The Institute of Strategy and Trade Policy Research (under the Ministry of Industry and Trade) cited statistics showing that global trade experienced a remarkable recovery in the second quarter of 2024, with a projected growth of 3% for the year. However, protracted geopolitical tensions could escalate to dangerous levels, potentially impacting Vietnam’s industrial production and trade in the coming months.

Closely Monitoring Developments

According to the Institute, geopolitical tensions, coupled with issues in the Red Sea, high debt levels, and economic fragility, negatively impact the global trade model. In the industrial sector, the prolonged Russia-Ukraine conflict has led to energy supply disruptions, driving up oil and gas prices. This has increased production and transportation costs in Vietnam, affecting businesses’ profits and commodity prices. High energy prices may fuel inflation, influencing consumer spending and living costs, ultimately slowing economic growth.

Moreover, as Ukraine is a significant exporter of agricultural products such as cereals and vegetable oils, the conflict has disrupted supply and increased prices. Vietnam may face raw material shortages or higher costs, impacting the food processing industry.

Vietnam’s garment exports are expected to face challenges due to global uncertainties. Photo: TAN THANH

In terms of trade, the Federal Reserve’s policy of maintaining high-interest rates could lead to changes in the USD/VND exchange rate, making Vietnamese exports more expensive and imports cheaper. This may impact the competitiveness of Vietnamese goods in the international market.

To address these challenges, the Ministry of Industry and Trade plans to continue economic diplomacy efforts, promote international integration, and build relationships with major countries to strengthen Vietnam’s trade position. They will also diversify e-commerce development models, boost domestic consumption, and connect to global supply chains. Additionally, they will promote the domestic market by enhancing trade promotion and vigorously promoting products on e-commerce platforms and digital platforms.

The Ministry of Industry and Trade has proposed that the government direct ministries, sectors, and localities to closely monitor global and regional political and economic developments to formulate timely and flexible policies. The State Bank is expected to provide financial support and credit incentives for businesses to help them fulfill signed contracts and expand exports.

The Ministry also advises businesses to closely monitor the Fed’s decisions and prepare countermeasures. These may include diversifying export markets, strengthening domestic production capacity, and seeking alternative sources of capital to ensure the sustainable development of Vietnam’s industry.

Keeping a Close Eye on Fed’s Interest Rate Cuts

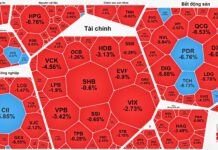

According to experts, recent fluctuations in the international financial market, particularly escalating geopolitical tensions in the Middle East, have caused concern.

Mr. Barry Weisblatt David, Director of Analysis at VNDIRECT Securities Corporation, stated that following the latest news about weak non-farm job growth in the US, there is a consensus that the Fed will cut interest rates at least once and possibly by 0.5 percentage points this year. This news caused the US Dollar Index (DXY) to drop by 0.75% yesterday to 102.5 points.

“The Fed’s expected two interest rate cuts could push the DXY below 100, giving the State Bank of Vietnam more flexibility in injecting liquidity into the market and making it easier to achieve the 14% credit growth target. In fact, the State Bank of Vietnam has just lowered the OMO interest rate from 4.5% to 4.25%,” said Mr. Barry Weisblatt David.

Assoc. Prof. Dr. Nguyen Huu Huan, a senior lecturer at the University of Economics Ho Chi Minh City, opined that the Fed’s interest rate reduction from September onwards may not significantly impact Vietnam’s economy, as the effects of interest rate adjustments have a certain lag. Moreover, Vietnam’s monetary policy is currently out of sync with the US. For example, on August 5, the State Bank of Vietnam cut the OMO interest rate, while the US maintained high-interest rates.

“USD/VND exchange rate pressure is usually seasonal, and the pressure on the market at this time is not significant. In fact, the exchange rate has cooled down considerably recently. The expectation of the Fed’s interest rate cut will open up more room for the State Bank of Vietnam to operate its monetary policy to ensure both economic growth and exchange rate control. The reduction in the OMO interest rate will help improve liquidity for banks, thereby promoting credit growth and pushing capital into the market in the coming time,” said Assoc. Prof. Dr. Nguyen Huu Huan.

According to VNDIRECT experts, the slowdown in US growth could put some pressure on Vietnam’s export forecast, as the US is Vietnam’s largest export market. However, the impact is not significant, as Vietnam’s production activities remained robust in July, with the PMI index reaching 54.7 points due to a significant increase in new orders.

Regarding the decision to raise interest rates by the Bank of Japan (BOJ), Mr. Barry Weisblatt David believed that it would have only a minor impact on Vietnam. Some domestic economic experts shared this view, noting that Japan is only Vietnam’s sixth-largest export market. Moreover, most investments from Japan to Vietnam are in the form of official development assistance (between governments) or long-term FDI, such as SMBC’s $1.5 billion investment in VPBank. This type of capital is not sensitive to moderate currency fluctuations, unlike ETF flows. Therefore, investment flows from Japan to Vietnam remain unaffected.

