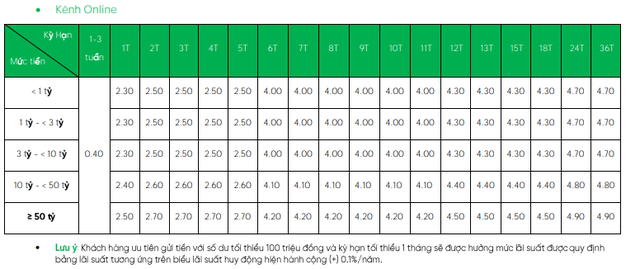

On March 7th, GPBank’s savings interest rate continued to decrease by 0.3 percentage points for terms ranging from 1 to 9 months. According to the online deposit interest rate chart, the lowest rate for a 1-month term is now 2.3% per year. GPBank maintains its online savings interest rate at 4.65% per year for a 12-month term and 4.75% per year for 13-36 months. This is also the highest deposit interest rate at GPBank by this time.

Source: GPBank

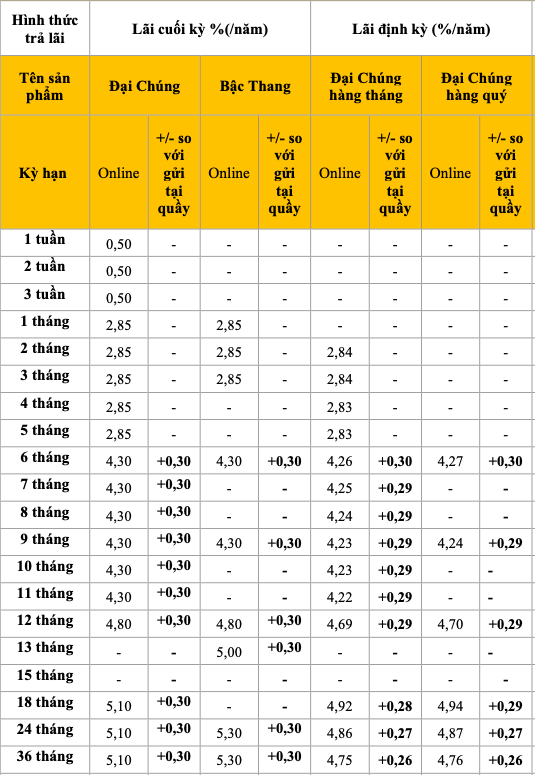

1 day earlier, PVcomBank’s savings interest rate was also adjusted down. According to PVcomBank’s online deposit interest rate table, all terms decreased by 0.1-0.5 percentage points. Specifically, the deposit interest rate for 1-3 months is currently maintained at 2.85% per year. The deposit interest rate for 6-9 months decreased by 0.1 percentage point to 4.3% per year. The deposit interest rate for 18-36 months decreased by 0.1 percentage point, from 5.2% per year to 5.1% per year. This is the highest interest rate applicable at this bank.

Saving interest rate at PVcomBank.

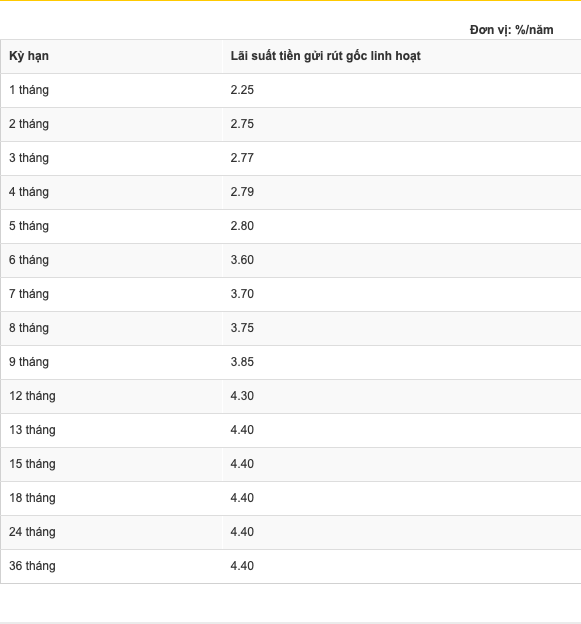

VPBank’s savings interest rate was also officially adjusted down on March 5th. Specifically, the bank reduced the interest rate by 0.3 percentage points for terms ranging from 1 to 12 months.

Accordingly, the minimum online deposit interest rate for 1 month is now only 2.3% per year and for the 12-18 month term is 4.3% per year. The bank maintained the deposit interest rate for the 24-36 month term at 4.7% per year. Previously at the end of February 2024, the latest savings interest rate at VPBank also decreased by 0.2 percentage points for the terms.

On March 4th, ACB’s savings interest rate was also newly posted for the online deposit form. The interest rate decreased by an average of 0.1-0.4 percentage points in most terms compared to the last adjustment in February. Currently, the bank applies the lowest deposit interest rate of 2.5% per year in January. For the 12-month online deposit term, the interest rate is now only 4.1% per year. Meanwhile, the highest interest rate is 5% per year for the 18-month term.

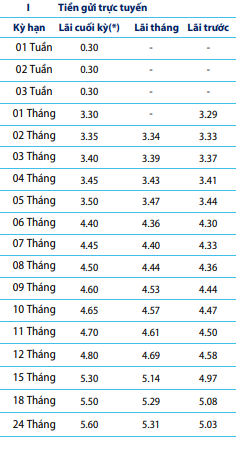

BVBank also adjusted the savings interest rate from March 4th. Specifically, in terms of deposit interest rates, the bank’s interest rate decreased by an average of 0.3-0.4 percentage points. For the 1-month term, the interest rate is currently posted at 3.3% per year. The deposit interest rate for the 12-month term decreased to 4.8% per year. The highest savings interest rate at BVBank is currently 5.6% per year for the 24-month term.

The latest savings interest rate at BVBank.

The latest savings interest rate at BaoViet Bank also decreased on average by 0.2% percentage points in some terms. Currently, the bank offers an interest rate of 3.2% per year for the 1-month and 2-month terms. The interest rate for the 12-month term is 5% per year. BaoViet Bank applies the highest interest rate of 5.3% per year for terms from 15 months to 36 months.

Similarly, the savings interest rate at PGBank was also adjusted down by an average of 0.2 percentage points. Accordingly, the current interest rate is 2.9% (1 month), 3% (2 months), 3.3% per year (3 months). The bank then reduced the interest rate by 0.2 percentage points for the 9-13 month term, equivalent to an interest rate of 4.2% per year – 4.8% per year. From the 18-month to 36-month terms, the interest rate remains unchanged. Specifically, the interest rate for the 18-month term is 5.1% per year.