Gold prices remained resilient above the $2,400/oz mark during Friday’s trading session (August 9) following a strong performance on Thursday.

Supporting gold prices during this session was a decline in U.S. Treasury bond yields and the U.S. dollar exchange rate, along with investors’ belief that the Federal Reserve may cut interest rates with a significant reduction in September.

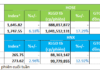

At the close of trading, spot gold in New York rose by $3.3/oz compared to the previous session’s close, equivalent to a 0.14% increase, settling at $2,431.7/oz, according to data from the Kitco exchange.

When converted using the USD selling rate at Vietcombank, this price is equivalent to approximately 74 million VND per tael.

For the week, gold prices fell by about 0.5%, marking the biggest weekly decline since the week ending June 7.

Monday’s sell-off caused gold prices to drop by up to 3%. Subsequently, the downward pressure on the precious metal eased as the stock market recovered and investors believed the Fed would initiate a monetary policy easing cycle at the meeting on September 18. On Thursday, gold prices rose by nearly 1.9%.

More importantly, the market is relatively confident about the Fed’s ability to cut interest rates by 0.5 percentage points this time. According to data from the FedWatch Tool of the CME exchange, the probability of a 0.5 percentage point cut in September stands at 49%, while the likelihood of a 0.25 percentage point reduction is at 51%.

“In the medium term, the outlook for gold prices remains positive. Each dip will be short-lived as macroeconomic factors continue to provide support,” said Zain Vawda, an analyst at Oanda, a data and analysis firm.

According to Vawda, the better-than-expected initial jobless claims report released by the U.S. Department of Labor on Thursday helped ease concerns about a recession in the U.S. economy, boosting the stock market and gold prices. Additionally, statements from Fed officials this week also reinforced the likelihood of an imminent rate cut.

Yields on 10-year U.S. Treasury bonds fell below 3.7% at one point, then recovered to 4% during Thursday’s session. By the end of Friday, the yield on this maturity was hovering around 3.94%. Lower yields are beneficial for gold prices as gold is a non-interest-bearing asset.

Additionally, gold prices were supported by the depreciation of the U.S. dollar. The Dollar Index, which measures the strength of the USD against a basket of six major currencies, fell by 0.1% on Friday, settling at 103.15 points. For the week, the index declined by 0.05%, according to data from MarketWatch. Since gold is priced in USD, a weaker dollar often corresponds to higher gold prices.

On Thursday, several Fed officials said they were more optimistic that inflation is cooling enough to allow for a rate cut. They added that new economic data, rather than stock market volatility, will determine the timing and magnitude of any rate cuts.

Next week, investors’ attention will turn to the Consumer Price Index (CPI) report for July. This data point will sharpen the picture of inflation in the U.S., helping investors better understand the Fed’s policy path.

In the past two weeks, the world’s largest gold ETF, SPDR Gold Trust, has purchased nearly 4 tons of gold. Data from the fund’s website shows that it currently holds 846.9 tons of gold.