Based on the Law on Identity Cards No. 26/2023/QH15 (effective from July 1, 2024) and the requirements of the State Securities Commission, investors’ information needs to be updated to match the national population database/electronic identification and authentication system/identity cards (CCCD) with chips.

To ensure compliance with the requirements of the management agency and avoid transaction disruptions when using products/services, many securities companies have sent notices to customers regarding the update/adjustment of non-chip ID cards/CCCD to chip-attached CCCDs. The update can be done in both physical (at transaction offices) and online formats.

Illustrative image

Some other securities companies such as PSI, VIX, and FPTS have also sent notices to investors without specifying a mandatory deadline for the update. As ID cards will become invalid from December 31, 2024, securities investors will have to update their chip-attached CCCD information before January 1, 2025, even without an official notice from the securities companies, to avoid transaction disruptions.

In fact, updating CCCD information is necessary to ensure investors’ rights and contribute to the transparency of the securities market. Especially, the Vietnamese stock market is in a strong development phase with an increasing number of new investors.

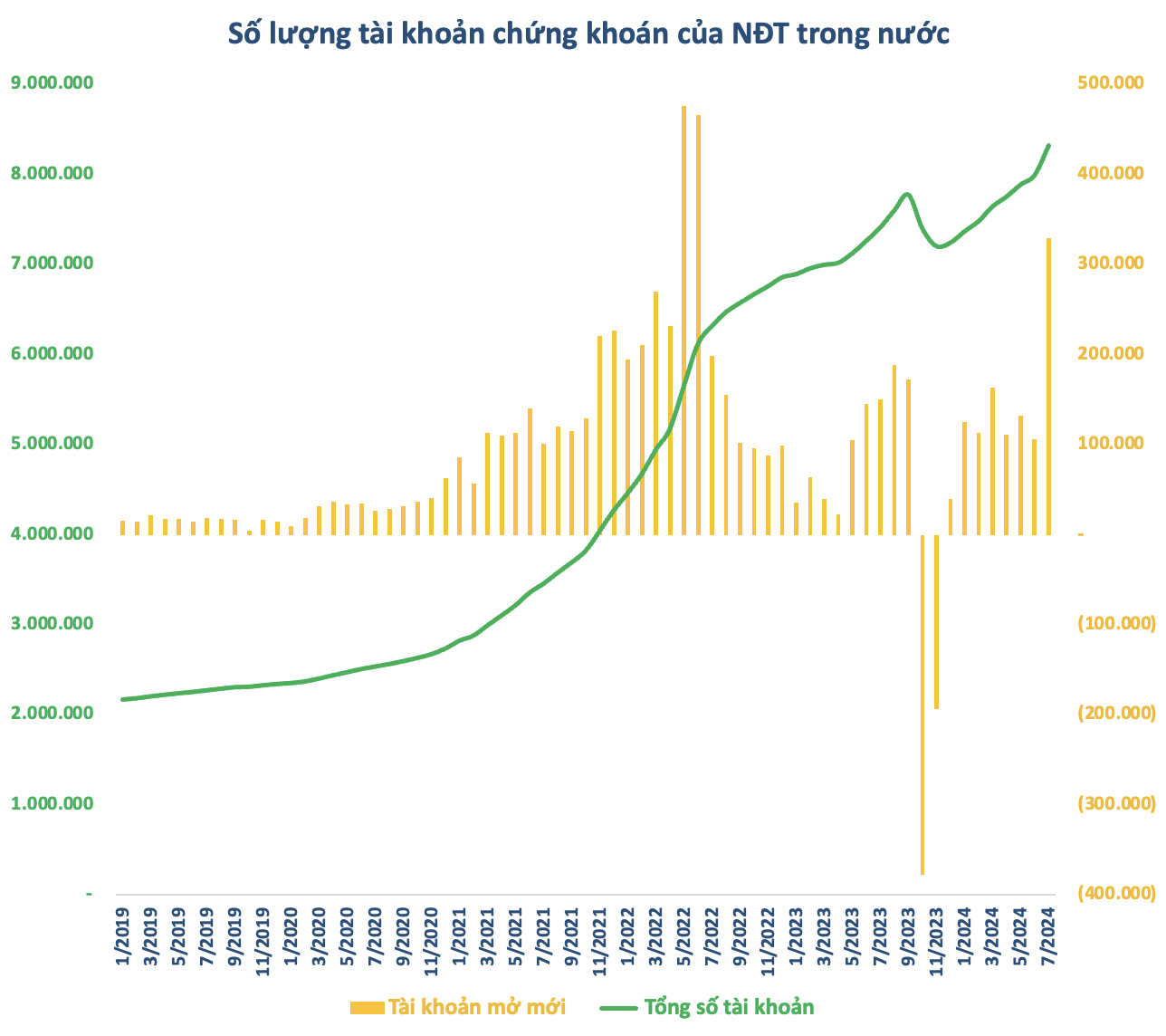

According to data from the Vietnam Securities Depository (VSD), the number of domestic investor accounts increased by nearly 330,000 accounts in July 2024, triple the number of the previous month and the highest in the last two years. This is the third-highest month in terms of the number of securities accounts in Vietnam, only after the period of May-June 2022.

Number of new securities accounts opened by domestic investors

In terms of structure, the number of securities accounts increased in July, mainly from individual investors with 329,836 accounts. Meanwhile, institutional investor accounts increased by only 146 accounts. Cumulatively, since the beginning of the year, the number of securities accounts of domestic investors has increased by nearly 1.1 million accounts.

As of the end of July, the total number of securities accounts of domestic investors reached more than 8.33 million accounts, the highest ever. Of which, individual investors had more than 8.11 million accounts, equivalent to about 8% of the population. This number brings Vietnamese securities closer to the target of 9 million accounts by 2025 and 11 million accounts by 2030.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.