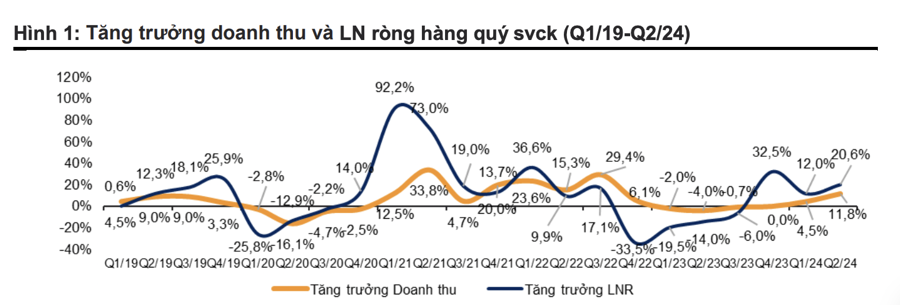

The second-quarter earnings season has officially come to a close, and the overall market performance is positive. According to VnDirect, the net profit of listed companies on the three exchanges, HOSE, HNX, and UPCoM, increased by 20.6% year-on-year, driven by a clearer economic recovery and low base effects from the second quarter of 2023.

The Steel and Retail sectors were the top contributors to this growth. The steel industry witnessed a significant improvement, with a 437% surge in profit year-on-year due to expanded EBITDA margins. This was a result of a more significant decrease in input costs compared to selling prices, along with increased revenue in the second quarter of 2024 due to higher sales volume.

The retail sector’s profit soared by 379% year-on-year in Q2/24, led by ICT retailer MWG, which posted an astonishing 6,635% rise in net profit, amounting to VND 1,170 billion in Q2/24. This impressive performance can be attributed to improved revenue per store and efforts to restructure the distribution system, including closing down inefficient stores.

The Industrial, Construction and Materials, and Chemicals sectors also displayed robust growth. Profit in these sectors increased by 319%, 71.3%, and 59.6%, respectively, year-on-year. This growth was fueled by rising domestic and export demand as the global economy rebounded.

While the Real Estate sector continued to face challenges, there are signs of improvement. The industry witnessed a 16.9% year-on-year decline in profit, but the rate of decline has slowed compared to the previous year. In the second quarter of 2023, the decrease was 36.1%, and it softened to 29.2% in the first quarter of 2024, indicating a potential recovery in the real estate market.

When analyzing market performance by capitalization, the mid-cap group stood out with a 46.2% year-on-year increase in net profit in Q2/24. This group also experienced substantial growth at the beginning of the quarter, and the release of financial results triggered a sell-off that pushed the VN-Index below the 1,200-point threshold.

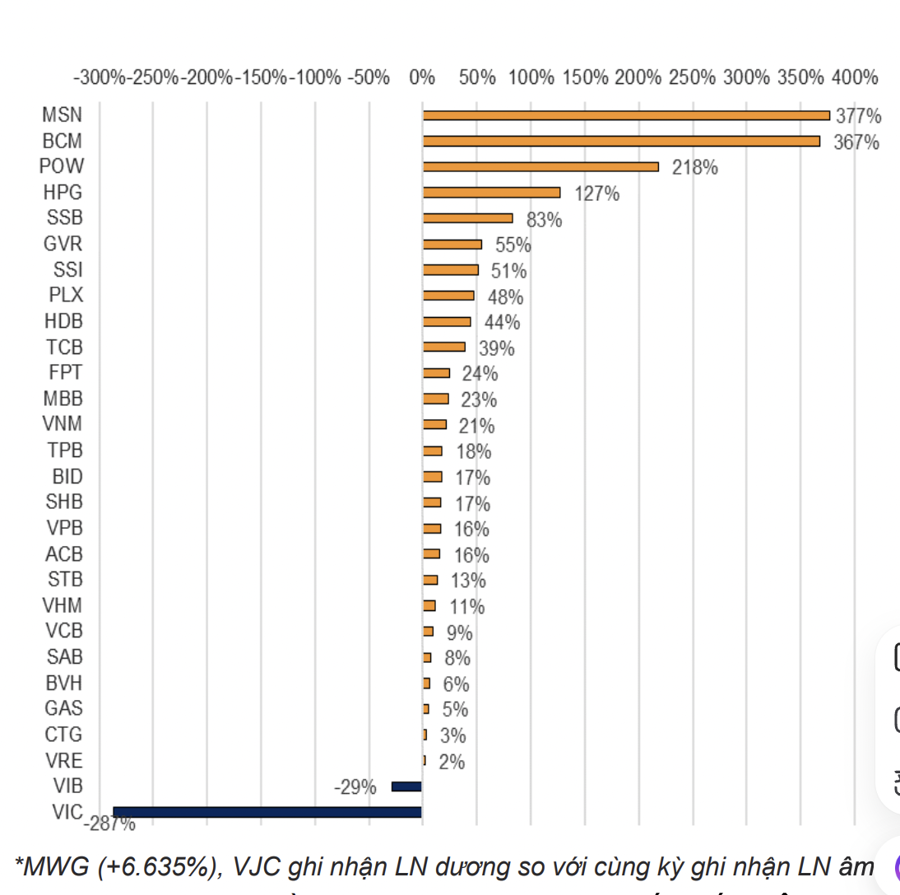

MWG, MSN, BCM, POW, and HPG were the top contributors to the VN30 index’s profit, with a collective 14.5% year-on-year increase in net profit in Q2/2024. MWG led the way with a staggering 6,635% surge in profit, followed by MSN at 377%, BCM at 367%, POW at 218%, and HPG at 127%.

The outstanding performance of MWG and MSN, both in the retail sector, signifies a recovery in consumer spending, partly attributed to the government’s consumption stimulus measures, such as VAT reductions. On the other hand, VIC experienced a 286% year-on-year decrease, while VIB reported a 28.6% decline in profit.

The overall gross profit margin for the market in Q2/24 improved by 1.1 percentage points to 16.5%. This enhancement was driven by the Real Estate (+10.4 percentage points) and Industrial (+3.3 percentage points) sectors.

Borrowing costs, which hit a low in Q1/24, edged slightly higher in Q2/24 as the economy recovered and credit demand increased. Interest expenses rose to 6.0% in Q2/24, up from Q1/24, and the debt-to-equity ratio dipped to 70.2% in Q2/24, a 5-percentage-point decrease from the previous quarter. These indicators suggest that the period of low-interest rates might be coming to an end as the economy enters a recovery phase, leading to higher deposit rates.

However, VnDirect believes that deposit rates will not rise too rapidly. Instead, they will likely be maintained at moderate levels to allow businesses to adjust their operations and financial plans accordingly.