Training workshop on “Legal regulations on Corporate Governance, Information Disclosure obligations, and the importance of IR for Public Companies”

|

On the morning of August 9, at the workshop on “Legal regulations on Corporate Governance, Information Disclosure obligations, and the importance of Investor Relations (IR) for Public Companies,” Mr. Nguyen The Minh, Director of Research and Product Development of Yuanta Securities Vietnam, shared that IR activities are challenging to quantify but have long-term effects and need to be consistently executed.

Firstly, IR demonstrates the responsibility of listed companies in disclosing information to shareholders.

Moreover, investors have numerous choices in the stock market. If they don’t invest in Stock A, they can opt for Stock B. Hence, without robust IR, companies may struggle to attract investors.

Thirdly, IR also upholds the company’s good reputation. “This is a long-term activity, not a seasonal one,” emphasized Mr. Minh.

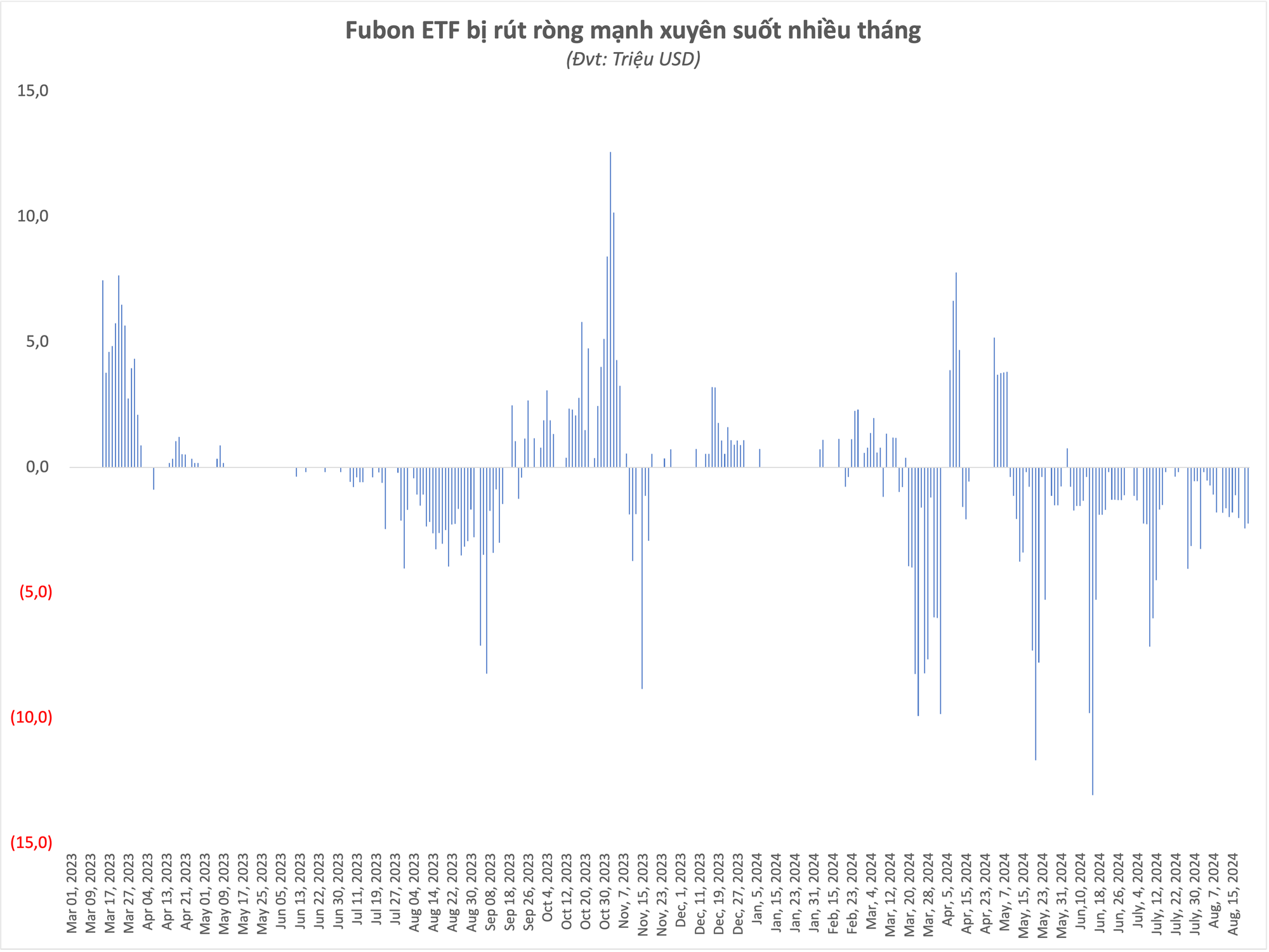

IR assists businesses in achieving their capital-raising goals and accessing institutional investors. Mr. Minh pointed out that the number of institutional investors is limited, and recently, they have faced challenges in raising funds to invest in the stock market. As a result, there is intense competition to attract these investors, and companies must put in effort to enhance their chances of accessing capital from investment funds.

