Vinhomes Joint Stock Company (VHM: HOSE) has just announced its plan to repurchase 370 million shares, equivalent to 8.5% of its outstanding shares. The expected timeframe for the buyback is after obtaining approval from the State Securities Commission and disclosing information about the share repurchase as per regulations. The company intends to use either the order matching or negotiated trading method.

On August 6, VHM’s closing price on the stock exchange was 34,800 VND per share, 21% lower than its book value of approximately 44,000 VND per share, based on the company’s Q2 2024 financial statements. Based on the closing price on August 6, Vinhomes is estimated to spend more than 12,876 billion VND on this repurchase.

Vinhomes’ bold move comes as VHM’s share price has fallen to its lowest level in history. The company stated that “VHM’s market price is lower than the company’s true value, and the share buyback is intended to protect the interests of the company and its shareholders.”

According to the 2019 Securities Law, which came into effect on January 1, 2021, the repurchase of 370 million shares will result in a corresponding reduction of 3,700 billion VND in Vinhomes’ charter capital because the company is required to cancel the repurchased shares.

The decrease in the number of outstanding shares will lead to an increase in earnings per share (EPS). Vinhomes’ move is expected to help push VHM’s price back up to at least its book value.

To date, Vinhomes has maintained its position as Vietnam’s largest residential real estate developer, with a land bank of approximately 19,600 hectares under management.

According to regulations, a public company must complete the share repurchase within the timeframe specified in the information disclosure but no later than 30 days from the start of the transaction. Additionally, the daily total volume of buy orders must be at least 3% and no more than 10% of the trading volume registered with the State Securities Commission (excluding canceled orders). This regulation is exempt when the remaining buy volume is less than 3%.

In 2019, Vinhomes conducted a share buyback of 60 million units (at an average transaction price of 92,425 VND per share) as the market price was considered lower than the company’s true value. The buyback was intended to protect the interests of the company and its shareholders.

In 2021, when VHM’s share price surged to over 110,000 VND per share, Vinhomes sold all the treasury shares to supplement its working capital.

According to Vinhomes’ consolidated financial statements for the first half of 2024, the company’s consolidated net revenue reached 36,429 billion VND. Excluding Q1 2024 revenue, the company earned more than 28,200 billion VND in Q2 2024.

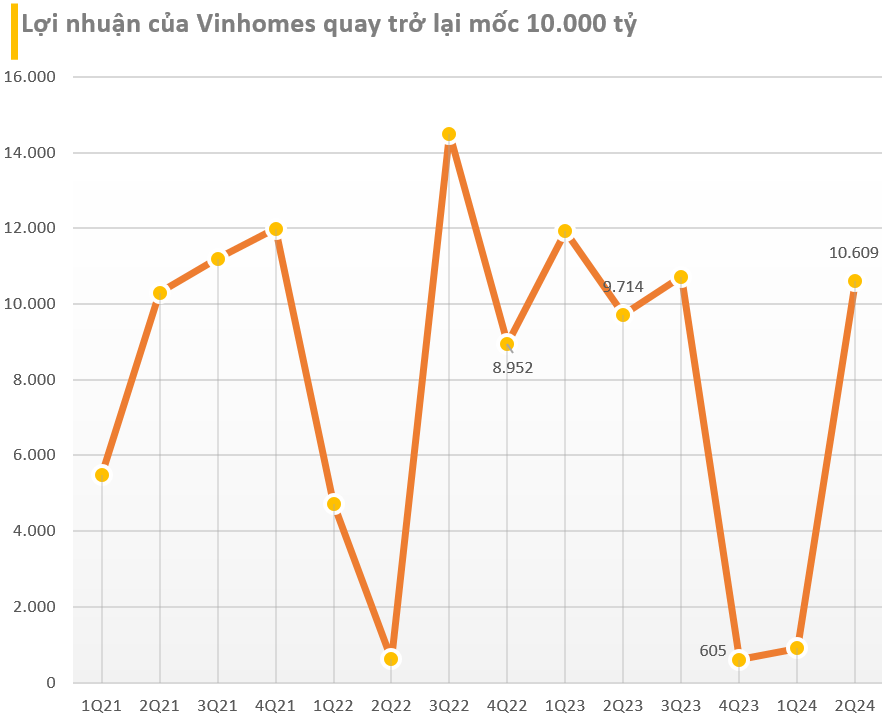

The company’s consolidated after-tax profit for the first half was 11,513 billion VND, mainly attributed to the recognition of a large-lot transaction at Vinhomes Royal Island and continued deliveries at existing projects. Thus, in Q2 2024 alone, the company’s profit exceeded 10,600 billion VND, an increase of nearly 10% compared to the same period last year.

As of June 30, 2024, Vinhomes’ total assets and equity reached 494,461 billion VND and 206,783 billion VND, respectively, an increase of 11.2% and 13.2% compared to the end of 2023.

According to An Binh Securities’ (ABS) analysis, Vinhomes’ growth prospects remain positive in the second half of the year due to high unrecorded cumulative sales of 118,700 billion VND as of Q2 2024, ensuring profits for the company.

Additionally, sales are expected to continue rising with the upcoming launch of large-scale projects. The company also mentioned being in the final stages of completing two bulk sales transactions worth a total of approximately 40,000 billion VND.

The outlook for the second half of 2024 focuses on the delivery of projects such as Vinhomes Ocean Park 3, Sky Park, Golden Avenue, and Royal Island, as well as recognizing revenue from bulk sales. Moreover, in the coming years, Vinhomes’ large-scale projects, including Vinhomes Co Loa (Dong Anh, Hanoi) and Vinhomes Wonder Park (Dan Phuong, Hanoi), will help maintain the company’s sales. Furthermore, VHM has been approved for numerous projects in various provinces, such as Hai Phong, Da Nang, Khanh Hoa, Ha Tinh, Tuyen Quang, Hung Yen, and Long An, ensuring a robust land bank and a pipeline of projects for the years ahead.

Additionally, the trio of laws related to the real estate industry, which came into effect on August 1, 2024 (the 2023 Real Estate Business Law, the 2023 Housing Law, and the 2024 Land Law), will positively impact the real estate market. Vinhomes, as a leading real estate developer in Vietnam with a vast and clean land bank and strong financial capabilities, is poised to benefit significantly from these new regulations.

Healing Lives in Ocean City: A Foreign Expert’s Perspective

In a fragmented healing industry, Ocean City has made a major breakthrough by integrating a comprehensive healing ecosystem into residential complexes, nurturing sustainable health and happiness woven into everyday life, Technode Global reports.