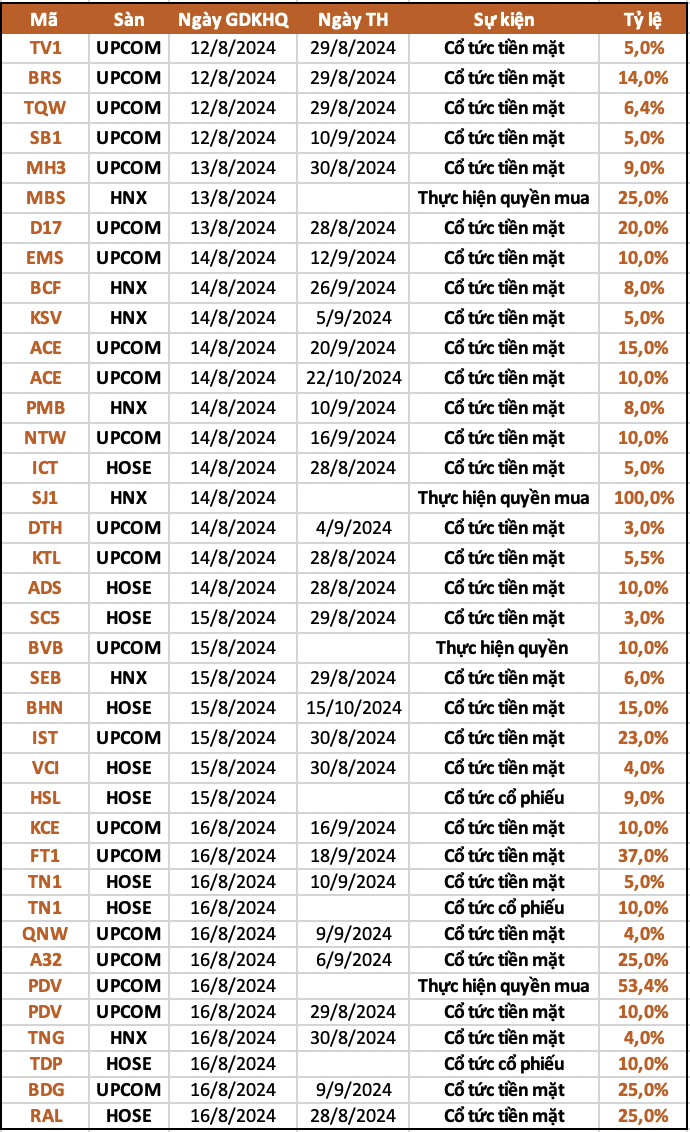

According to statistics, 35 companies announced dividend lock-in during the week of August 12-16. Of these, 27 companies will pay cash dividends this week, with the highest rate being 37% and the lowest 3%. In addition, this week, 2 companies paid stock dividends, 3 companies exercised stock purchase rights, and 3 companies paid combined dividends.

The Hanoi Beer, Alcohol, and Beverage Joint-Stock Corporation (Habeco, code: BHN) has just announced that August 16 will be the record date for the 2022 dividend payment in cash and to collect shareholders’ opinions via written form. The ex-dividend date is August 15.

Habeco plans to pay a 15% dividend in cash (VND 1,500 per share), with the expected payment date on October 15, 2024. With 231.8 million shares currently in circulation, the company will have to spend nearly VND 348 billion.

Tan Cang Song Than (code IST) announced the closure of the 2023 dividend payment list with a rate of 23% in cash (VND 2,300 per share), requiring a payment of over VND 27.6 billion. The ex-dividend date is August 15, and the payment date is August 30, 2024.

This is the 8th consecutive year that IST has maintained dividend payments to shareholders since 2016, with the highest rate being 34% in cash in 2020. Most recently, the Company distributed a 2-phase dividend for 2022 with a total rate of 25.6%.

On August 16, Vietcap Securities Joint Stock Company (code VCI) will finalize the list of shareholders for the first 2024 dividend payment in cash with a rate of 4%, meaning that for every 1 share owned, shareholders will receive VND 400. With 441.9 million shares currently in circulation, VCI is expected to spend about VND 177 billion on dividend payments. The expected payment date is from August 30, 2024.

After this interim cash dividend payment, VCI will also start the process of increasing its charter capital through bonus share issuance from the owner’s equity source. According to the decision, Vietcap plans to issue nearly 133 million bonus shares at a ratio of 10:3 (equivalent to 30%), meaning that for every 1 share owned, shareholders will receive 1 right, and for every 10 rights, they will receive 3 additional shares. The expected timeline for this is in the third or fourth quarter of 2024.

After the capital increase, Vietcap’s charter capital will increase from VND 4,419 billion to over VND 5,700 billion.

Machine No. 1 Accessories Joint Stock Company (code FT1) has just announced the closure of the 2023 dividend payment list in cash at a rate of 37%, equivalent to VND 3,700 per share. With more than 7 million shares in circulation, Machine No. 1 Accessories is expected to spend about VND 26 billion on dividend payments to shareholders. The record date is August 19, and the dividend payment date is from September 18.

Looking back at history, since its shares were traded on UPCoM in 2017, the company has never forgotten to pay dividends to shareholders at a rate of over 30% in cash. The peak was in 2021, with a cash dividend rate of up to 45%.

Many businesses pay cash dividends immediately after Tet

After the Lunar New Year in 2024, many companies listed on the stock market will distribute dividends to investors. The banking sector stands out with its generous cash dividend payment.