The HoSE-listed Ho Chi Minh City Construction Joint Stock Company (HBC) saw a positive trading session on August 6, 2024, with its share price surging to the maximum daily limit of VND 5,470 per share, marking a notable recovery from the previous two sessions’ floor prices. This improvement comes after a string of losses, with only two gains out of the last nine trading sessions.

The recovery was triggered by news of HBC’s planned transfer of nearly 347.2 million shares to the UpCOM exchange, as disclosed in a recent statement. The company has committed to maintaining transparent information disclosure practices and protecting shareholders’ interests throughout this process, with the transfer expected to be finalized in August 2024.

In a separate development, HBC has contested the HoSE’s decision to consider mandatory delisting, citing disagreement with the grounds for such action. The company has requested HoSE to reconsider before making a final decision regarding the delisting of its shares.

On another note, Le Viet Hung, Senior Advisor to Hoa Binh Construction, has registered to purchase 500,000 HBC shares from August 8 to September 6, 2024, aiming to diversify his investment portfolio. Mr. Hung, who is also the older brother of HBC’s Chairman, Le Viet Hai, currently holds a 0.25% stake in the company.

In contrast, Hyundai Elevator, a strategic shareholder and subsidiary of Hyundai Group, reported a sale of 5 million HBC shares on July 31, 2024, reducing its ownership to 6.64%. This move comes after a five-year holding period without any transactions and results in an estimated 70% loss compared to their initial investment.

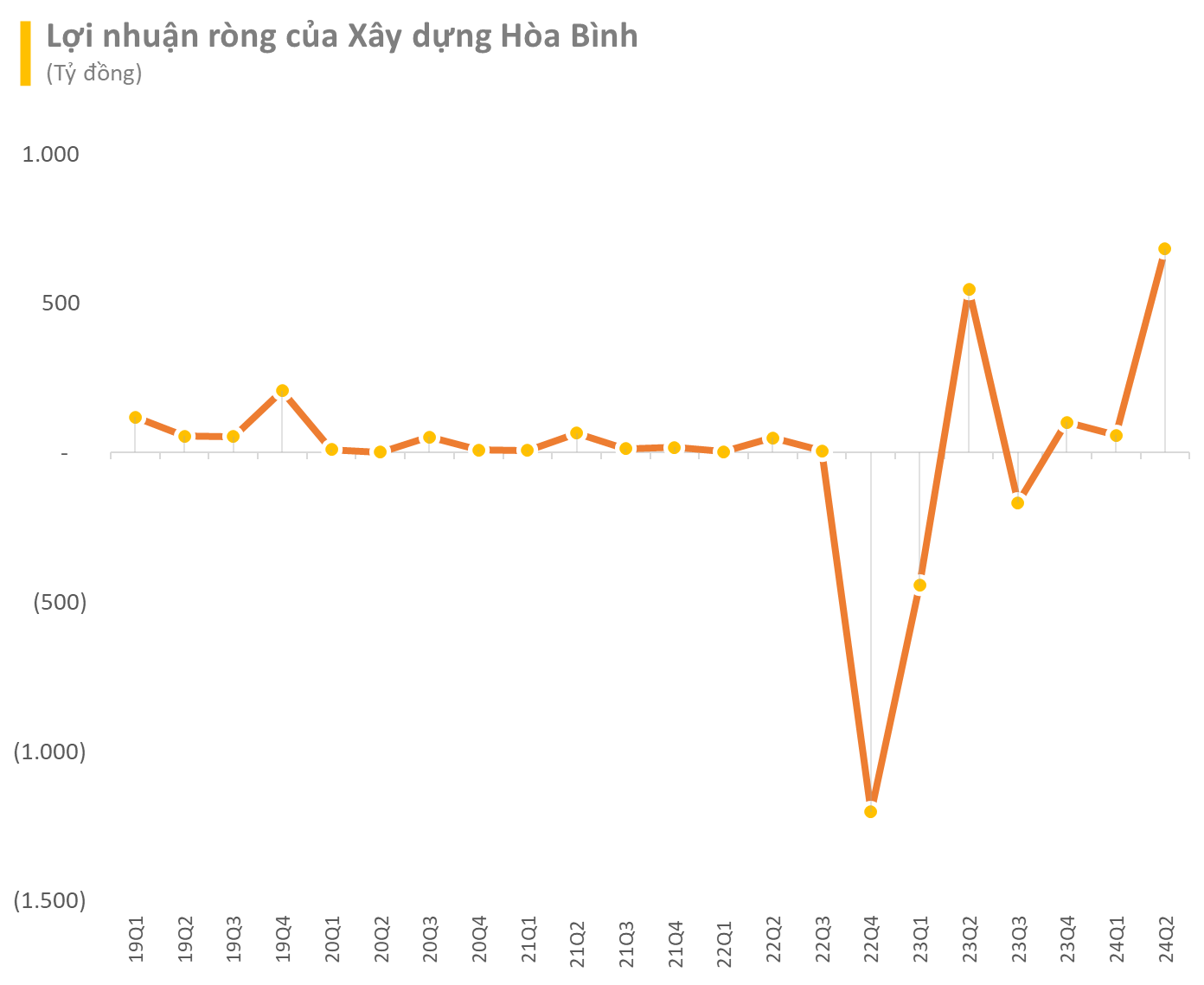

Turning to HBC’s financial performance, the company reported a remarkable turnaround in the second quarter of 2024, with a post-tax profit of VND 684 billion, a significant improvement from a loss of over VND 268 billion in the same period last year. Notably, the company’s parent entity posted a record-high post-tax profit of over VND 682 billion for the quarter.

For the first half of 2024, HBC recorded a 10% year-on-year decline in revenue to VND 3,811 billion. However, its post-tax profit surged to VND 741 billion, in sharp contrast to a loss of VND 713 billion in the previous year. With these results, HBC has surpassed 71% of its full-year profit target for 2024.

Most recently, Hoa Binh Construction approved a resolution to invest in the establishment of PAX Trading and Investment Joint Stock Company, with a charter capital of VND 10 billion. HBC will hold a 98% stake in this new company, which will primarily focus on trading construction materials and interior decoration. Mr. Le Viet Hieu, representing HBC, will serve as the authorized representative for the new company.

Building Peace Welcomes “Vía Thần Tài” with 5 Winning Projects in Kenya, Asserting Leading Position in the “Promised Land” of Africa

In addition to winning 5 bids, Hòa Bình Construction has also received an invitation to the final round for 2 other social housing projects in Kenya. If awarded these additional projects, the total value of Hòa Bình Construction’s social housing construction contracts in Kenya will reach 163.6 million USD.

A Vietnamese construction company wins bids for 5 affordable housing projects in Kenya.

Hoa Binh Construction JSC has won the bid for 5 social housing projects in Kenya, totaling an investment of $72 million. These projects involve the construction of 3,400 residential units.