Today’s blue-chip group was weak, with some major stocks putting significant pressure on the market, notably TCB. However, the overall market only fluctuated slightly due to the T+ effect of bottom-fishing volume. The low liquidity indicated that buying power was subdued rather than a strong selling force.

The market is still in a technical rebound phase, with low-volume rising sessions and high-volume falling sessions. However, this is only superficial, as the overall statistics show a different story when looking at individual stocks’ performance.

It’s not unusual to see daily spasms in a market searching for its bottom. Investors who bought on dips will have to consider whether to take profits as, technically, VNI is still in a clear downtrend and shows no signs of bottoming out. Bottom fishers also face high risks, so they can’t afford to go all in or chase rising prices.

This psychological tug-of-war will lead to indecision in buying and selling. It’s evident that whenever VNI loses significant points and the decline accelerates, the breadth also contracts quickly. This is a common effect when investors focus on the index for short-term trading. In a bottom-forming region, intraday or session-wide volatility is expected, influenced by large-cap stocks and speculative stocks, which tend to fluctuate more than usual.

I maintain the view that investors should monitor individual stocks’ bottom-forming potential and selectively buy. Since the market collapse on August 5th, stocks’ ability to defend their prices has varied significantly. Narrow fluctuations and/or low liquidity during this period are positive signs. A stock that maintains its price during a highly volatile market phase is likely a strong stock held by confident investors. Even if the index continues to fall and breaks its lows, these stocks are less likely to plunge further.

Experience suggests that the volatility range on August 5th, when fear peaked, can be used as a benchmark. If subsequent sessions don’t break the lows and show a recovery of more than 100%, it can be considered a strong positive reaction. Some stocks had already established a price base before August 5th and continued to trade in a narrow range, consolidating their position. These stocks have a higher probability of successfully forming a bottom. The signals in these stocks will be even more positive if buying support emerges during sharp intraday declines in VNI, leading to an early and swift recovery.

