Internal and External Pressures

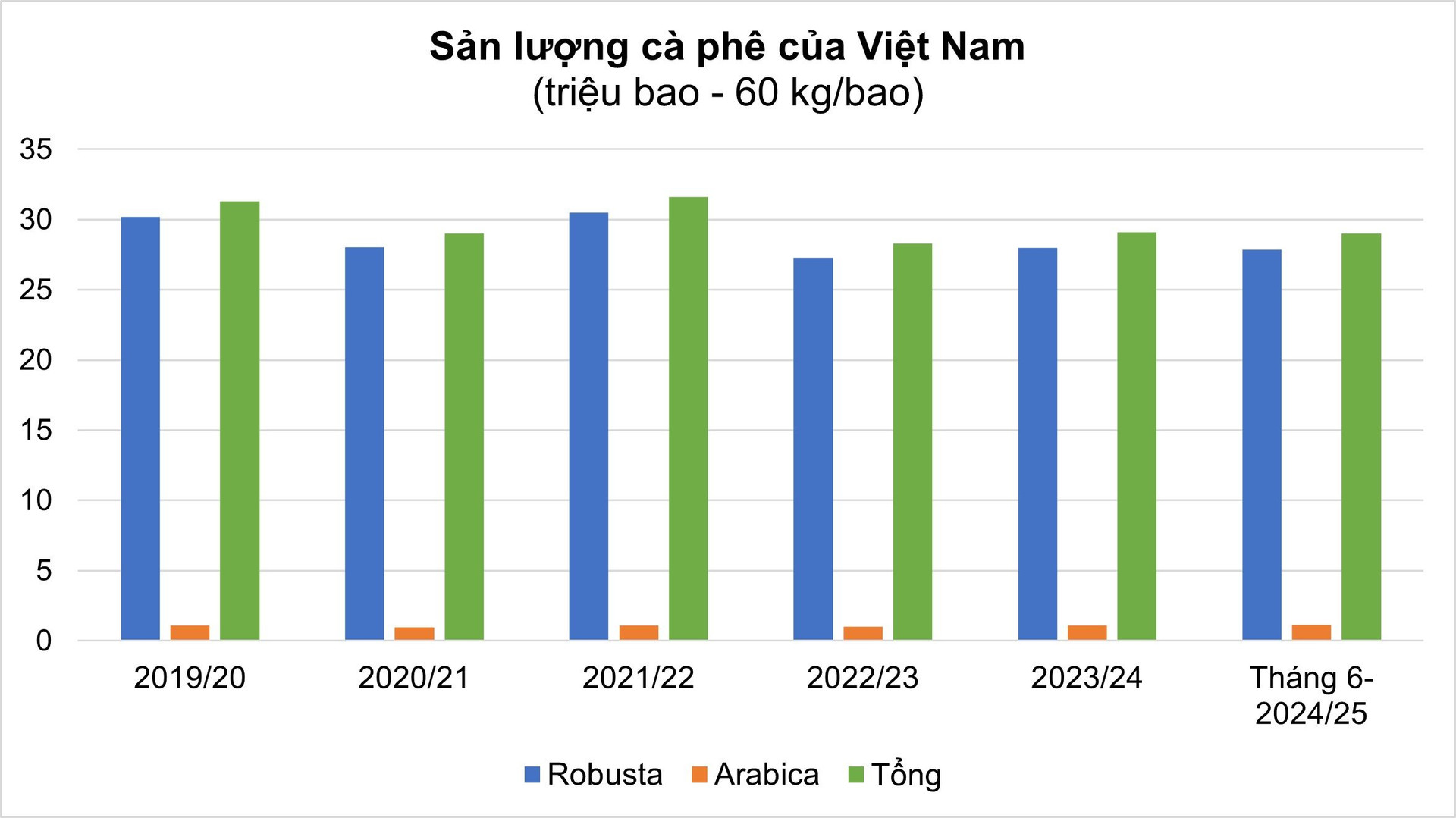

Vietnam’s coffee industry is a crucial pillar of the global coffee market and significantly contributes to the country’s economy. Vietnam is currently the world’s largest producer of Robusta coffee, with approximately 97% of its output being Robusta. The remaining includes Arabica and other specialty varieties.

While domestic coffee consumption is on the rise, exports remain the primary source of income for Vietnam’s coffee industry.

Coffee exports are estimated to total 25 million bags (60 kg/bag) in the 2023-2024 crop year, a decrease of about 10% from the previous year. However, Vietnam remains the second-largest exporter of Robusta coffee globally, after Brazil.

According to Dr. Devmali Perera, a Finance lecturer from RMIT University, Vietnam’s coffee industry faces significant challenges and changes amidst a volatile market and increasing environmental pressures.

