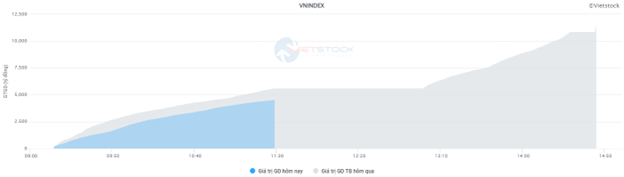

Market liquidity decreased compared to the previous trading session, with the matched trading volume of the VN-Index reaching over 544 million shares, equivalent to a value of more than 12.7 trillion VND; HNX-Index reached over 50 million shares, equivalent to a value of more than 993 billion VND.

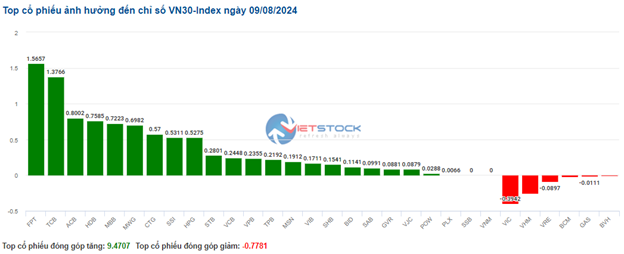

The afternoon session started with continuous buying pressure, causing the index to surge despite selling pressure reappearing towards the end of the session. The index, however, managed to close with positive gains. In terms of impact, FPT, CTG, MWG, and BID were the codes with the most positive influence on the VN-Index, contributing over 5.9 points. On the other hand, VIC, HVN, VHM, and PGV were the codes with the most negative impact, taking away more than 1.5 points from the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on August 9th |

The HNX-Index also witnessed a rather positive performance, influenced by the gains in SHS (+4.79%), MBS (+4.26%), VIF (+4.85%), PVS (+1.58%), among others.

|

Source: VietstockFinance

|

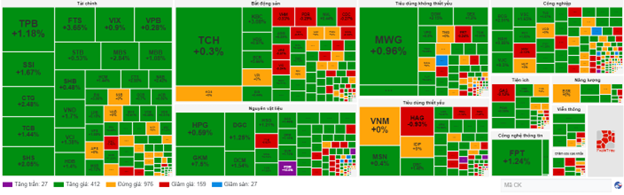

The information technology sector was the group with the strongest upward momentum, increasing by 4.49%, mainly driven by FPT (+4.53%), CMG (+4.31%), ITD (+0.79%), and CMT (+2.94%). This was followed by the telecommunications services sector and the non-essential consumer sector, which rose by 2.54% and 2.18%, respectively. On the other hand, the real estate sector witnessed the sharpest decline, falling by -0.06%, mainly due to losses in VHM (-1.06%), VIC (-1.44%), and VRE (-0.85%).

In terms of foreign trading activities, foreign investors returned to net buying, with a net purchase value of over 48 billion VND on the HOSE exchange. The main focus was on MWG (150.12 billion VND), FPT (144.78 billion VND), CTG (121.86 billion VND), and VCI (52.42 billion VND). On the HNX exchange, foreign investors net sold over 21 billion VND, focusing on PVS (24.64 billion VND), VCS (4.17 billion VND), TNG (4.09 billion VND), and DTD (3.16 billion VND).

| Foreign Investors’ Net Buying and Selling Activities |

Morning Session: Maintaining Positive Territory

Investor sentiment gradually stabilized, and buyers dominated the morning session despite lackluster liquidity and persistent net selling pressure from foreign investors. At the midday break, the VN-Index stood at 1,214.62 points (+0.52%), while the HNX-Index narrowed its gains towards the end of the morning session, hovering just above the reference level at 226.73 points.

The market breadth was positive, with 381 advancing stocks and 223 declining stocks. The VN30 basket continued to play a significant role in supporting the upward momentum of the index, with 19 gainers, 7 losers, and 4 stocks remaining unchanged.

The trading volume of the VN-Index lacked consensus with the index’s upward trend, reaching only over 236 million units, equivalent to a value of more than 5.2 trillion VND in the morning session. The HNX-Index recorded a trading volume of over 26 million units, with a value of nearly 496 billion VND.

In terms of impact, CTG, BID, and GVR were the three pillars with the most positive influence on the VN-Index, contributing over 2.7 points to the index’s gains. Conversely, the decline in VHM, VIC, and BCM took away approximately 1 point from the index.