Nevertheless, considering the global situation and the impact of the Fed’s interest rate cuts, the recommendations are for businesses to closely monitor the situation and prepare appropriate countermeasures to seize opportunities and mitigate risks amid uncertainties.

Minister of Planning and Investment NGUYEN CHI DUNG:

There is a need to strongly promote domestic consumption stimulus

The common difficulties and challenges of the world and the region continue to significantly affect the socio-economic situation of our country. Therefore, to overcome difficulties and challenges, in the coming time, we need to strongly promote and renew the driving forces for growth in terms of investment, consumption, and exports. In particular, it is necessary to focus on effectively implementing support policies for businesses and people.

Priority should be given to strongly promoting domestic consumption stimulus and effectively implementing the campaign “Vietnamese people give priority to using Vietnamese goods”, attracting domestic and international tourists. At the same time, it is necessary to take advantage of the opportunities from key and strategic export markets and FTAs that have been signed; promote negotiation and signing of new FTAs to promote exports.

Secretary-General of Vietnam Fruit and Vegetable Association DANG PHUC NGUYEN:

Taking advantage of the great advantages of nearby markets

The escalation of conflicts recently has greatly affected the flow of goods globally. In particular, due to the tension in the Red Sea, the transportation of goods from Europe and America to Asia and vice versa takes 2-3 weeks longer, sea freight increases by 2-3 times, there is a shortage of empty containers for loading… making import and export in distant markets difficult.

However, we have the advantage of exporting to nearby markets, which are China, Korea, and Japan. In the first six months of 2024, these three markets alone accounted for 73% of the export market share.

Vietnam’s fruit and vegetable industry needs to take advantage of the great advantages of these markets by negotiating to open more new products.

Mr. NGUYEN VAN THU, Chairman of the Board of Directors of GC Food Joint Stock Company:

Balancing production to avoid large inventories

The risk of conflict escalation in many parts of the world negatively affects import and export activities. Global consumers are more cautious and tighten their spending, leading to weak purchasing power. The increase in shipping costs erodes business profits. Some countries’ currencies have depreciated against the US dollar, making imports difficult.

This is also a significant challenge, requiring domestic enterprises to take the initiative in responding. Specifically, GC Food is trying to find new and potential markets and plans to balance production according to customers’ needs to avoid overproduction and large inventories.

M. Chien – T. Nhan – N. Anh recorded

New Risks Threaten Global Supply

US Federal Reserve policymakers on August 5 dismissed the notion that weaker-than-expected July jobs data indicated that the world’s largest economy was sliding into recession. However, they warned that the Fed would need to cut interest rates to avoid such an outcome.

Ms. Mary Daly, President of the Federal Reserve Bank of San Francisco, stated that many details in the latest employment report showed that the US economy was slowing but not falling. Ms. Daly also said that the timing and magnitude of interest rate cuts would depend on upcoming economic data, and there would be much data between now and the Fed’s next meeting in mid-September. “It’s incredibly important that we don’t let the labor market slow down to the point where it falls into a recession,” she told Reuters.

On the same day, Mr. Austan Goolsbee, President of the Federal Reserve Bank of Chicago, said that the global stock market plunge was partly due to the Bank of Japan’s decision to raise interest rates the previous week and escalating geopolitical tensions in the Middle East. He referred to the Fed’s dual mandate of employment and price stability while noting the volatility of financial markets.

At last week’s meeting, the Fed decided to keep interest rates in the range of 5.25% – 5.50% and signaled that it was on track to start cutting interest rates in September. US stocks fell sharply on August 5 (local time) amid concerns that the Fed had been slow to cut interest rates. Asian stock markets also had a red Monday but rebounded on August 6. Among them, Japan’s Nikkei 225 and Topix indexes rose 10.23% and 9.3%, respectively.

Meanwhile, oil prices rose on August 6 due to concerns about supply amid escalating conflicts in the Middle East and falling output at Libya’s Sharara oil field. According to Reuters, Brent crude futures rose to $77.06 a barrel, while WTI crude futures rose to $73.86 a barrel. Analysts said that the risk of a full-scale conflict in the Middle East continued to increase worries about supply in the oil market. “The possibility of a full-scale war in the Middle East is becoming a reality, threatening global supply,” said Ms. Priyanka Sachdeva, an analyst at Phillip Nova (Singapore).

Hoang Phuong

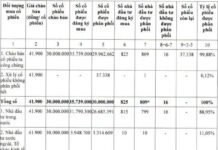

Territory-based credit policy in Ho Chi Minh City shows nearly 39% growth

Credit programs, not only support and assist the poor and vulnerable, who are the main subjects of policies in Ho Chi Minh City, with capital for production and business to create livelihoods and employment opportunities, but also play a significant role in the direction of sustainable economic development, economic growth, and social security ensured by the Government.

Looking back at meaningful credit policies

Results in overcoming obstacles, recovery, and business growth, as well as macroeconomic stability, are greatly influenced by credit and policy credit.