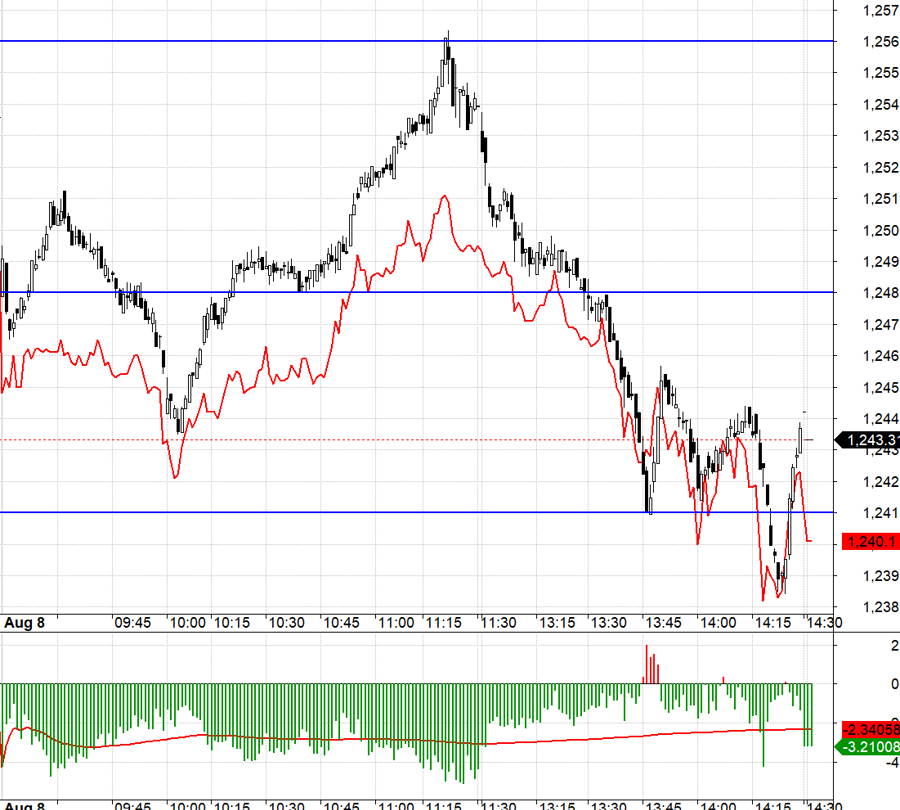

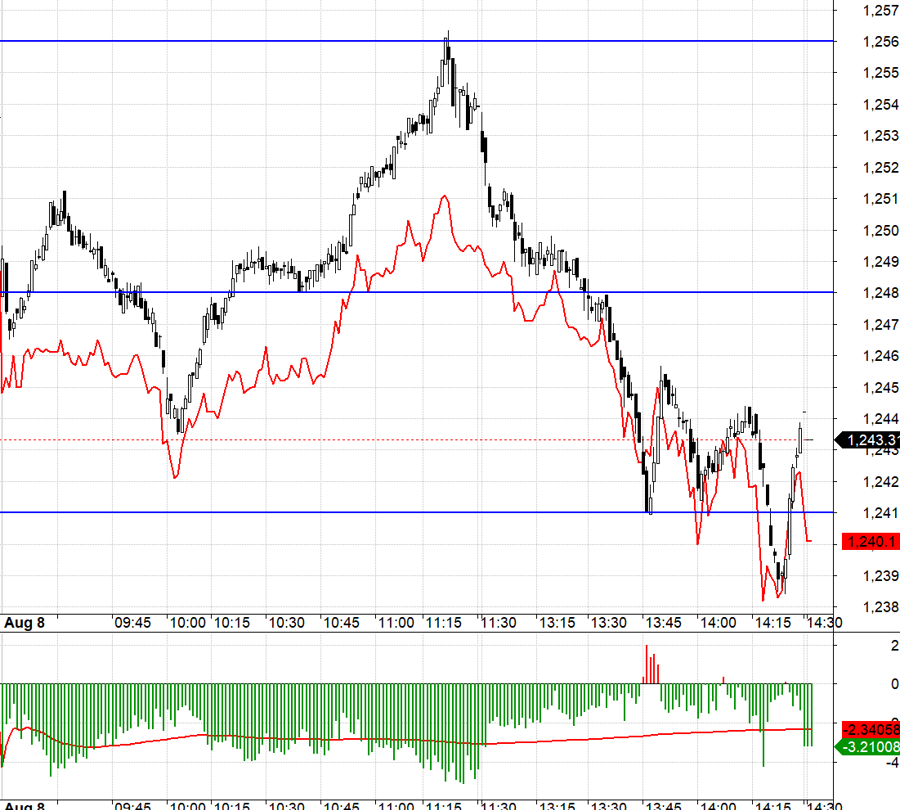

Today’s futures market clearly anticipated adjustments, as F1 accepted a wide discount. Even during VN30’s intraday rise, F1 lagged significantly. This made trading challenging, despite the advantage of the long position due to the discounted basis. For example, during the morning session, when VN30 rebounded above 1248.xx, retested this level, and then surged to 1256.xx, F1’s rise was much weaker. The negative basis prevented trading the short position during the decline from 1256.xx back to 1248.xx. The most stable trade was the drop from 1248.xx to 1241.xx.

Today’s T+3 settlement was uneventful, with no significant pressure. While blue-chips caused VNI to lose many points, most of them didn’t fall sharply, except for a few. The money flow has become noticeably passive. There’s no need to buy at high prices, as short-term selling creates frequent dips. The strategy remains to be flexible with futures, taking long and short positions as needed.

VN30 closed today at 1243.31, right at a critical level. The next resistance levels are 1248, 1257, 1260, and 1273. Support levels are 1234, 1227, and 1217.

“Stock Market Blog” reflects the personal views and opinions of the author and does not represent the views of VnEconomy. The opinions and analysis are those of the individual author, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the opinions and analyses presented in this blog.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.