Yellow phosphorus is a critical commodity for global industries. Prior to 2021, it was primarily used in fertilizers. However, with the growing demand for semiconductors and lithium phosphate batteries used in electric vehicles, the future of yellow phosphorus is expected to align with the promising prospects of the semiconductor and lithium battery industries. Currently, approximately 20% of the demand for phosphorus is driven by the semiconductor industry.

The yellow phosphorus industry is energy-intensive, highly polluting, and faces prominent environmental risks and long-term excess capacity issues. In recent years, China has consecutively introduced a series of policies to promote the development of the yellow phosphorus industry towards a greener, more energy-efficient, and low-carbon direction.

As a result, these policies have strictly restricted the production of yellow phosphorus in China while also encouraging the phasing out of some outdated production capacities from the market. Furthermore, since 2018, China has almost halted its exports of phosphorus, producing only for domestic consumption. This is considered a good opportunity for Duc Giang Chemical Group JSC (HOSE: DGC).

Source: MBS Securities Corporation

DGC is Asia’s largest exporter of yellow phosphorus. Yellow phosphorus is a critical material in semiconductor manufacturing technology and in the F&B industry. DGC is also the only company in the world capable of producing yellow phosphorus from apatite ore in both powder and lump forms.

DGC currently has only two main competitors in this market segment: Kazphosphate (KAZ) in Kazakhstan, with a capacity of 120,000 tons/year, and Bayer in the US, with a capacity of 200,000 tons/year. KAZ’s product quality is lower than that of DGC due to lower phosphate rock quality and production technology.

