In the afternoon of August 5, Prime Minister Pham Minh Chinh worked with the State Bank of Vietnam (SBV) and leaders of several ministries and sectors on monetary policy management.

According to the SBV’s report, in the first seven months of 2024, the SBV has implemented synchronous solutions to facilitate businesses and people’s access to credit, thereby promoting production and business recovery, as well as enhancing capital absorption capacity, boosting growth in tandem with macroeconomic stabilization, curbing inflation, and ensuring the safe operation of the credit institution system.

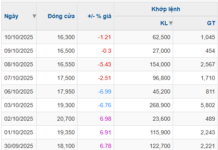

As of July 31, the central exchange rate stood at 24,255 VND/USD, up 1.63% compared to the end of last year. This is a relatively low and stable level compared to regional and global currencies.

Additionally, as of the end of June 2024, interest rates for new and outstanding loans continued to decrease, with the average lending rate at 8.3%/year, down 0.96% compared to the end of 2023, and the average deposit interest rate at 3.59%/year, down 1.08% compared to the end of 2023.

Since late March, the credit growth of the entire system has recovered and increased gradually over the months, higher than the same period last year. By the end of the second quarter of 2024, credit growth reached 6% as directed by the Government and the Prime Minister.

As of the end of July 2024, credit outstanding was nearly VND 14,330 trillion, up 14.99% compared to the same period last year and up 5.66% compared to the end of 2023.

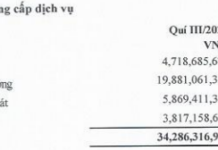

Over the past seven months, the SBV, in coordination with ministries, sectors, and localities, has implemented industry-specific and field-specific credit programs, such as the VND 120 trillion credit package for social housing, worker housing, and apartment renovation and reconstruction projects, and the credit program for the forestry and fishery sectors, with a total accumulated capital of VND 34.4 trillion.

What is the purpose of the over 15 million billion VND in the banking system?

Prime Minister Pham Minh Chinh works with leaders of the SBV and some ministries and sectors on monetary policy management. Photo: VGP

After listening to opinions, Prime Minister Pham Minh Chinh emphasized that monetary policy plays an extremely important role, and banking activities are the lifeblood of the economy. Effective monetary policy management will create favorable conditions and a foundation for the country’s development, including various economic sectors.

The Prime Minister applauded and commended the efforts and achievements of the SBV and the entire banking system in implementing monetary policies, contributing to socio-economic development goals. He also urged them to continue promoting and further enhancing their performance in the coming time.

Highlighting the country’s solid macroeconomic foundation and positive economic outlook predicted by international financial institutions, the Prime Minister acknowledged the challenges facing monetary policy management and banking activities in the short and long term.

These challenges include inflationary pressures, upward trends in interest rates, credit growth falling short of demands, increased capital demands towards the end of the year, rising foreign currency needs, and risks stemming from geopolitical tensions worldwide.

Currently, the deposit amount in the banking system exceeds VND 15 quadrillion. This substantial sum has been channeled by the banking system into the economy through credit activities. The Prime Minister instructed the necessity of devising solutions to ensure that this capital effectively serves production and business activities, rather than merely remaining within the banking system.

Furthermore, the Prime Minister pointed out several valuable lessons, including data-driven decision-making, drawing on international experience while adapting it to Vietnam’s conditions and circumstances, addressing both immediate and long-term concerns, avoiding abrupt policy changes, and ensuring harmonious coordination among policies.

He emphasized the importance of conveying clear and decisive messages and policies that are practical and action-oriented. He also stressed the need to learn from experience to improve and expand credit packages to encourage growth drivers.

Regarding monetary policy, the Prime Minister requested to consistently implement the Central Committee’s Conclusion 64 on socio-economic development in 2023-2024. He instructed proactive, flexible, timely, and effective policy management, along with harmonious, tight, and well-coordinated implementation with other policies.

The Prime Minister directed a credit growth target of around 15%, focusing on traditional and new growth drivers. He also emphasized the need for flexible management of exchange rates using various tools.

Additionally, he instructed the SBV to strike a flexible, harmonious, reasonable, and balanced approach to managing interest rates and exchange rates. Credit management should be aligned with macroeconomic developments and inflation control to meet the capital needs of the economy.

Moreover, the Prime Minister called for a fundamental and methodical strengthening of gold and foreign currency market management. He also urged the acceleration of bad debt handling and the vigorous implementation of the Project “Restructuring the system of credit institutions associated with bad debt handling in the 2021-2025 period,” with a focus on effectively handling weak credit institutions.

Which bank offers the highest interest rate for online savings in early February 2024?

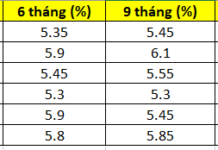

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Banks Sacrificing Profits to Support the Economy

In 2023, the question “which bank has the lowest interest rates?” is being talked about more than ever. With the prevailing difficult economic situation affecting individuals and businesses, in line with the directive of the State Bank of Vietnam (SBV), banks have unanimously sacrificed their profits by reducing lending rates and introducing credit packages with interest rates as low as 0%.