In a recent update on August 9th, the Ho Chi Minh City Stock Exchange (HoSE) announced the cancellation of the listing of 347.2 million HBC shares of Hoa Binh Construction Joint Stock Company, effective from September 6th. The last trading day for HBC shares will be September 5th.

The decision to delist HBC shares was made due to the company’s accumulated losses exceeding its paid-up capital, as per the audited financial statements for 2023. This falls under the mandatory delisting criteria as stipulated in Point e, Clause 1, Article 120 of Decree 155/2020/ND-CP, dated December 31st, 2020.

On the same day, HoSE also decided to delist over 1.1 billion shares of HAGL Agrico Joint Stock Company from September 6th, with the last trading day being September 5th.

The reason for the delisting of HAGL Agrico’s shares was due to the company’s unprofitable business operations for three consecutive years, based on the audited financial statements for 2021, 2022, and 2023. This is also a case of mandatory delisting as per Point e, Clause 1, Article 120 of Decree 155/2020/ND-CP, dated December 31st, 2020.

Towards the end of July, HoSE had informed both companies about the impending delisting of their shares. In response, Hoa Binh Group sent a letter to the regulatory body, expressing their disagreement with the grounds for the mandatory delisting of HBC shares.

Hoa Binh Construction stated that their chartered capital stands at VND 2,741 billion, while their post-tax losses amounted to VND 2,401 billion in the audited separate financial statements for 2023 and VND 3,240 billion in the audited consolidated financial statements for the same year. Thus, the total accumulated losses on the audited separate financial statements have not exceeded the company’s chartered capital, which does not meet the delisting criteria.

Furthermore, HBC argued that HoSE’s reliance on past precedents (historical application) to consider the delisting of HBC shares is inconsistent with the current legal framework.

Specifically, the previous Listing Regulations of the Ho Chi Minh City Stock Exchange, issued together with Decision No. 85/QD-SGDHCM dated March 19th, 2018, provided guidance on referring to consolidated financial statements when considering the condition of accumulated losses for listed companies with subsidiaries. Therefore, similar cases to Hoa Binh Group in the past were delisted in accordance with these regulations.

“Hence, at the present time, HoSE’s reliance on past precedents (historical application), the principle of similarity, or any other basis other than the current legal provisions is inconsistent with the law,” HBC clarified.

Regarding HAGL Agrico, at the 2024 Annual General Meeting of Shareholders held on May 4th, Chairman of the Board of Directors, Tran Ba Duong, assured shareholders that if the company’s shares were delisted and moved to the UPCoM exchange, they would continue to disclose information transparently to all 33,000 shareholders, just as they did when listed on HoSE. He also stated their intention to relist on HoSE as soon as they met the requirements.

“Shareholders may be concerned about the delisting, but I believe that transparency and the formation of real value are more important. Even if we move to UPCoM, if we perform well, the share price can still go up,” said Mr. Tran Ba Duong.

It is worth noting that both companies have planned to list their shares on the UPCoM exchange following the delisting from HoSE.