Most sector indices traded in positive territory. The telecommunications services and information technology sectors led the market’s advance, driven by the strong performance of various stocks such as FPT (+1.24%), VGI (+1.13%), CTR (+3.65%), FOX (+2.43%), CMG (+1.54%), and others.

The securities sector followed closely with a 1.56% gain. Green dominated this sector, including notable names such as SSI (+1.5%), VND (+1.7%), VCI (+1.85%), HCM (+1.44%), FTS (+4.04%), and more.

On the flip side, the real estate sector lagged, declining by 0.53%. Stocks within this sector exhibited mixed performances, as several large-cap stocks weighed down the sector’s index, including VHM, VIC, BCM, VRE, and NVL, while others managed to stay in positive territory, notably KBC, DIG, SSH, DXG, HDG, SZC, and IJC.

Foreign investors net sold over 415 billion VND on the HOSE exchange during the morning session, with the majority of the selling pressure concentrated in VJC (over 400 billion VND). On the HNX exchange, foreign investors net sold more than 10.5 billion VND, focusing their sales on PVS.

10:30 a.m.: Green Dominates, Financial Sector Provides Support

The market demonstrated a rather optimistic performance but lacked the support of strong trading volume, indicating investors’ cautious sentiment following the previous day’s lackluster session. As of 10:30 a.m., the VN-Index rose slightly by 7.29 points, hovering around 1,215 points. Meanwhile, the HNX-Index gained 0.75 points, trading near the 227-point level.

Most stocks within the VN30 basket traded in positive territory, with green dominating. Notable gainers included FPT, which rose by 1.56 points, TCB with a 1.37-point increase, ACB up by 0.8 points, and HDB, which climbed by 0.76 points. Conversely, the codes VIC, VHM, VRE, and BCM continued to face selling pressure, but their impact on the overall index was negligible.

Source: VietstockFinance

|

The materials sector led the market’s recovery, advancing by 1.31%. This was mainly driven by strong performances from GKM (+7.5%), HPG (+0.98%), DGC (+1.25%), DCM (+1.96%), and others.

The information technology sector followed closely, ranking second in terms of gains, with a 1.29% increase. This upward momentum was specifically driven by two stocks: FPT (+1.32%) and CMG (+2.67%).

Additionally, the financial sector contributed positively to the overall market’s performance, with the securities sector witnessing gains in various stocks such as SSI (+1.83%), SHS (+2.74%), FTS (+4.04%), and VIX (+1.35%). Meanwhile, the banking sector also displayed strength, with green prevailing across stocks like TPB (+1.48%), CTG (+2.48%), TCB (+1.68%), and STB (+0.71%).

From a technical perspective, the FTS stock stood out as it continued its upward momentum after retesting its previous high, which was broken in October 2023. The stock also managed to surpass the Middle line of the Bollinger Bands during the morning session of August 9, 2024, and its trading volume was expected to exceed the average level by the end of the session. This suggested that the short-term outlook was becoming less pessimistic following the previous correction. Furthermore, the Stochastic Oscillator and MACD indicators had generated buy signals, further reinforcing the potential for a recovery in FTS in the near term.

Source: https://stockchart.vietstock.vn/

|

Compared to the opening, the number of stocks trading at reference prices continued to account for a large proportion, with over 970 codes. However, buyers slightly outnumbered sellers, as 412 stocks advanced while 159 stocks declined.

Source: VietstockFinance

|

9:30 a.m.: Green Prevails Across Most Sector Indices

At the start of the August 9 session, as of 9:30 a.m., the VN-Index surged by more than 5 points, reaching 1,214.15 points. Similarly, the HNX-Index also edged higher, climbing to 227.89 points.

Green temporarily dominated the VN30 basket, with 20 advancing stocks, 9 declining stocks, and 1 stock trading at the reference price. Notably, TPB, SSI, and GVR were the top gainers. On the other hand, BCM, VHM, and SSB experienced mild losses, falling by 0.98%, 0.66%, and 0.93%, respectively.

As of 9:30 a.m., the materials sector stood out with impressive gains, driven by strong performances from various stocks right from the opening bell. Notable gainers included POM, which hit the daily limit-up of 12.5%, NTP (+4.67%), HPG (+0.78%), HSG (+1.21%), DCM (+1.26%), DPM (+0.72%), and GVR (+1.41%), among others.