Additionally, IR can support businesses during a media crisis. Nowadays, social media has a significant influence, and misinformation can spread rapidly. Companies should focus on IR to manage risks associated with these information flows.

Given the above roles, IR brings numerous benefits to businesses.

Firstly, when interacting with investors, their feedback helps the company’s leadership make appropriate adjustments to their business strategies.

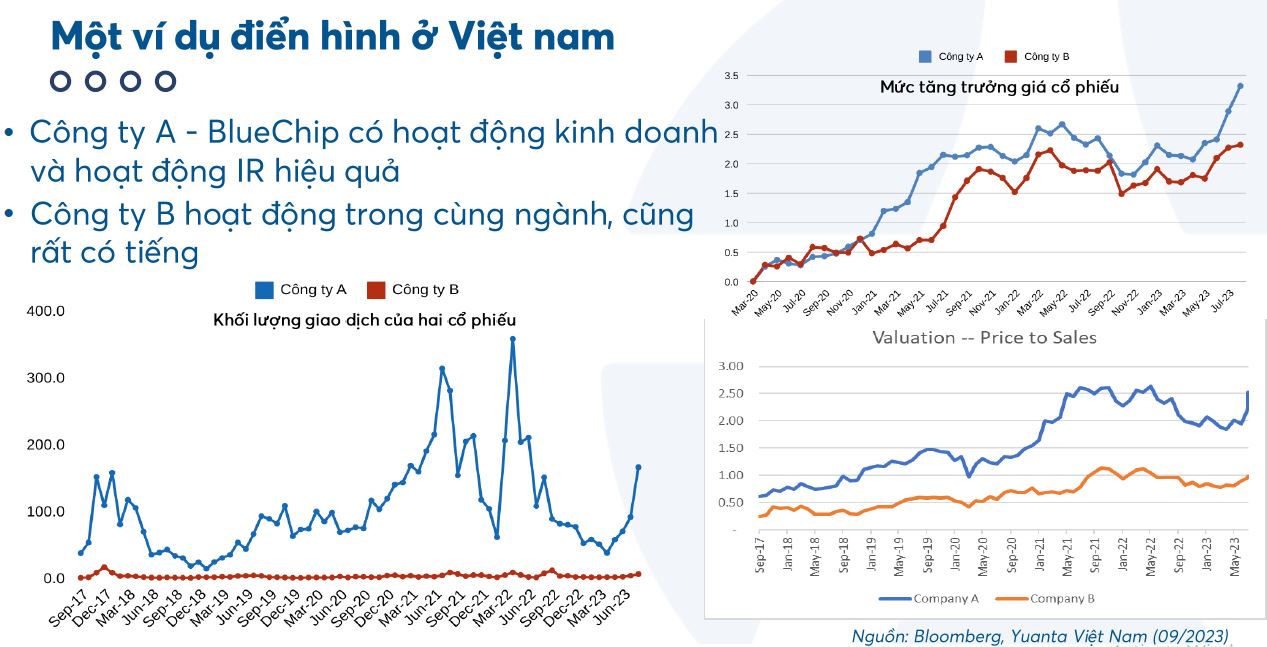

Effective IR will increase the number of analysts covering the company and support its growth. Transparent disclosure of operational and management information builds trust and a positive reputation for investors, making it easier for the company to raise capital when needed.

Another advantage is stable stock prices and reduced surprises for investors. Providing periodic information as per standards will prevent unexpected situations for investors and help prevent panic selling or buying sprees.

Furthermore, with sufficient information, analysts and investors can more accurately assess and forecast the company’s business results, leading to a reduced gap between the company’s intrinsic value and a lower cost of capital.

Lastly, applying effective IR methods and actively engaging in IR activities will broaden investor reach and attract more analyst interest. Consequently, this will result in increased stock liquidity.

Example of IR effectiveness in the Vietnamese market

|

The Yuanta expert affirmed that IR is not just about sharing good news but also addressing unclear information that may worry shareholders. In such cases, companies should provide information to clarify the issue.

When there are fluctuations, if a company fails to provide clear information, speculative investment funds tend to sell their stocks, causing prices to drop. Hence, IR is an ongoing activity, not a seasonal one.

Mr. Minh cited the example of the Total oil group (France) in 2001, when the AZF factory explosion occurred in Toulouse. Total immediately responded to the authorities, the public, and investors, taking responsibility for the accident. The company’s chairman also actively provided information. As a result, Total’s stock price did not fluctuate significantly, and the incident did not severely impact its image.

Chi Kien