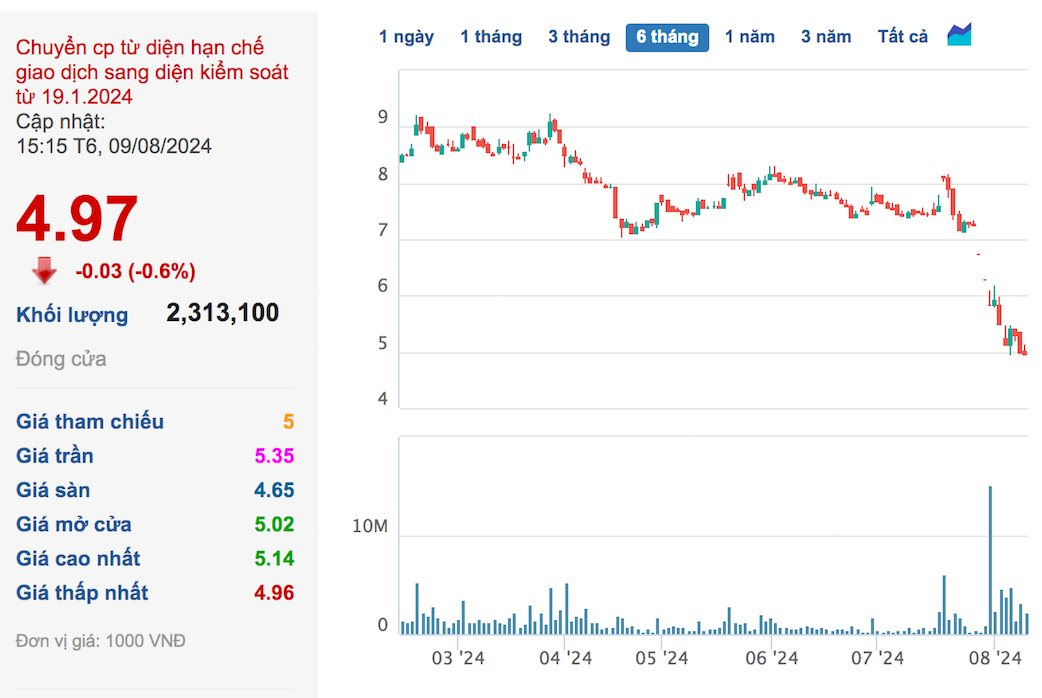

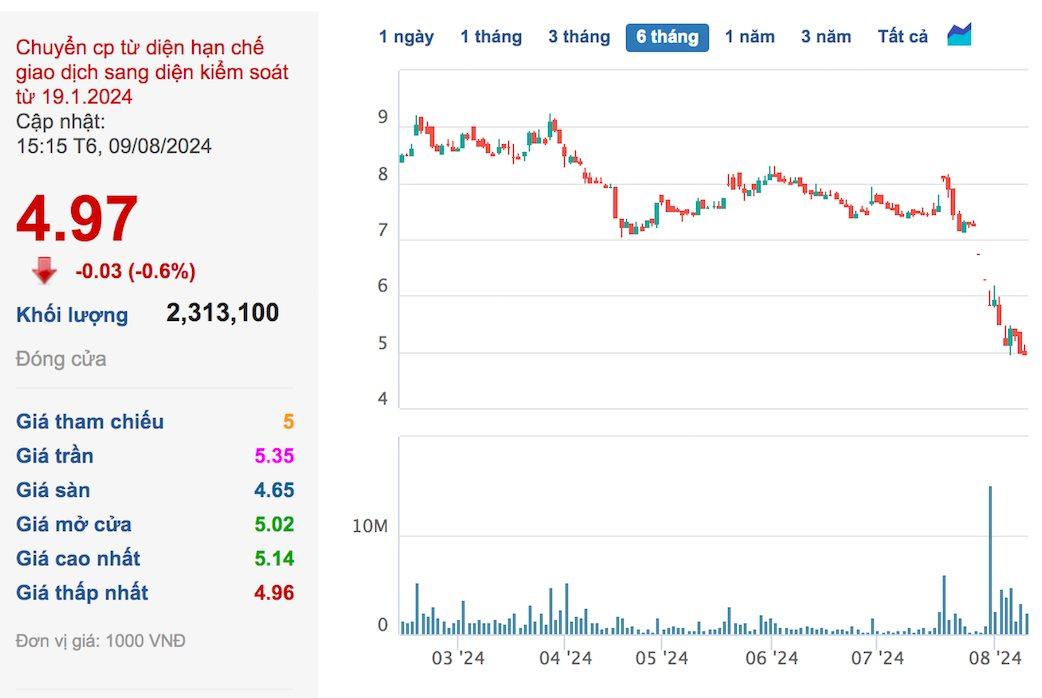

In the stock market, both HBC and HNG shares have witnessed a downward trend following the delisting announcement. HBC’s share price closed at VND 4,970 per share on August 9th, a nearly 30% drop over the past two weeks. Similarly, HNG’s share price declined by more than 26% between July 11th and August 5th before recovering recently, ending at VND 4,080 per share on August 9th.

HBC Share Price

HNG Share Price