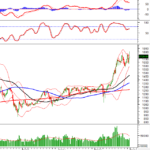

“The Vietnamese coffee market faces two main challenges this year: declining output and rising prices,” Dr. Perera remarked. “Prices are increasing due to heightened domestic and international demand, particularly in Southeast Asian countries. Meanwhile, unfavorable weather conditions and supply chain disruptions contribute to the decrease in production.”

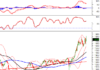

Prolonged droughts and rising temperatures are increasingly impacting Vietnamese coffee production, resulting in reduced yields and affected crop quality.

Simultaneously, the global supply chain is experiencing significant disruptions due to container shortages and port congestion, causing shipment delays and increased costs. These challenges are further exacerbated by geopolitical tensions worldwide.

“Such logistical barriers make it difficult for Vietnamese coffee to reach international markets on time, affecting exporters’ ability to meet market demands,” said Dr. George.

An inefficient value chain also poses challenges. Many smallholder farmers in Vietnam still rely on traditional farming methods, resulting in inconsistent quality and yields. The lack of advanced facilities for processing and post-harvest storage can lead to significant quality degradation.

“New environmental regulations, especially those from the European Union regarding pesticide residues, require producers to adjust their farming methods and incur higher compliance costs,” Dr. George explained. “This adds pressure to smallholder farmers, who may not easily adapt quickly.”

Despite having over 700,000 hectares of coffee land, Vietnam struggles to find suitable land to increase production due to concerns about deforestation and pressure to meet climate-related goals.

According to Dr. Perera, many domestic coffee farmers have switched to growing durian due to the increasing demand for this fruit in the Chinese market. This shift has further reduced the land available for coffee production.

Additionally, Vietnamese farmers face rising production costs, mainly due to increasing fertilizer and labor prices. While higher domestic coffee prices may offset some production costs for farmers, the increased production costs challenge exporters.

“Exporters are currently grappling with financial pressures, product shortages, and higher transportation costs, making them more cautious about taking on new orders,” Dr. Perera observed.

“The increasing demand amid supply chain constraints is creating additional price volatility and instability in the coffee market,” she added.

Strategic Solutions for Ensuring Sustainability and Competitiveness

The Vietnamese coffee market stands at a critical juncture, with rising prices and declining output presenting both challenges and opportunities.

According to two experts from RMIT University, Dr. Devmali Perera (Finance lecturer) and Dr. Majo George (Senior lecturer in Supply Chain and Logistics Management), stakeholders can navigate this volatile environment and position themselves for long-term success by adopting strategic approaches. Farmers, exporters, and investors must be flexible and proactive in their strategies to thrive in the dynamic coffee market.

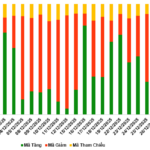

The top priority is to promote sustainable farming practices and initiatives focused on environmental conservation. This can help mitigate the negative impacts of climate change on coffee production.

According to Dr. Majo George, public-private partnerships such as the Production, Protection, and Inclusion Compact (PPI Compact) in Dak Lak can create sustainable models and improve the resilience of farmers. These partnerships can also facilitate agroforestry models and other environmentally friendly approaches to enhance long-term sustainability.

Additionally, implementing strict quality standards and certification processes related to coffee processing is crucial.

Furthermore, training programs for farmers on best farming practices, quality management, and certification processes can motivate them to produce high-quality coffee that meets international standards.

“Moreover, the government can collaborate with domestic and international universities to conduct research on sustainable farming methods and new technologies to support this industry,” Dr. Perera suggested.

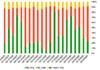

Investing in modern infrastructure for transportation, storage facilities, and processing plants is also essential to improving post-harvest handling and reducing quality losses. This can streamline the supply chain and enhance the efficiency of coffee transportation and storage.

Government support in the form of financial assistance and subsidies can reduce production costs for coffee farmers. Specifically, subsidies for fertilizers and advanced farming equipment can help farmers maintain and improve coffee-growing areas at more reasonable costs.

Additionally, export promotion is another critical area of focus. Policies aimed at promoting Vietnamese coffee in the international market, including participating in global trade fairs and leveraging trade agreements such as the Vietnam-EU Free Trade Agreement, can enhance market access for Vietnamese coffee exports.

“The industry must continue to innovate and adapt to mitigate risks. The resilience and adaptability of Vietnamese coffee producers, coupled with strong government support and innovative measures, will be key to overcoming current challenges and ensuring long-term success in the global coffee market,” Dr. Perera concluded.

Vietnam has just 18 months to join the semiconductor race

Mr. Truong Gia Binh – Chairman of FPT Corporation’s Board of Directors made the statement at the “Human Resource Development Conference for Semiconductor Industry” held on the afternoon of April 24, 2024. The FPT Chairman said that Vietnam has a great opportunity to join the semiconductor industry. However, time is running out.