Editor’s Note: Global and Vietnamese stock markets have just experienced two volatile days, plunging on August 5th but quickly recovering on August 6th. Dr. Can Van Luc and the BIDV Training and Research Institute team have provided a rapid assessment of this development.

——-

According to the research team, there are five main reasons behind the stock market plunge on August 5th.

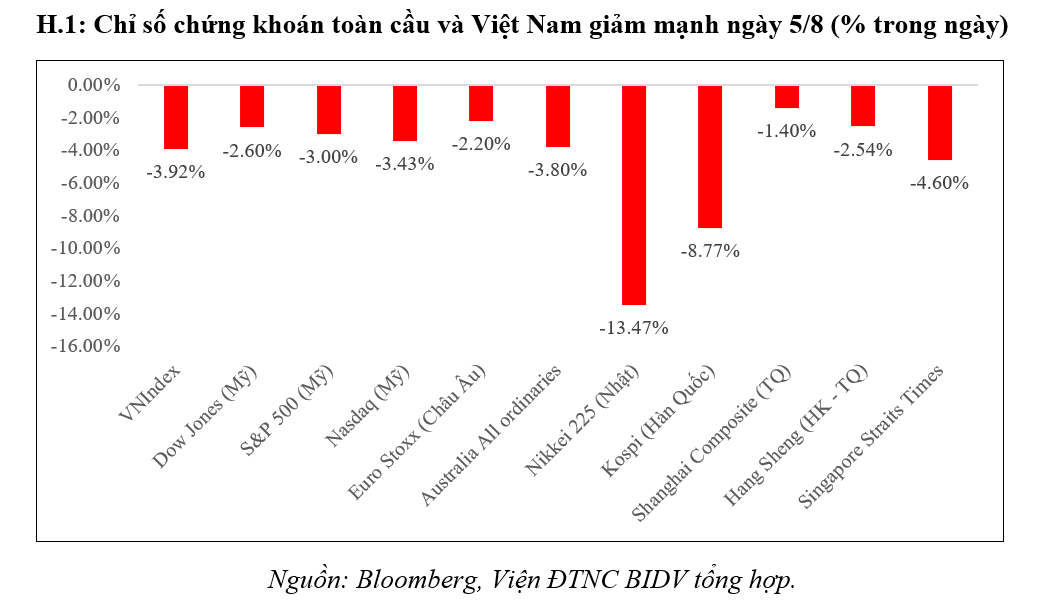

Firstly, the US economy showed some disappointing signs: The jobs report released last Friday (August 2nd) indicated that only 114,000 new jobs were created in July, falling short of the expected 175,000. Experts and investors worry that this signifies the US economy is feeling the weight of high-interest rates, leading to concerns about the Fed’s inaction (not cutting rates sooner, even at the recent July meeting). Goldman Sachs forecasts a 25% chance of a US recession next year, a significant jump from the previous 15% prediction. This anxiety caused US stock indices to drop by 2.6-3.4% on August 5th—the most considerable decline since 2022.

Secondly, global stock markets (especially in the US and Europe) are adjusting after rapid gains in the past: Over the past year, particularly since the start of 2024, stock prices (especially in the IT and e-commerce sectors) have surged (by the end of July, the Nasdaq index was up 14.2%, S&P 500 up 14%, Stoxx Europe 600 up 8.4%, and Nikkei up 19.7%…), while the real economy’s recovery has been sluggish (global GDP growth for 2024 is projected at around 2.6%, similar to 2023). As a result, a market correction was inevitable. These major indices have dropped by 10-12% from their mid-July 2024 peaks.

Thirdly, geopolitical risks, especially the escalating conflict in the Middle East, pose multiple hazards to the global economy, prompting many investors to sell stocks and seek safer investments like the JPY and US government bonds.

Fourthly, the Bank of Japan continued to raise interest rates by 0.25 percentage points, narrowing the interest rate gap between the USD and JPY, causing the JPY to strengthen and negatively impacting Japan’s exports. The allure of the JPY also increased due to the carry trade trend, where investors borrow in JPY and then invest in other markets with higher interest rates. These factors led to the JPY appreciating by over 10% against the USD in the past month and about 6% in the week before (July 29 – August 2).

