In its latest activity report, foreign fund Pyn Elite Fund stated that the stock market in July experienced a turbulent period, with the VN-Index fluctuating within the 1,220-1,300 range and a slight increase of 0.5% compared to the previous month.

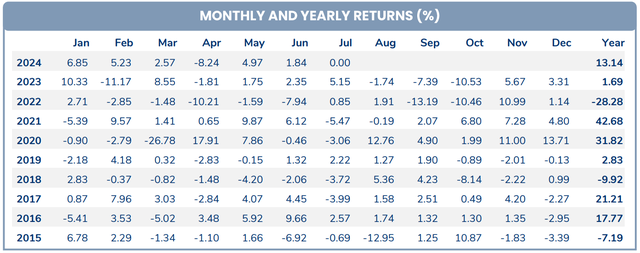

Pyn Elite Fund is one of the largest foreign funds in the Vietnamese stock market, with assets under management of over 789 million EUR (~21.7 trillion VND) as of the end of July. The fund’s cumulative investment performance from the beginning of 2024 to the end of July reached 13.14%, outperforming the main index’s 10% growth.

The top 10 investment portfolio, including STB, ACV, MBB, HDB, TPB, FPT, CTG, DSE, OCB, and VHC, accounts for the largest proportion of the fund’s holdings.

In the past month, the best-performing stocks were HDB, PLX, and MBB, with increases ranging from 9.9% to over 19% in value. In contrast, HVN stock plummeted 36% in July, and DXS decreased by 17.4%, hindering the fund’s overall performance.

Pyn Elite Fund’s Investment Performance

Top 10 Investment Portfolio of Pyn Elite Fund

According to Pyn Elite Fund, the stock market in July was supported by the upward trend in the banking sector, while mid and small-cap stocks declined due to profit-taking. Pressure on the VND eased following messages from the Fed, and the currency appreciated by 0.76% against the USD in July. Additionally, the Q2 2024 financial results of many listed companies showed a strong recovery from the lows of 2023.

Macroeconomic Overview: July economic data indicated robust growth. Exports and imports accelerated to record highs, increasing by 19.1% and 24.7%, respectively, year-over-year. Export growth was driven by electronics exports. Meanwhile, the manufacturing PMI for July remained solid at 54.7 points. Industrial production increased by 11% year-over-year, the highest since August 2022, outperforming the 7.7% growth in the first half of 2024.

Moreover, FDI disbursement from the beginning of the year to date increased by 8.4%. In July, the government implemented a base salary increase, but inflation rose insignificantly, remaining stable at 4.4%.

Continuously Increasing Ownership in Dabaco (DBC)

In a related move, Pyn Elite Fund recently purchased an additional 1.63 million DBC shares of Dabaco Vietnam JSC. The transaction, executed on August 1, was made through the stock exchange.

Following this transaction, Pyn Elite Fund’s ownership in Dabaco reached 22.8 million shares, equivalent to a 9.45% stake. Previously, the fund became a major shareholder of Dabaco in late May 2024. Over the past two months, Pyn Elite Fund has net purchased 10.8 million shares of this livestock company.

Regarding Dabaco, Pyn Elite Fund considers it one of the largest companies in Vietnam in the animal husbandry and animal feed sectors. Recently, the company has made significant progress in developing a new business line for vaccines to prevent African Swine Fever (ASF), a project undertaken in collaboration with American scientists since 2021.

Since the beginning of 2024, the vaccine has been administered to 300,000 of DBC’s pigs with promising results. Notably, a vaccine plant with a capacity of 200 million doses per year was completed and obtained the GMP-WHO certification in early August, bringing DBC closer to obtaining commercial approval for the vaccine. This not only contributes to protecting Dabaco’s livestock but also positively impacts the Vietnamese livestock industry and is expected to boost the company’s profit growth significantly in the coming periods.