The VN-Index closed the 32nd trading week of 2024 at 1,223.64 points, a decrease of 12.96 points or -1.05% from the previous week, with slightly higher liquidity thanks to more active negotiated trades.

The average trading value for the week across all three exchanges was 19,085 billion VND, a 3.9% increase from the previous week. For matched orders alone, the average trading value was 16,376 billion VND, a 2.8% decrease from week 31 and a 6.6% decrease from the 5-week average.

There were more upward sessions than downward ones (3 out of 5 sessions increased), but the VN-Index still fell for the 5th consecutive week, mainly due to a sharp decline (-3.92%) on Monday, in line with the adjustment of the global stock market due to sell-offs.

The BU/SD (Buy Active/Sell Active) ratio improved slightly from the previous week, especially in the Retail, Information Technology, and Food sectors.

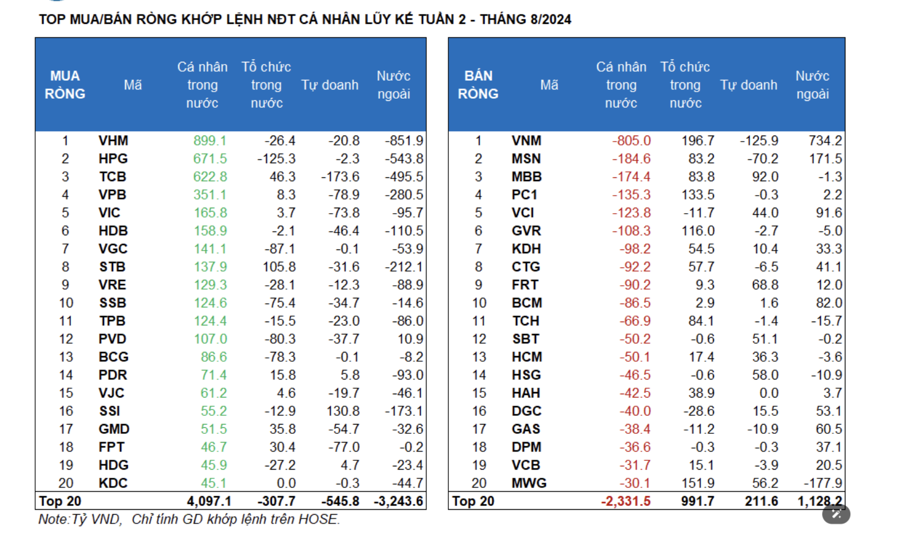

Foreign investors sold a net amount of 3,943.6 billion VND. For matched orders, they net sold 2,666.7 billion VND.

The main net buying sectors for foreign investors were Food and Beverage and Oil and Gas. The top net bought stocks by foreign investors were VNM, MSN, VCI, BCM, GAS, DGC, CTG, DPM, PLX, and KDH.

On the net selling side, foreign investors focused on the Banking sector. The top net sold stocks were VHM, HPG, TCB, VPB, STB, SSI, HDB, VIC, and E1VFVN30.

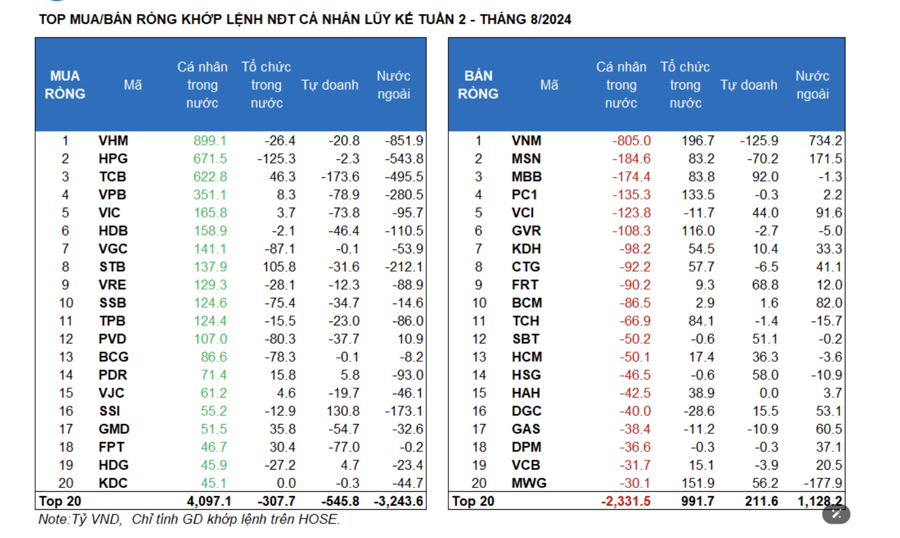

Individual investors net bought 1,931.9 billion VND, including 2,126.8 billion VND in negotiated trades. For matched orders, they net bought 11 out of 18 sectors, mainly in Banking. The top stocks bought by individual investors were VHM, HPG, TCB, VPB, VIC, HDB, VGC, STB, VRE, and SSB.

On the net selling side, they net sold 7 out of 18 sectors, mainly in Food and Beverage and Retail. The top net sold stocks were VNM, MSN, MBB, PC1, VCI, GVR, CTG, FRT, and BCM.

Domestic institutional investors net bought 3,044 billion VND. For matched orders, they net bought 967.2 billion VND.

For matched orders, domestic institutions net sold 6 out of 18 sectors, with the highest value in Basic Materials. The top net sold stocks were HPG, VGC, PVD, BCG, SSB, HVN, DGC, VRE, BAF, and HDG.

The main net buying sector was Banking. The top net bought stocks were VNM, MWG, PC1, GVR, STB, TCH, MBB, MSN, E1VFVN30, and CTG.

Proprietary trading net sold 1,032.4 billion VND, and for matched orders, they net sold 427.3 billion VND.

For matched orders, proprietary trading net bought 7 out of 18 sectors. The strongest buying sector was Financial Services, followed by Retail. The top net bought stocks by proprietary trading this week were SSI, MBB, FRT, HSG, MWG, SBT, BID, VCI, NKG, and HCM.

The top net sold sector was Banking. The top net sold stocks were TCB, VNM, VPB, FPT, VIC, MSN, GMD, ACB, HDB, and PVD.

Money Flow Trend: Looking at the weekly frame, the allocation of money flow increased in many large sectors such as Banking, Real Estate, Securities, Oil and Gas, Retail, and Information Technology, while it decreased in Steel, Food, Chemicals, and some smaller sectors (including Personal Goods, Textiles, Aviation, Telecommunications, Healthcare, and Insurance).

Money Flow Strength: Looking at the weekly frame, money flow continued to increase in the large-cap VN30 group, remained sideways in the mid-cap VNMID group, and decreased sharply in the small-cap VNSML group.

In week 32, money flow continued to focus on the large-cap VN30 group, with the average trading value for this group increasing by 1,303 billion VND (+16.7%), raising the allocation to 53.5% from 48.5% in week 31. The sudden trading volume in VHM stock on Wednesday (August 7) contributed significantly to this increase in liquidity in the VN30 group.

Meanwhile, the money flow allocation in the mid-cap VNMID group remained almost unchanged from the previous week (35.3% vs. 35%) with a slight increase in average trading value (+7.1% or +398 billion VND).

In contrast, the average trading value decreased significantly in the small-cap VNSML group, falling by 410 billion VND or 22.3%, causing the money flow allocation to drop from 11.5% in the previous week to 8.4% – the lowest in the past 14 weeks.

In terms of price movements, the VN30 and VNMID indices decreased by -1.26% and -1.24%, respectively, while VNSML decreased more sharply (-1.74%).