The Great Tech Divide: As High-Tech Rises, “Low-Tech” Industries Feel the Squeeze

At a factory nestled in China’s manufacturing heartland, workers are painstakingly hand-painting and glittering flower prints, making small changes that help salvage dwindling profits amid a slump in global demand.

“If you want to aim for a higher-end product, a better-quality painting, you have to add more classic elements to it. But in today’s global economy… the more we sell, the lower the price,” says Wang Xiaosha, general manager of Fujian Jie Ao Industrial, based in Fujian province, in an interview with the FT.

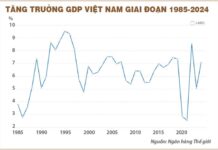

In recent years, China has steered its economy towards “new quality production forces” such as green technology and electric vehicles. But as high-tech industries boom, the country’s low-tech sectors are struggling to keep up.

Traditional factories were once the backbone of the country’s explosive growth and one of the largest job creators. But they are now grappling with dwindling orders from Western clients, trade restrictions in foreign markets, and increasing competition from rival hubs, particularly in Southeast Asian countries like Vietnam and Indonesia, as well as Bangladesh and India.

As the world’s largest exporter of apparel, as well as a major producer of toys and furniture, “China remains a significant producer of labor-intensive goods,” says Fred Neumann, Asia economist at HSBC.

Faced with increasing competition from lower-cost rivals, “these industries are hanging on by their fingernails.”

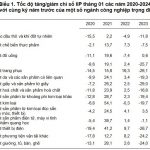

According to Bank of America’s Global Research report, apparel, footwear, and furniture accounted for 9% of China’s exports in the first eight months of last year, down from 20% in 2001. In contrast, the share of autos and machinery in total exports rose from 16% to 33% during the same period.

China’s market share in global footwear and apparel sales has declined in recent years, with its share of supply to brands Nike and Adidas falling from 20-27% in 2017 to 16-20% in 2022, according to BofA’s report.

Although still the world’s largest supplier, China’s share of global footwear exports has dropped by over 10% in the past decade, according to the 2023 World Footwear Yearbook.

Much of this market share has shifted to Southeast Asian countries, particularly Indonesia and Vietnam. Vietnam, now the world’s second-largest exporter, has been the biggest beneficiary, with its market share rising from 2% to about 10%.

High-Tech to the Rescue?

China finds itself in a bind, unable to abandon traditional manufacturing sectors even as high-tech industries represent the future and have already made significant strides.

HSBC’s Neumann suggests that any retreat of labor-intensive industries could lead to job losses, something policymakers in Beijing want to avoid.

“A lot of the manufacturing in China is still middle to low-end products… you need those labor-intensive factories there,” he says.

“The mindset of the policymakers is not just to dominate electric vehicles or advanced technology or to have a domestic semiconductor industry, but also to maintain production capacity across all goods, even at the lower end.”

Shoes and textile factories, from towering 12-story buildings to warehouse-like structures with corrugated steel roofs, line the streets of Jinjiang, an industrial city in Fujian. The city is home to major shoe manufacturers like Anta and is the world’s largest “one-stop shop” for sports textile and footwear.

Lai Mingquan, who runs Shenglong Microfibre, a wholesaler in the complex, says that while China’s high-tech electric vehicle program has boosted demand for synthetic leather for car interiors, weak domestic and foreign demand means factories struggle to fully adopt the latest technologies.

“To automate, a factory must reach a certain order volume,” he says. “But currently, some orders in China are not that big.”

Yang Xian’an, sales manager at BoBang, a manufacturer of synthetic suede, says that while the synthetic fabric industry is becoming increasingly competitive, new overseas orders have decreased since the end of the pandemic. “In this industry… each year is worse than the last,” he says.

Zhang Xinglou, sales manager at Jia Yi Plastic Products, which produces shoe accessories, also complains about the impact of declining domestic and foreign demand for footwear on his company.

“High-tech is like a drop in the bucket,” he says. “A factory produces a lot of products in a day, and there are so many factories everywhere. How can technology support all of that?” he wonders.

Back at Jie Ao Industrial, a sign hangs at the entrance of a warehouse, stating: “Innovation is the root, quality is life.”

But with dwindling demand and customers haggling for lower prices, the company has had to halve its workforce of about 300 painters, according to general manager Wang.

“For traditional businesses like ours, there are actually many obstacles.”

Vietnam ready to welcome record international visitors

In January of this year, Vietnam welcomed over 1.5 million international visitors, the highest number since the country reopened its tourism in March 2022.