The unadjusted market has seen many stocks enter a bear market, with only BSI and FTS showing short-term upward trends as of August 6th, trading session.

Examining the performance of securities stocks after the trading session on August 6th, only two stocks, BSI and FTS, exhibited short-term upward trends, while all other securities stocks remained below the MA20 line. This indicates a recent shift in the market dynamics.

With the exception of FTS and BSI, all securities stocks have lost their short-term upward momentum as of the close of the August 6th trading session.

|

Indeed, this is a recent development as the VN-Index recovered more than 20 points on August 6th to reclaim the 1,200-point level. Prior to this, a pessimistic sentiment prevailed, and there were times when all securities stocks simultaneously lost their short-term momentum.

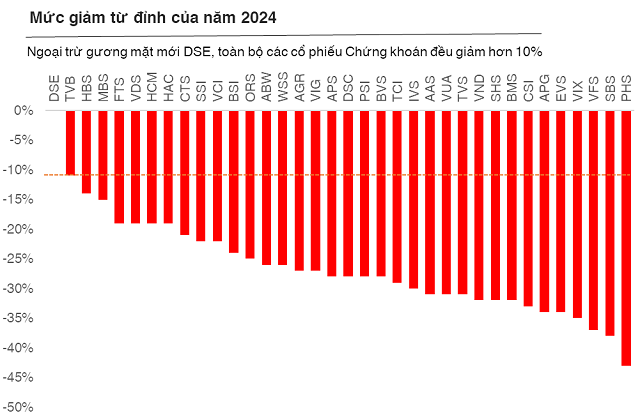

It is worth noting that BSI and FTS are the stocks that broke records in 2024, alongside MBS and CTS. However, following a period of market instability, all four stocks have entered a correction phase, with losses exceeding 10%, and some even entering a bear market, signifying declines of over 20%. Specifically, the peak-to-trough declines for these four stocks are as follows: FTS (-19%), MBS (-15%), CTS (-21%), and BSI (-24%).

In contrast, when examining the broader group of securities stocks, several leading companies have also been classified as being in a bear market, including VIX (-35%), VND (-32%), SHS (-32%), VCI (-22%), and SSI (-22%).

This indicates that securities stocks have underperformed, deviating from the overall market trend. In fact, the VN-Index has not officially entered a correction phase in 2024, and its drawdown from the peak remains within a 10% range.

The VN-Index has not experienced any official correction phases in 2024.

