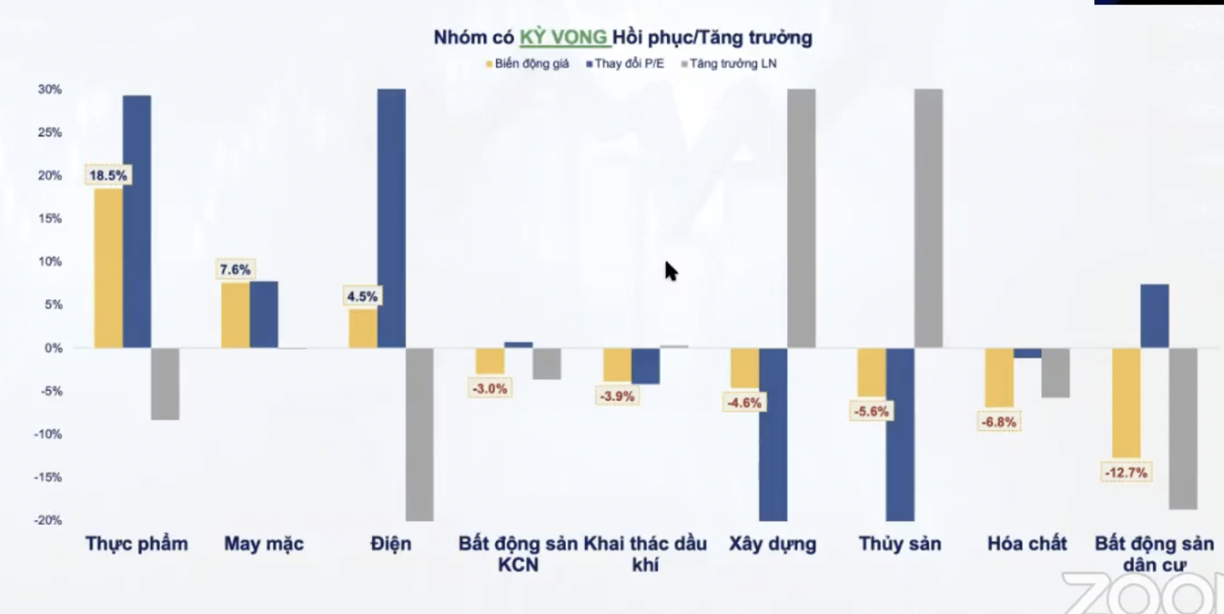

Explaining the reason for the profit growth but the corresponding stock price recovery, the FiinGroup expert cited four common phases in the market: (1) Desperation, the initial collapse phase driven by declining profits and valuations as risk aversion increases; (2) Hope, the point at which stock prices rebound strongly; (3) Growth, the phase where profit recovery occurs but valuations are no longer attractive; and (4) Optimism, where valuations expand.

“The optimistic phase generates the highest profits for investors, while the growth phase, despite profit recovery, sees the most negative stock price movements,” the FiinGroup expert opined. “I believe that the stock market has now shifted from the optimistic to the growth phase, marked by two prominent signals: (1) corporate profit growth in line with macro fundamentals and (2) declining market valuations as the excitement of investors during the hopeful phase subsides.”

Delving deeper into the different stock categories, the expert noted a clear differentiation in the phases within industries.

In the optimistic phase group, notable sectors include food, garments, and electricity, which experienced price increases in Q2 due to expanding valuations, despite declining or stagnant profits. On the other hand, construction, though growing, has not yet seen core business performance improvements, and seafood, while profitable in Q2, has merely reduced losses compared to previous quarters.

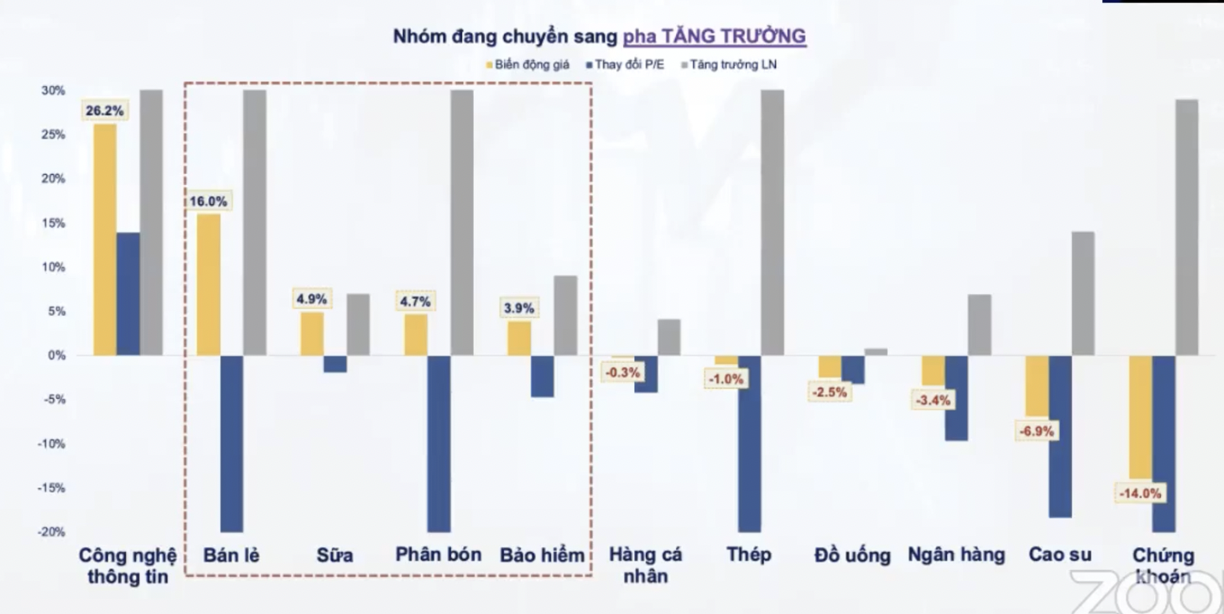

The group transitioning to the growth phase includes retail, dairy, fertilizers, and insurance, which are at the beginning of the growth phase. These sectors could offer investment opportunities in the coming time, given their promising profit outlook. However, considering the current market context, these stocks should be discounted to a reasonable level of about 15-20% compared to their current prices. Steel, banking, and securities are in the middle of the growth phase, indicating profit growth but declining stock prices.

The FiinGroup expert suggested that real estate, exports (garments), and retail would be the sectors with potential in the coming time.

Sharing a similar view, Mr. Nguyen Thanh Nguyen Vu, Founder of TVN & Partners, stated that with the Fed’s interest rate cuts, factors related to exchange rates would diminish. Businesses that benefit from a lower exchange rate include those with large USD-denominated debts, such as oil and gas, electricity, retail, and steel.

Regarding the banking sector, the expert anticipated a rally before capital flows into real estate, expected to occur at the end of August. The residential real estate group is likely to witness positive effects from the Land Law, Housing Law, and Real Estate Business Law, which took effect on August 1st. Investors should prioritize companies with clean land banks that have already paid land use fees. The retail sector is also expected to recover cyclically with the economy in the long term, with MWG as the focal point.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.