The recently published report, “Vietnam at a Glance – FDI” by HSBC, reveals that Vietnam has enjoyed a stable inflow of FDI, averaging over 4% of its GDP, one of the highest in ASEAN in terms of proportion to GDP. Competitive costs and a conducive investment environment play a pivotal role in attracting foreign businesses, particularly manufacturing companies, to set up factories in Vietnam and export goods from there.

However, with the shift in global investment dynamics and the intensifying competition to attract FDI, questions arise as to whether Vietnam can sustain the strong investment inflows it has experienced since joining the World Trade Organization (WTO) in 2007, especially in light of the implementation of the Global Minimum Tax.

Vietnam Remains a Preferred Destination for FDI

Over the past two decades, Vietnam has transformed itself into a major manufacturing hub and deeply integrated into global supply chains. Exports have grown by more than 13% annually since 2007, largely driven by foreign-invested enterprises.

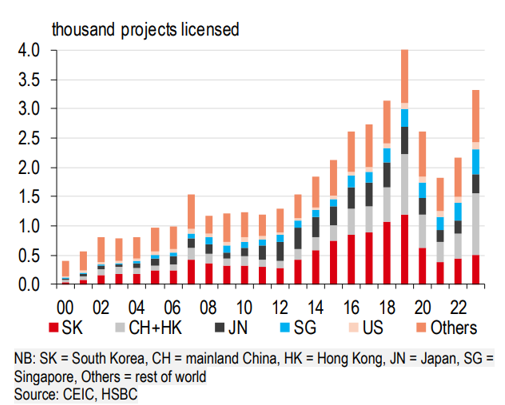

Historically, FDI in Vietnam has primarily originated from South Korea, with Samsung being the most notable investor. Since Samsung established its first mobile phone factory in Bac Ninh province in 2008, more than half of the company’s global smartphone production has been based in Vietnam, with total investment exceeding $20 billion. Additionally, leading Chinese manufacturing companies have been ramping up their investments in Vietnam, with nearly 20% of new FDI registered in 2023 originating from mainland China.

“The efforts of these early market entrants have encouraged other major technology groups to invest in Vietnam’s production capabilities,” the report states.

South Korea is the top FDI provider, but China is catching up.

HSBC’s experts attribute the increased interest from multinational corporations to several factors, including competitive costs and FDI-supportive policies.

According to the OECD, Vietnam has made significant progress in establishing various economic agreements with its trading partners, such as the EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These agreements have facilitated and encouraged foreign investment, making Vietnam increasingly open to FDI.

Additionally, the favorable investment environment can be partly attributed to the supportive role of the Vietnamese government through its tax system. Vietnam offers a competitive position compared to other countries with a statutory corporate income tax rate of 20%. Some businesses can further take advantage of extended tax holidays and reductions to lower their effective tax rates.

According to HSBC’s experts, these attractive factors have played a crucial role in attracting investment and helping Vietnam integrate deeply into global value chains.

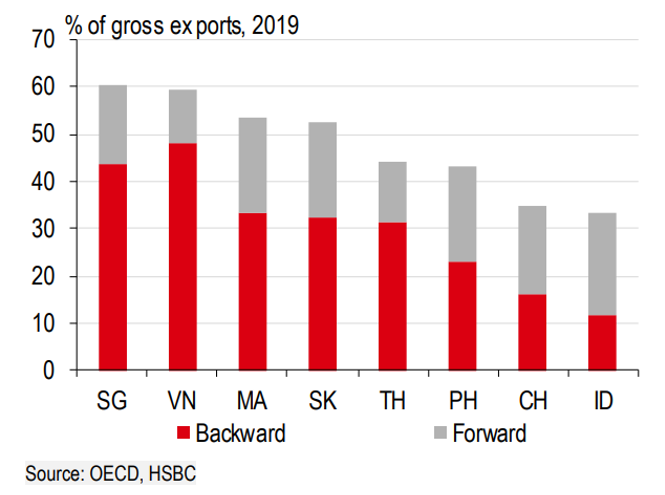

“In fact, Vietnam’s participation in global value chains has increased significantly over the years, now comparable to Singapore,” the report emphasizes.

However, HSBC notes that this increased integration has primarily occurred through more backward linkages. Vietnam is currently positioned as a center for importing complex intermediate inputs for final assembly, as evidenced by the low localization rate in the electronics industry.

Vietnam is deeply integrated into global supply chains.

What Vietnam Needs to Maintain Strong Investment Inflows

To sustain strong investment inflows, HSBC emphasizes the importance of Vietnam moving up the production value chain and increasing the domestic value-added in these goods. While consumer electronics exports have surged, Vietnam’s share in global integrated circuit (IC) exports has grown at a slower pace.

Moreover, the report highlights that despite a well-educated workforce, the shortage of skilled technical personnel poses challenges to developing semiconductor manufacturing capabilities. This prompts the government to seek ways to expand the semiconductor industry workforce in the coming years.

The lack of skilled labor also impacts other sectors, such as logistics and maritime transport. In addition to expanding and enhancing vocational education at the national level, more initiatives are needed to encourage the participation of foreign companies in the domestic economy, which can help increase the benefits of increasingly complex FDI inflows. Encouragingly, complex manufacturing knowledge and processes have started to penetrate Vietnam.

For instance, US-based chipmaker Synopsys recently signed an agreement to collaborate with students and faculty at Ho Chi Minh City National University in chip design, training, and research. In 2022, Samsung established a research and development center in Hanoi to further develop its production capabilities and began producing some semiconductor components. Meanwhile, Apple has also increased its presence in Vietnam, allocating product development resources for the iPad.