Mr. Minh from Cau Giay, Hanoi, shared that he had put down a deposit of VND 100 million for two off-plan apartments (also known as paper houses) in a project in Hoang Mai district.

At the time of the launch in late 2022, the standard payment price was about VND 40 million per square meter. However, if customers paid early, they would be offered a significant discount, bringing the price down to around VND 30 million per square meter. At that time, the developer’s sales policy was quite rare. Many people decided to make a deposit and choose the early payment method to enjoy the benefits.

However, for over a year, the project has been stagnant with no construction progress. Buyers are quite discouraged as there has been no update for a long time, and their capital is stuck. Quite a few people have signed with brokers to sell their apartments at prices that have increased by up to VND 1 billion compared to the purchase price. For example, an 82-square-meter apartment with an early payment method originally cost VND 2.5 billion; now, the owner has listed it with a broker for VND 3.5 billion.

Despite the significant increase in asking prices, Mr. Minh expects prices to continue rising in the future. Insiders have hinted that the project has completed its legal procedures and will soon update its progress. Additionally, the developer plans to release a small number of units to the market at higher prices than previous launches.

“The broker told me that most of the apartment projects currently on sale in the market are priced at VND 70-80 million per square meter. So, it is expected that the developer will set a similar price for the remaining units. Consequently, the prices of the units sold in the previous launches are also expected to increase,” said Mr. Minh.

Mr. Minh decided to invest in two apartments where the previous owner had already paid 95% to the developer. Specifically, he purchased a 75-square-meter unit and a 100-square-meter unit, both at a price of VND 43 million per square meter, totaling an investment of VND 7.5 billion.

Mr. Hoang, a broker for off-plan apartments, shared: “The prices of used apartments in Hanoi have surged in the past year. Even projects without red books have seen price increases. Following the price fever in the secondary market, the primary market has also set new price levels in recent launches. In this spiral of rising prices, off-plan apartments are no exception.”

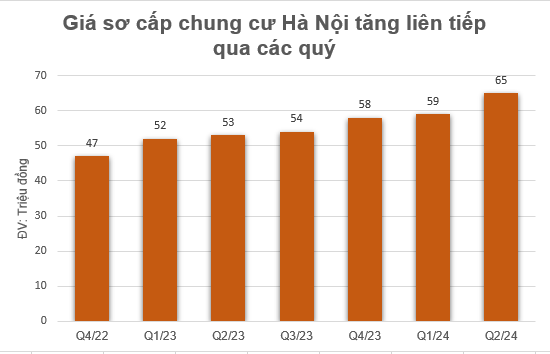

Data source: Savills

Observing the market for off-plan apartments recently, another project in Nam Tu Liem district was launched in mid-2023, offering commercial apartments at an average price of about VND 37 million per square meter. Now, brokers are listing these apartments at VND 49 million per square meter. Thus, after more than a year, the price has increased by 32% compared to the initial launch, even though the project is still under construction, and delivery is expected in Q1/2025.

Even for newly launched projects, brokers are asking for premiums of VND 100-200 million per apartment, claiming that buying through transfer is cheaper than from the developer. In reality, the prices of subsequent launches are higher than those of the previous ones.

Ms. Ngan, who is exploring a project in Nam Tu Liem, said that a broker suggested she consider buying an apartment from a customer who purchased it during the first launch at a lower price.

“The broker told me that a customer wants to sell an apartment they bought during the first phase at the progressive price of VND 6.8 billion. Now, they are offering it with a premium of VND 150 million, which is still cheaper than buying from the developer. Because, in subsequent launches, the developer increases the apartment prices, and the incentives and discounts are not as attractive as in the first launch,” Ms. Ngan quoted the broker.

In reality, during the launch of off-plan apartments, developers often offer attractive sales policies and programs, such as interest rate support and high discounts. Many customers consider this an investment opportunity for “surfing,” putting down deposits of only VND 50-100 million for apartments with good floors and views and then reselling them at premiums of VND 100-300 million per apartment.

Mr. Le Quoc Kien, a veteran real estate investor in Ho Chi Minh City, said that many people prefer to invest in off-plan apartments, especially in the condominium segment. With a thin capital slice, they can make high profits and gradually sell their investments. For example, for an apartment worth about VND 2.5 billion, the initial payment is only about VND 200-400 million. Then, they can resell it at a premium. If an investor puts in VND 500 million and sells it at a premium of VND 100 million, they have already made a 20% profit.

