The market saw a significant boost in the afternoon session as trading enthusiasm picked up. HoSE’s matching liquidity soared by 82% compared to the morning, and breadth surged. The VN-Index closed up 1.27%, just shy of the day’s high. Foreign investors net bought over 478 billion VND in the afternoon.

Generally, rising prices and increasing liquidity are a result of active buying demand. The market was lackluster and traded within a narrow range in the morning, but the situation changed dramatically in the afternoon. The notable increase in some stocks’ prices created a strong sense of enthusiasm, as these stocks witnessed extremely impressive buying participation.

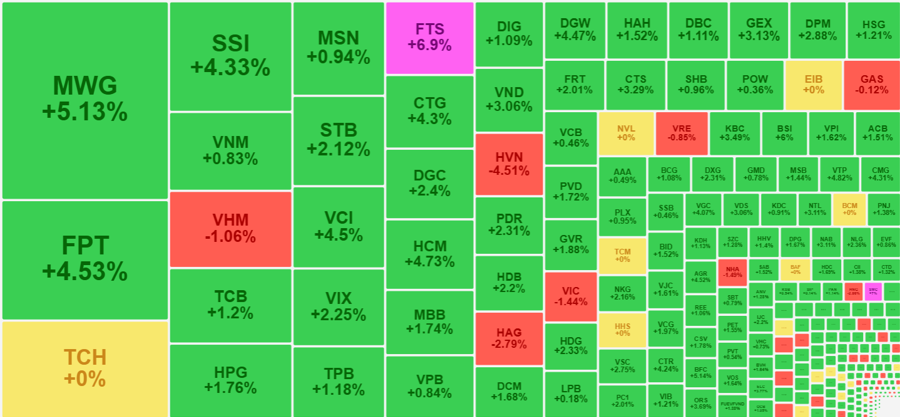

FPT, MWG, and SSI, while not the largest stocks by market capitalization, had a strong price performance that inspired confidence. FPT experienced a rapid acceleration just minutes into the afternoon session. Notably, FPT saw a significant influx of capital, with nearly 514 billion VND in matching value in the afternoon alone, and its price soared by 3.26% compared to the morning session, closing up a total of 4.53% from the reference price. As the fifth-largest stock by market capitalization, FPT had a considerable impact on the VN-Index. MWG was even more aggressive, with its price rising by 3.63% on the back of the market’s largest trading value of 846.5 billion VND, pushing the daily gain to 5.13%, and liquidity to 1,129 billion VND. SSI also performed well, with its price climbing by an additional 2.79% on top of a liquidity of 348.7 billion VND, closing up a total of 4.33%, and a trading value of 462.9 billion VND.

FPT, MWG, and SSI were also stocks that foreign investors heavily supported. In the morning, the net buying in these three stocks was negligible, but by the closing bell, FPT stood at 159 billion VND, MWG at 145.4 billion, and SSI at 42 billion.

In the VN30 basket, 24 stocks posted gains compared to the morning session, with 11 of them climbing by more than 1%. The VN30 index, which was up just 0.65% at the morning close, ended the day up 1.73% with 18 stocks advancing by more than 1% from the reference price. The basket’s liquidity in the afternoon surged by 125% compared to the morning, reaching 4,298 billion VND. Unfortunately, four stocks closed in the red, including GAS, down 0.12%; VHM, down 1.06%; and VIC, down 1.44%—all among the top 10 stocks by market capitalization.

