The stock market has unexpectedly witnessed a sharp decline in the duo of stocks, TCH of Hoang Huy Financial Services Investment JSC and HHS of Hoang Huy Investment Services JSC.

A rush of sell orders from investors caused the two stocks to plunge to the floor price. TCH closed the August 8 session at VND16,600 per share, down 6.74% from the previous session, with nearly 13 million shares left at the floor price. Notably, the massive sell-off pushed the trading volume of TCH to over 21 million shares.

Sharing the same fate, HHS’s share price also dropped by 6.92% to VND8,610 per share, with about 2 million shares left at the floor price.

The deep decline of these two stocks came as a surprise, especially given HHS’s recently announced financial results for the second quarter of 2024, with a consolidated after-tax profit of over VND108 billion, up 68% over the same period last year. During this period, HHS’s revenue from sales and services reached over VND104 billion, a 68% increase year-on-year. The company also experienced a high gross profit increase of 66%, resulting in a profit of over VND103 billion.

As for Hoang Huy Finance, according to the financial results for the first quarter of the 2024 fiscal year (April 1, 2024 – June 30, 2024), the company achieved a revenue of VND828 billion, with a gross profit of VND351 billion, an increase of 218% over the same period last year. The consolidated after-tax profit reached VND229 billion, a nearly 35% increase compared to the same period in the 2023 fiscal year.

TCH attributed its revenue growth primarily to its automobile business and real estate development activities, with stable and growing product deliveries to customers.

Anticipating Benefits from the Rising Real Estate Market in Thuy Nguyen District

In a recent report, Vietcap Securities assessed that Thuy Nguyen District is leading the real estate market in Hai Phong. According to VARS, land prices in Thuy Nguyen District surged by 50-100% in 2021 when the plan to establish Thuy Nguyen City was announced, and then decreased by 15-30% during 2022-2023.

After the comprehensive plan to upgrade Thuy Nguyen to a city was officially approved in December 2023, land prices in the district witnessed a moderate increase of 5-10%. Thuy Nguyen District continues to lead the Hai Phong real estate market in terms of transaction volume. VARS believes that land prices in Thuy Nguyen District still have room for growth in the medium term, thanks to the development of infrastructure and social facilities.

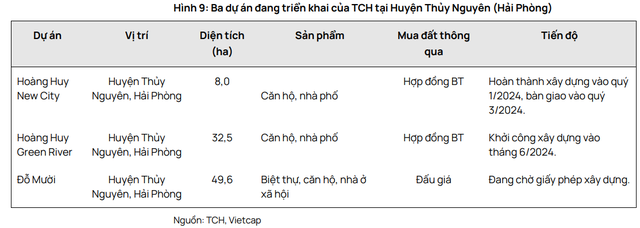

One of the significant beneficiaries of the rising real estate market in Thuy Nguyen District is Hoang Huy Financial Services Investment JSC (TCH). TCH is currently developing three real estate projects in Thuy Nguyen District, including Do Muoi Urban Area, Hoang Huy New City, and Hoang Huy Green River.

These projects mark a significant milestone for TCH, transitioning from developing small and medium-sized projects under 5 hectares to larger-scale developments of up to 49.6 hectares. Apart from Hoang Huy New City, which has already been constructed, the remaining land bank will be developed during 2024-2028, according to the company’s management. Vietcap expects that the transformation of Thuy Nguyen into a new city could support the absorption of TCH’s upcoming projects.

Moreover, the land bank of the two projects, Hoang Huy New City and Hoang Huy Green River, was acquired by TCH at favorable costs through BT contracts with the Hai Phong People’s Committee. The brokerage firm anticipates that these projects will continue to deliver attractive gross profit margins of over 40%, in line with TCH’s previous BT land development projects.

According to Vietcap’s statistics, TCH currently holds a total of seven projects obtained through BT contracts, including completed, ongoing, and upcoming projects. In the past, many securities companies have stated that acquiring projects through BT contracts would bring significant benefits to TCH, amounting to trillions of dong.

However, not all of TCH’s projects are obtained through BT contracts. The Do Muoi project in Thuy Nguyen District, for instance, was acquired through a public auction. This project also has a commercial name, Hoang Huy New City – II. Located in Tan Duong commune, Thuy Nguyen district, the Do Muoi Urban Area project stretches along the extended Do Muoi road.

With a total area of 49.6 hectares, the project offers villas, shophouses, and apartments. TCH acquired this project in December 2023 through an auction with the Hai Phong People’s Committee. The company plans to invest VND15,000 billion in the Do Muoi Urban Area project, making it TCH’s largest-scale project to date. TCH expects to complete the legal procedures for the project and commence construction in July 2024.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.