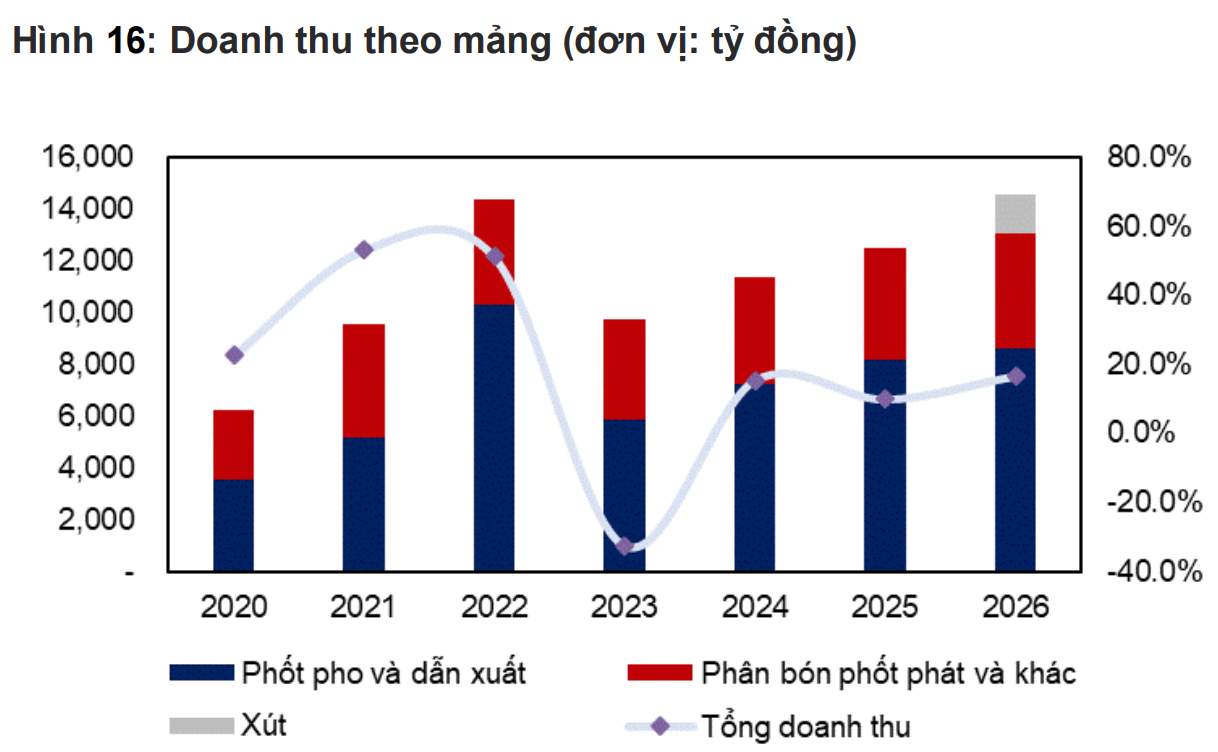

According to the financial report released by Duc Giang, the company’s revenue in Q2/2024 reached VND 2,504 billion, an increase of 3.7% year-on-year. Revenue from agricultural phosphate fertilizers and other segments increased by 11.2% year-on-year as the WPA plant resumed operations after a 3-month maintenance period in Q1/2024, while revenue from phosphorus and derivatives decreased by 2.5% year-on-year due to lower prices for this commodity (down 16.7% year-on-year).

The gross profit margin in Q2/2024 increased by 0.3 percentage points year-on-year to 39.3% thanks to lower apatite ore prices, resulting in a 4.6% year-on-year increase in gross profit. However, lower financial income (down 8.8% year-on-year) due to lower deposit interest rates caused net profit in Q2/2024 to remain flat (down 0.1% year-on-year).

DGC’s net profit in Q2/2024 increased by 19.6% quarter-on-quarter, mainly due to the agricultural phosphate fertilizer and other segments, indicating a recovery signal for DGC. Net profit for the first half of 2024 reached VND 1,515 billion, a decrease of 7.1% year-on-year.

Source: MBS Securities Corporation

Yellow phosphorus prices are currently at their lowest level in a year and are unlikely to drop to 2021 levels due to apatite mining restrictions in China.