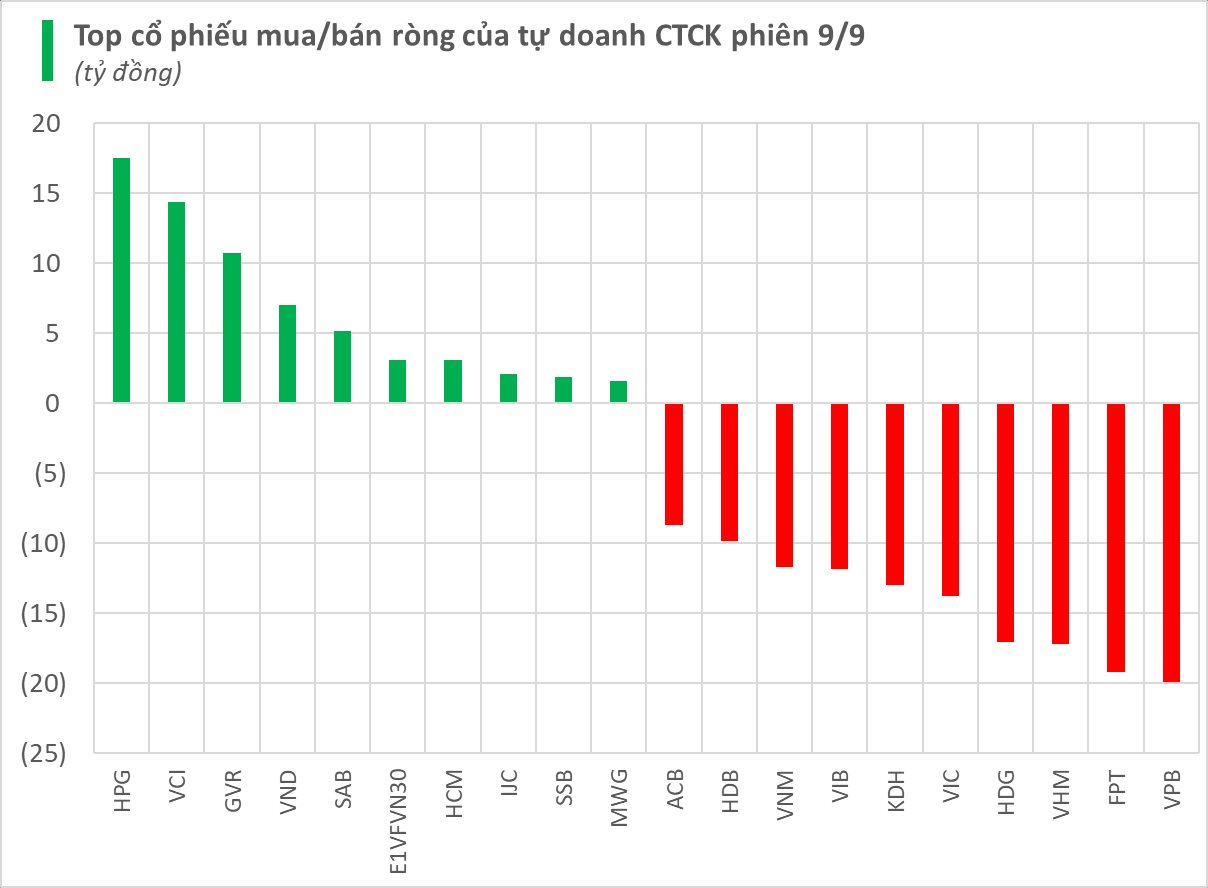

Expanding to the entire HoSE, the breadth changed rapidly as the buying wave in the large caps that drive the index took hold. At the end of the morning session, the breadth was already positive, with 238 gainers and 136 losers, but it ended the day with 329 gainers and only 86 losers. In the morning, only 71 stocks on the exchange had risen by more than 1%, but by the close, that number had jumped to 150. Nearly 30 stocks in this group achieved liquidity of over 100 billion VND, indicating the impressive buying power of the money flow. In addition to the aforementioned large caps, many securities stocks performed excellently, such as VCI, up 4.5%; VIX, up 2.25%; FTS, up 6.9%; HCM, up 4.37%; and VND, up 3.06%, all with high liquidity.

Small-cap stocks, of course, also benefited significantly from this enthusiastic trading environment. SMC and FTS hit the daily limit-up. BSI, APG, BFC, VTP, SGR, AGR, DGW, CMG, CTR, and VGC saw their prices climb by more than 4%, although their liquidity was not high.

Today’s left-behind group did not include many notable stocks besides VHM and VIC. Among the 86 losers, most had minimal liquidity. HVN fell 4.51% with a trading value of 149.5 billion VND, HNG dropped 2.86% with 13.7 billion, HAG declined 2.79% with 128.5 billion, NHA decreased by 1.49% with 30.1 billion, and DLG fell by 2.38% with 11.1 billion—the only group worth mentioning.

The strong rally at the end of the week pushed the VN-Index past the 1,220-point threshold to 1,223.64 points. Thus, the index has recovered to the level seen in July.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.