FMC’s Q1 2024 Financial Results: Revenue Growth, Margin Squeeze, and Higher Net Income

Source: Company’s Financial Statements

|

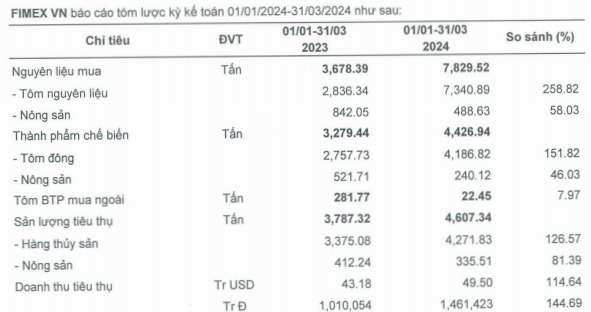

FMC’s total sales volume increased mainly due to a 27% year-over-year growth in seafood consumption, reaching 4,272 tons; meanwhile, agricultural product sales declined by nearly 19% year-over-year to approximately 336 tons.

In the first quarter, the company’s gross profit reached VND 96 billion, a 20% increase compared to the same period last year. The gross profit margin was 7%, a slight decrease from 8% in the same period last year.

|

FMC’s Q1/2024 Business Results

Unit: Billion VND

Source: VietstockFinance

|

Financial expenses decreased by 28% to VND 6 billion. However, interest expenses surged by 40% to VND 4 billion.

After deducting financial expenses, selling expenses (VND 30 billion), and general and administrative expenses (VND 20 billion), FMC’s pre-tax profit was over VND 57 billion, an increase of 13% year-over-year. Compared to the pre-tax profit plan for 2024 (VND 320 billion), the company achieved 18% after the first quarter.

Consequently, FMC reported a net income of VND 50 billion in Q1/2024, an increase of 14%.

At the end of Q1/2024, FMC had a total asset size of over VND 3,503 billion, an expansion of over 4% compared to the beginning of the year. In which, inventory was at VND 941 billion, a decrease of 6%.

Construction in progress costs were over VND 82 billion, a decrease of 14%. This period does not reflect the expenses of the Tam An factory project, which was recorded at over VND 13 billion at the beginning of the year.

Source: Company’s Financial Statements

|

On the other side of the balance sheet, liabilities reached VND 1,212 billion, an increase of 8%, mainly due to short-term debts. Of which, FMC borrowed VND 778 billion from banks for short-term purposes, a decrease of over 5%.

At the end of the trading session on April 19, FMC’s stock price closed at VND 48,200 per share, up 7% since the beginning of the year.

| FMC’s Stock Price Movement Since the Beginning of 2024 |