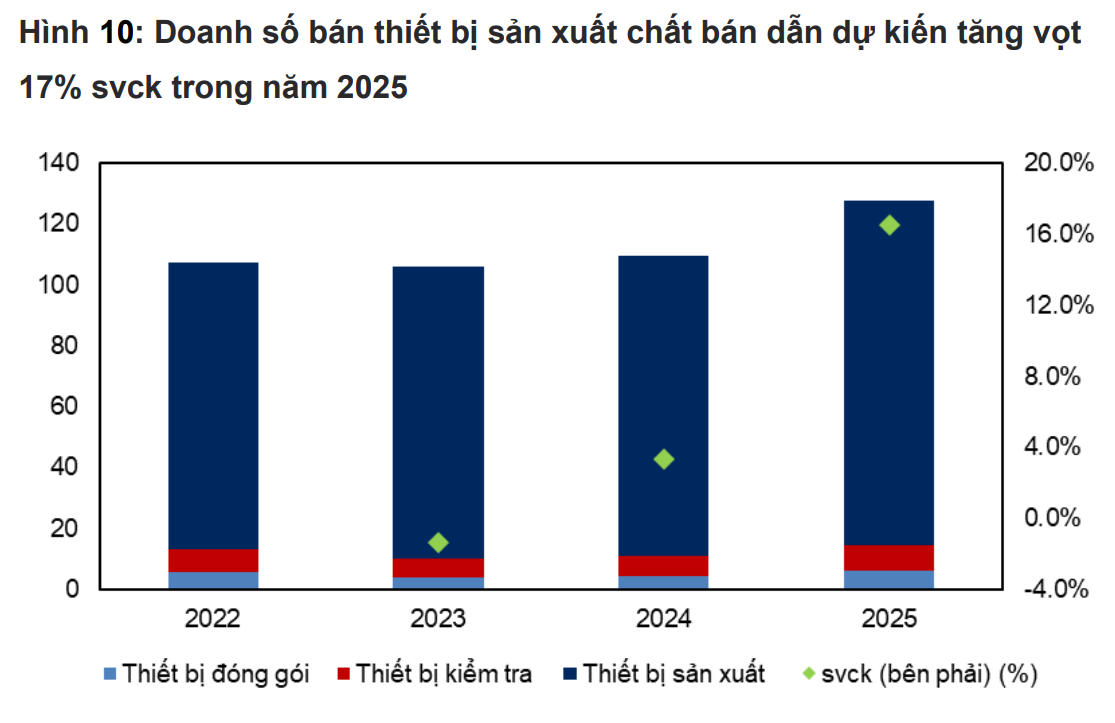

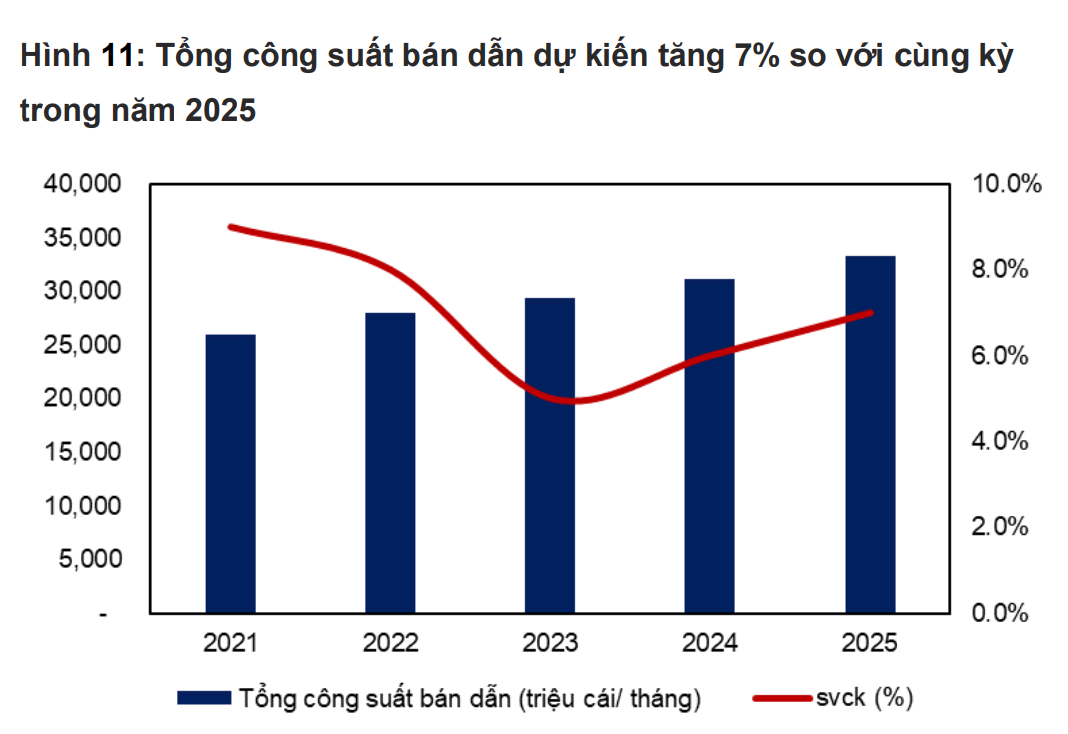

The analysis report by MBS Securities Corporation states: “We expect yellow phosphorus prices to recover stronger in the second half of 2024 as the semiconductor industry fully recovers. We forecast DGC’s P4 price to reach $4,400/ton in the second half of 2024 (up 4.6% compared to the first half) and P4 output to reach 25,000 tons in the second half of 2024 (up 25% compared to the first half of 2024).

Therefore, we forecast DGC’s net profit in the second half of 2024 to reach VND 1,985 billion, an increase of 31.0% compared to the first half of 2024, bringing the full-year 2024 net profit to VND 3,504 billion.

Moving into 2025, thanks to the expansion of global semiconductor capacity, we forecast DGC’s yellow phosphorus price and output in 2025 to increase by 4.5% and 12.7% year-on-year, respectively, reaching $4,600/ton and 51,000 tons, resulting in a 22% growth in net profit to VND 4,284 billion.”

Yellow phosphorus is essentially pure phosphorus (white) with impurities.

Yellow phosphorus is extracted from apatite ore (Ca3(PO4)2), which is an important raw material for the production of phosphoric acid (H3PO4) used in the manufacture of semiconductors and electric vehicle batteries.

Largest taxi company in Nghệ An cancels car purchase contract with Toyota to switch to VinFast

Mr. Ho Chuong, CEO of Son Nam International Transport Co., has recently disclosed that he had previously signed contracts to purchase gasoline-powered vehicles from a Japanese car manufacturer. However, he has since diversified his investment portfolio by also venturing into VinFast electric vehicles, in order to embrace long-term and sustainable development.

Ford’s revenue in early 2024 shines with hybrid cars

Ford Motor, the car manufacturer, has kickstarted the year with robust sales fueled by its hybrid vehicle lineup.