The Ho Chi Minh City People’s Committee has unveiled plans to restructure state-owned enterprises and those with state capital under its management by the end of 2025. As per the plan, 10 enterprises will be equitized by 2025, with the state’s common holding ratio standing at 50-65%.

On the other hand, Ho Chi Minh City will continue to maintain 100% of the charter capital in 32 limited liability companies. These are large enterprises that own a series of prime “gold lands” such as Saigontourist, Tan Thuan IPC, as well as businesses in specific industries such as the Ho Chi Minh City Financial Investment State-owned Company (HFIC), the Saigon Water Corporation (Sawaco), the Urban Railway No. 1 Company, and the Saigon Jewelry Company (SJC)…

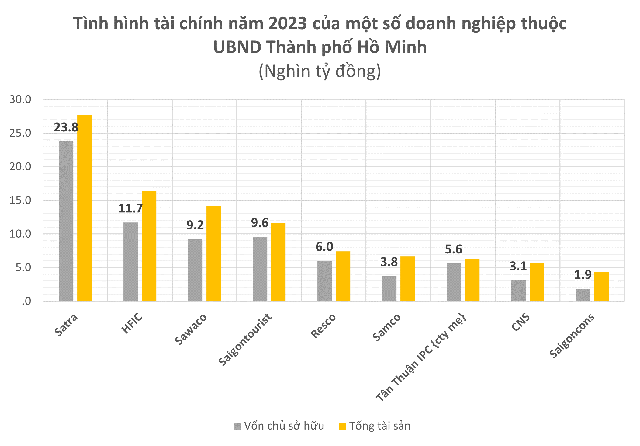

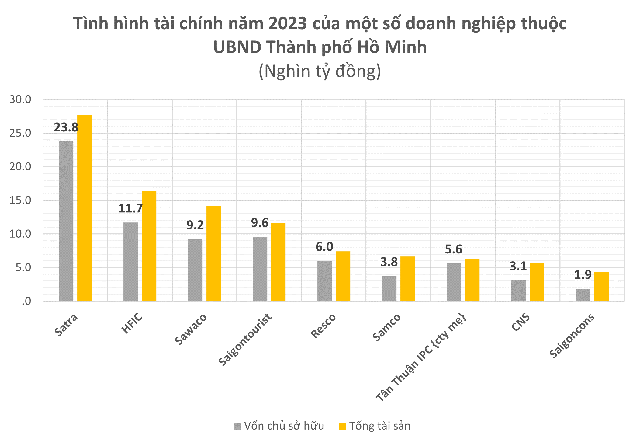

Although not the largest in terms of capital scale – second to Satra – the Ho Chi Minh City Financial Investment State-owned Company (HFIC) is likened to a “cash cow” for the Ho Chi Minh City People’s Committee as it directly and indirectly invests in fields prioritized by the city.

HFIC can be considered a miniature model of SCIC. As of December 31, 2023, HFIC’s total assets amounted to VND 16,400 billion. HFIC currently owns 100% of the Ho Chi Minh City Lottery Company – the largest lottery company in the country with profits in the thousands of billions each year, as well as numerous investments in other enterprises such as REE, VietA Bank, HSC Securities, Giditex, and Cholimex…

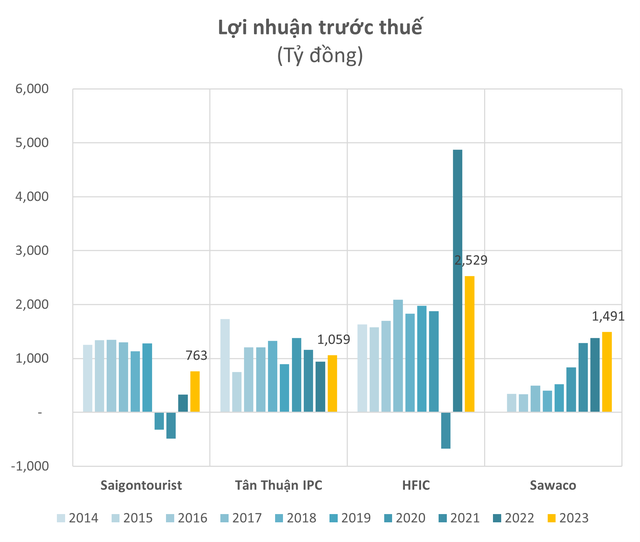

In 2021, HFIC suddenly reported a loss of nearly VND 800 billion due to provisioning for some loans. However, it made an extraordinary profit of nearly VND 5,000 billion in 2022.

Another notable enterprise in the Ho Chi Minh City People’s Committee’s “reserve” is the Saigon Tourism Corporation (Saigontourist). Due to its unique operations, Saigontourist holds numerous five-star hotels that are the oldest and most advantageously located in Saigon, including: Majestic Saigon Hotel (located at the intersection of Ton Duc Thang and Dong Khoi, District 1), Grand Saigon Hotel (8 Dong Khoi, District 1), Continental Saigon Hotel (132-134 Dong Khoi, District 1), Royal Hotel Saigon (133 Nguyen Hue, District 1), and Rex Saigon Hotel (141 Nguyen Hue, District 1)…

In addition, Saigontourist also owns a sizable portfolio of investments in joint venture companies such as Caravelle Hotel (49%), New World Saigon (25%), Saigon Exhibition and Convention Center, and SCTV Cable Television…

Saigontourist’s business activities have been significantly impacted since the COVID-19 pandemic outbreak.

The Saigon Water Corporation (Sawaco) – has seen a steady increase in profits in recent years, reaching nearly VND 1,500 billion in 2023.

Another large enterprise in the real estate field is the Tan Thuan Industrial Development Company (Tan Thuan IPC). Tan Thuan IPC holds a sizable portfolio of investments in many other real estate businesses, most notably 30% of Phu My Hung Joint Venture Company. Profits from Phu My Hung are the main contributors to Tan Thuan IPC’s profits of thousands of billions each year.

In addition, Tan Thuan IPC is also the major shareholder of Long Hau Joint Stock Company (LHG), Hiep Phuoc Industrial Park Joint Stock Company, Sepzone – Linh Trung Company, and SCPT Port…

A notable member is SJC, which, despite its modest asset scale, stands out with its outstanding revenue, several times that of the other units. In 2023, SJC recorded a gross revenue of VND 28,408 billion. Profit after tax also increased by 24% to VND 61 billion, exceeding the assigned target by 7%.

In 2024, amid the gold price fever, SJC sets a revenue target of VND 30,145 billion and aims to increase profit after tax by 22% to over VND 70 billion.

Prime Minister Pham Minh Chinh: Corporations and State-Owned Enterprises must concentrate resources for investment and development

Prime Minister Pham Minh Chinh has called for a focused effort to remove legal obstacles, thereby facilitating smooth business operations. He emphasized the need to streamline the legal framework and decentralize power to ensure appropriate resource allocation. The aim is to create a conducive environment for businesses to thrive.