“Especially, investors don’t like to pay the full amount and wait for the price to increase before selling. They prefer to sell during the project’s construction phase. In this phase, prices increase rapidly, and it is easier to make a profit. From the foundation stage, prices start to rise. As a few floors are built, prices continue to climb. When the roof is completed, prices rise again. There are many factors contributing to price increases, such as construction progress, legal issues, etc. So, investors feel that prices are rising very quickly. That’s why they favor investing in off-plan properties. Another advantage is that developers collaborate with banks to offer interest rate support and preferential loans,” said Mr. Kien.

Mr. Le Quoc Kien, a veteran real estate investor

Mr. Le Quoc Kien, a veteran real estate investorDespite the thin capital slice, rapid price increases, and high profits, Mr. Kien said that there are quite a few risks that investors should carefully consider before making a decision.

“First, there is a risk of legal complications. During the project’s implementation, if there are any legal issues, the project may be halted. This has happened quite often, where developers launch sales, receive deposits, and offer discounts, only to encounter problems and stall for years.

Second, the developer’s financial health is crucial. If the developer’s financial capacity is weak, and they spread themselves too thin across multiple projects, they may run out of money, causing the project to stall. This harms investors.

Third, there may be discrepancies between the actual area and the promised brand and quality of finishing materials upon handover.

Fourth, there is a risk of project delays. The promised timeline and the actual progress may differ significantly. For example, the developer may commit to a two-year delivery but end up taking three to four years, which is quite common.

Fifth, there is a risk regarding the issuance of the pink book (land use right certificate). Some developers mortgage the project to a bank and simultaneously raise capital from customers to build it. This situation has occurred in many projects, and in Ho Chi Minh City, there is even a case where residents have lived in the apartments for several years, but the bank is now demanding the property back because the developer mortgaged the project to secure a loan,” Mr. Kien enumerated the possible risks.

Mr. Nguyen Anh Que, a member of the Executive Committee of the Vietnam Real Estate Association, also warned that buyers of off-plan properties face the risk of developers not meeting the conditions for sale but still selling through capital contribution contracts or loan contracts. In essence, they are collecting money from customers in advance and will collect the remaining 30% as stipulated when they fulfill the conditions for signing the sale and purchase contract.

“Currently, many projects are facing investment procedure bottlenecks. In the past two years, apartment prices have skyrocketed by 50-150%. Even projects nearing completion have seen significant price increases. Therefore, investing in off-plan apartments is no longer as profitable as it used to be. Only a few exceptional projects with specific legal, ownership, or other characteristics have softer prices than the market average.

Mr. Nguyen Anh Que, Member of the Executive Committee of the Vietnam Real Estate Association

Mr. Nguyen Anh Que, Member of the Executive Committee of the Vietnam Real Estate AssociationTo minimize risks, homebuyers should thoroughly research the legal conditions and the developer’s capacity, even the contractor’s capacity. When considering a purchase, investors should request that brokers and owners transparently disclose the project’s legal status and sales conditions. If they refuse to provide this information, buyers can choose not to proceed with the purchase or accept the risks if they decide to buy,” said Mr. Que.

Mr. Kien also advised that, in the off-plan property resale market, if a stalled project suddenly has rumors of resuming progress, investors need to verify this information carefully. Usually, this is a tactic used by secondary investors who previously “held” the property to release their holdings.

“In this case, it depends a lot on the investor’s ability to verify information. For example, if a project was previously halted due to legal issues, the investor must be able to assess whether those issues have been resolved. Often, the legal problems are vaguely mentioned without specifics, leaving investors in the dark. If the investor can confirm that the issues have been addressed, then they can proceed with the investment. It’s crucial to have the skill to verify information. Investors need to remain calm and rational before making decisions.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Hanoi to reclaim over 2,600 hectares of agricultural land in two districts

The plan for land use in 2024 for Hoang Mai district and Dong Anh district has just been approved by the city of Hanoi. As a result, a total area of over 2,600ha of agricultural land is expected to be reclaimed by these two units within the year.

Hanoi’s Update on the Delayed 1.000 billion VND Hospital Project

To address the challenges faced by investors, the Hanoi People’s Committee has instructed the Long Bien People’s Committee and the Department of Natural Resources and Environment to resolve any obstacles that arise during the implementation of the Thang Long 1,000-Year Oncology and Plastic Surgery Hospital project.