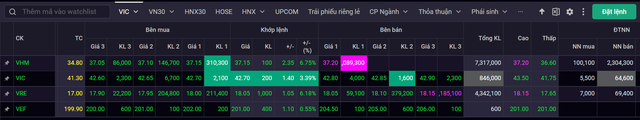

Vingroup’s stocks, including VRE, VIC, and VHM, witnessed a strong surge at the start of the trading session on August 7th. VHM, owned by Vinhomes, and VRE, from Vincom Retail, stood out with a 7% jump right at the opening bell, while VIC, the flagship stock of Vingroup, also joined the rally with a nearly 4% gain.

It’s worth noting that the “Vin” stocks have been on a downward spiral since the beginning of the year and are currently trading at historical lows. However, foreign investors have been net sellers of VIC, VRE, and particularly VHM, offloading millions of shares at the beginning of the session.

The “Vin” stocks caught a wave of investor interest after Vinhomes announced its plan to repurchase 370 million treasury shares, equivalent to 8.5% of its outstanding shares. The expected timeline for this buyback is after obtaining approval from the State Securities Commission, and the company will disclose information about the repurchase in accordance with regulations. The transaction will be conducted through either matched orders or negotiated deals.

At the close of the trading session on August 6th, VHM’s share price was 34,800 VND/share, reflecting a 21% discount to its book value per share as reported in the second quarter of 2024 (approximately 44,000 VND/share). Based on the closing price on August 6th, Vinhomes is estimated to spend more than 12,876 billion VND on this repurchase.

To date, Vinhomes has maintained its position as Vietnam’s largest residential real estate developer, managing a land bank of approximately 19,600 hectares.