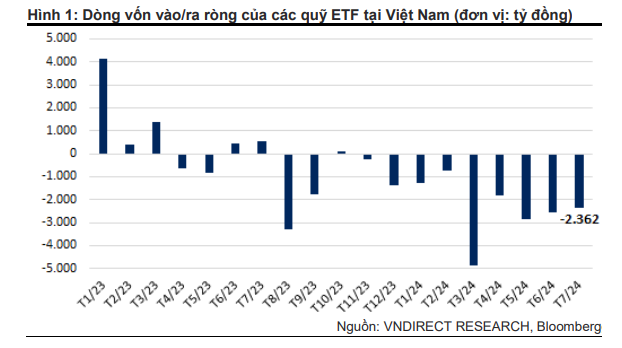

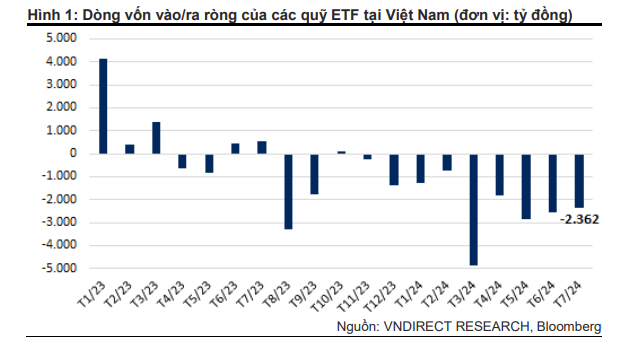

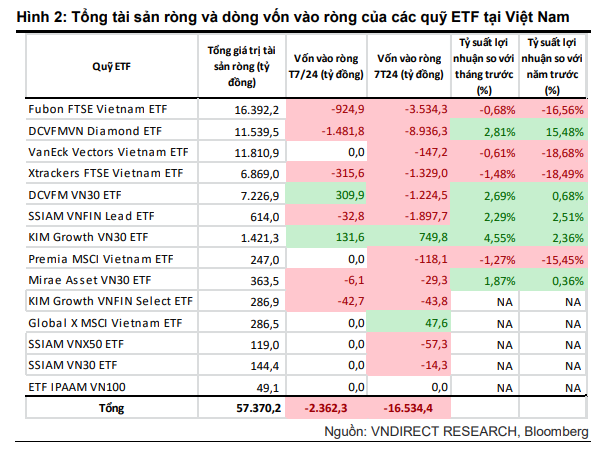

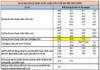

ETFs witnessed a significant outflow of capital in July, totaling over VND 2,362 billion. As a result, the year-to-date outflow from ETFs stands at VND 16,534 billion.

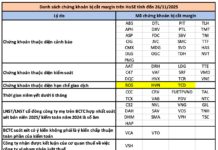

In this wave of outflows, the DCVFMVN Diamond ETF suffered the most significant loss, with a net outflow of more than VND 1,481 billion. This was followed by Fubon FTSE Vietnam and Xtrackers FTSE Vietnam ETF, with net outflows of VND 924 billion and VND 315 billion, respectively. Conversely, DCVFMVN30 and KIM Growth VN30 ETF attracted net inflows of VND 310 billion and VND 131 billion.

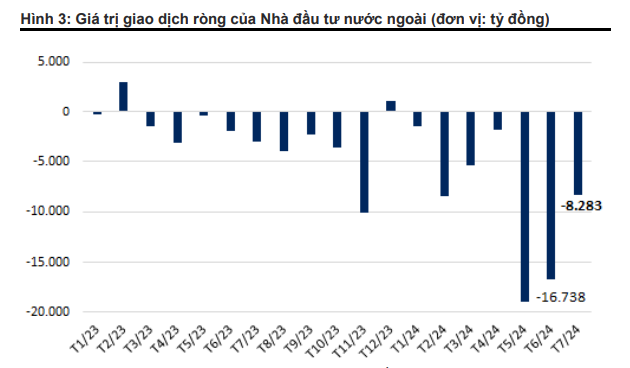

In a separate development, foreign investors maintained their net selling trend, offloading VND 8,283 billion worth of shares in July. This brought the year-to-date net selling value to a substantial VND 60,904 billion. The HOSE exchange bore the brunt of the selling pressure, with VND 8,372 billion, while HNX also experienced outflows of VND 110 billion. Conversely, UPCoM saw a positive inflow of VND 199 billion.

Amid this landscape, certain stocks shone bright and captured the interest of foreign investors. SBT, HDB, VNM, KDC, and BID were the most heavily bought, while FPT, VHM, VIC, VRE, and MSN experienced a selling frenzy from foreign investors.

A positive sign is the notable decrease in the net selling value of foreign investors, with some buying sessions even appearing towards the end of July.

“We believe that the international US Dollar is showing signs of cooling down as expectations of an early Fed rate cut loom. This should ease pressure on domestic exchange rates and, in turn, reduce net selling pressure from foreign investors in the coming period,” said analysts from VNDirect Securities Corporation.

Bank stocks plummet after overnight financial report release on January 31st.

The banking stock group, which has been leading the market in the first weeks of the year, experienced a collective downturn today.