Fifthly, investor sentiment turned to “panic,” fearing further losses if they didn’t sell (FOMO—fear of missing out on cutting losses) and worrying about not having enough funds to meet margin calls or reduce financial leverage from previous borrowings. This led to somewhat of an “overreaction.”

These factors negatively impacted the Vietnamese market, resulting in a 3.92% drop in the VNIndex on August 5th.

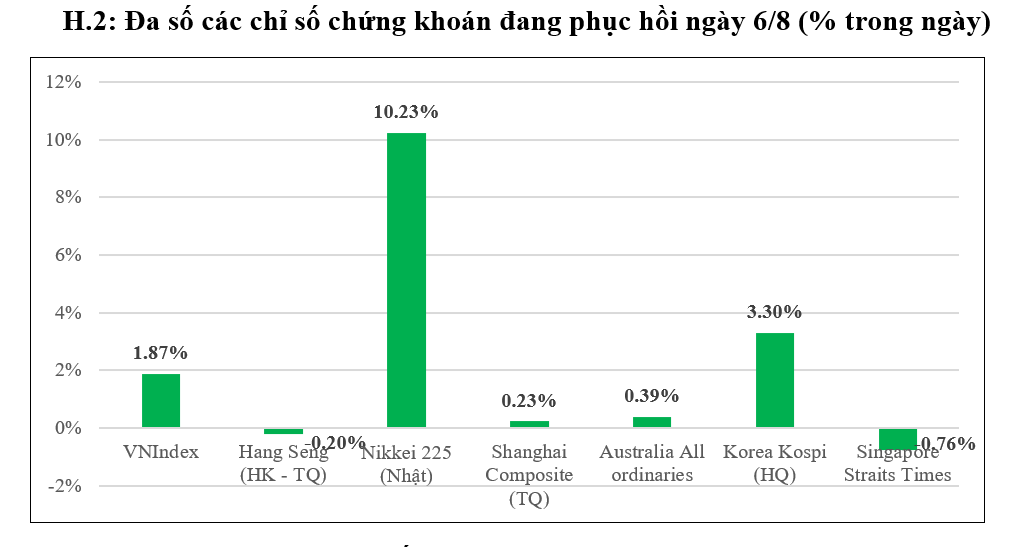

However, the market quickly adjusted and rebounded as most Asian stock indices (European markets had just opened, and American markets were yet to open) climbed back up during the trading session on August 6th, with the Nikkei 225 (Japan) surging 10.23% and VNIndex rising 1.87%… Investors regained their composure. We believe that American and European stocks will also recover, as the US economy is unlikely to fall into a recession but rather slow down (projected to grow by about 2.5% in 2024 and 1.8% in 2025), while the European economy rebounds (growing by around 0.7% in 2024 and 1.4% in 2025, up from 0.5% in 2023, according to the World Bank).

Lessons Learned and Recommendations

Three key lessons can be derived from this event. Firstly, the timing of policy implementation is crucial. The Bank of Japan’s rate hike path has been ongoing, but the latest increase coincided with the escalating Middle East conflict and the US jobs report. Secondly, investor panic can occur in any financial market. Thirdly, policy communication and guidance are vital, especially for fiscal and monetary policies.

Based on these lessons, the research team offers four recommendations. Firstly, investors need to remain calm during such events, as they are likely overreactions or short-term adjustments triggered by a confluence of negative news. Secondly, the 4D principle previously suggested by the research team still holds value for stock market investing. It states that markets will always experience “corrections” after overheating or freezing; “financial leverage” is a double-edged sword; “diversification” of portfolios or investment channels is essential to manage risks and ensure minimum profits; and “herd mentality” should be avoided or minimized (thus, making decisions based on one’s own judgment or appropriate advice is crucial).

Thirdly, regulatory authorities should consider the timing and dosage of policy changes carefully and closely monitor global economic and financial developments to proactively introduce appropriate policies and solutions amid the current unpredictable fluctuations. Fourthly, enhance policy communication and guidance with transparency, clarity, and consistency to improve investors’ and the market’s understanding, awareness, and alignment with the policies.