|

Stock price movements contradict positive financial results

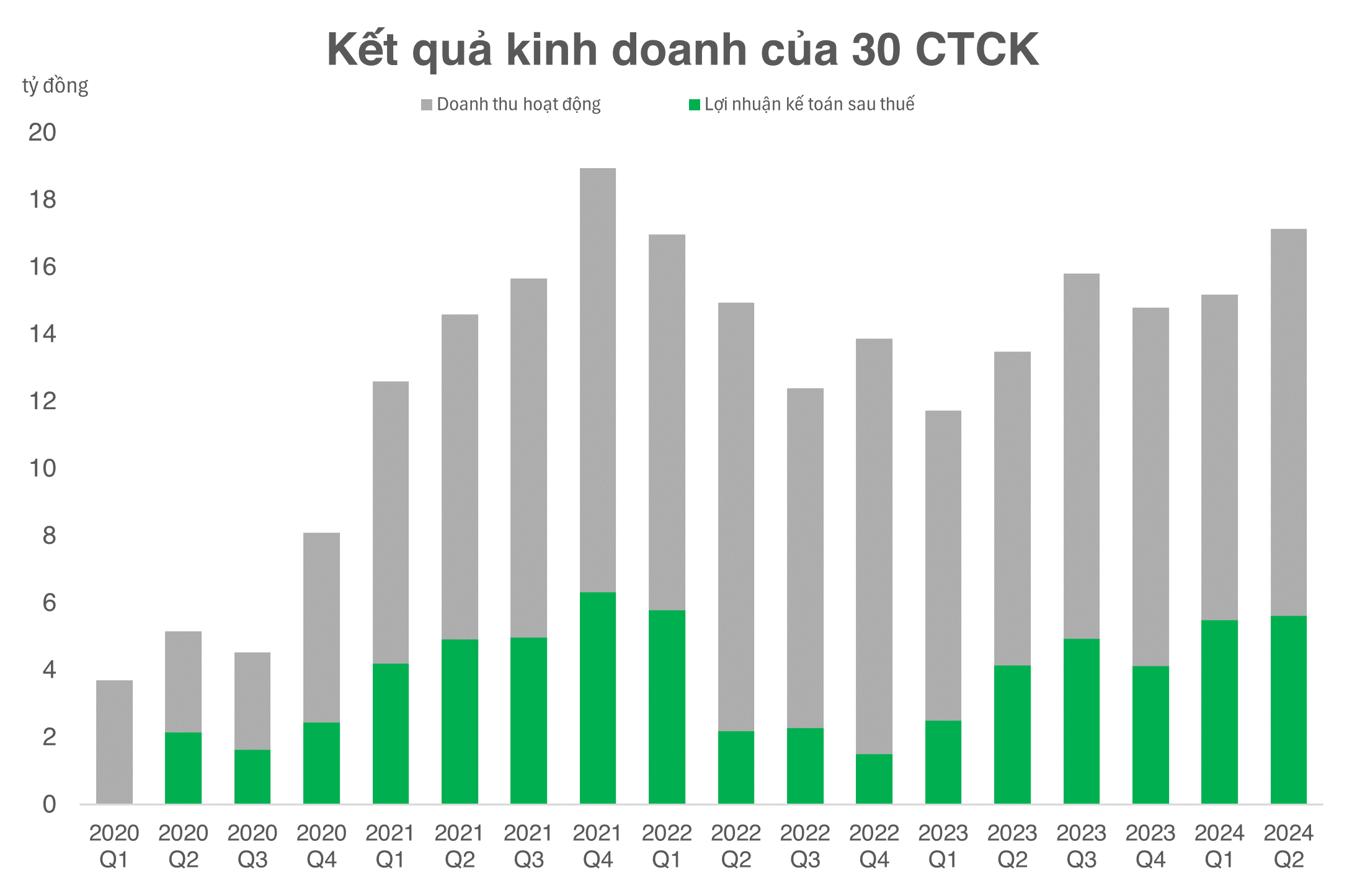

It is challenging for investors to explain the pessimism surrounding securities stocks solely based on the internal dynamics of these companies. During the season of financial statements for the second quarter of 2024, while some businesses, such as VND and VIX, reported weakened profits, the overall trend for the industry remains positive.

Aggregated data from 30 securities companies showed a 13% growth in operating revenue compared to the first quarter of 2024, with a 2% increase in post-tax profits, amounting to over 5,600 billion VND.

The post-tax profits for the second quarter of 2024 were the highest among the last nine quarters.

|

For the first six months of the year, post-tax profits surged by 68% compared to the same period last year, reaching over 11,000 billion VND.

Additionally, it is worth mentioning that the lending activities of securities companies continue to demonstrate their aggressive nature in attracting investors. With the scale of lending breaking records, some securities companies, such as TCBS and SSI, have surpassed a lending balance of over 20,000 billion VND. Meanwhile, HSC, following a capital increase at the beginning of the year, expanded its lending by 30% in the last quarter to over 18,500 billion VND. HSC’s management also aims to reach a lending balance of 20,000 billion VND in 2024.

This indicates that the recent stock price movements contradict the positive financial results and the intentions of the businesses themselves. Similar scenarios have played out for various industry groups and stocks in the overall market following the release of financial statements for the second quarter of 2024.

According to Ms. Nguyen Thi Thuy, an analyst at KB Vietnam (KBSV), the VN-Index entered a sharp decline and strong differentiation after the conclusion of the season for the release of second-quarter financial statements in 2024. However, many companies with good financial results were still heavily sold off, indicating that investor sentiment has been significantly impacted by the negative news affecting the market.

On the other hand, Mr. Nguyen The Minh, Director of Individual Customer Analysis at Yuanta Vietnam Securities Company, stated that it would be challenging for the market to form a bottom without the participation of the securities sector.

“In addition to banks, the securities group will continue to be a sector to watch thanks to its positive financial results and traditional narratives such as market upgrades, KRX implementation, and most recently, pre-funding. After the recent deep decline, the P/B valuation of the securities group has become attractive for investment, hovering around 1.5 times,” added Mr. Minh.