Illustration.

Oil rises 3.5% weekly on positive economic data, hopes of rate cuts

Oil prices edged higher on the last trading session of the week, registering a weekly gain of over 3.5%, as positive economic data and signals from Fed policymakers indicating a possible rate cut as early as September eased concerns about demand, while worries about an expanding Middle East conflict continued to heighten supply risks.

Brent crude futures for October delivery rose 50 cents, or 0.6%, to $79.66 a barrel, while U.S. West Texas Intermediate (WTI) crude futures climbed 65 cents, or 0.9%, to $76.84. Brent gained over 3.5% on the week, while WTI rose more than 4%.

A trio of Fed policymakers on Thursday said they were more confident that inflation was easing enough to allow for a rate cut. A larger-than-expected drop in U.S. jobless claims data also helped bolster the rebound.

Meanwhile, the dollar index fell 0.136% to 103.14 after three days of gains. The weaker greenback made oil cheaper for buyers holding other currencies.

Gold steady on Fed rate cut hopes, lower yields

Gold prices steadied after a sharp rise in the previous session, underpinned by falling U.S. Treasury yields as investors grew increasingly confident that the Fed will cut rates in September.

Spot gold was little changed, trading at $2,427.73 an ounce, as of 18:26 GMT, after climbing 1.9% on Thursday. U.S. gold futures rose 0.4% to $2,473.40. However, bullion posted a 0.6% decline for the week.

“In the medium term, the outlook for gold remains positive, with any dips likely to be short-lived due to the underlying macroeconomic fundamentals,” said Zain Vawda, a market analyst at OANDA’s MarketPulse.

Spot silver fell 0.4% to $27.44 an ounce, while platinum dropped 1.1% to $920.47. Both metals registered weekly losses. Palladium declined 2.1% to $903.30, but posted a weekly gain.

Copper rises as concerns about U.S. growth ease and Chinese inventories decline

Copper prices rebounded after U.S. employment data eased worries about a slowdown in U.S. growth, while falling inventories in China bolstered positive sentiment.

LME benchmark copper ended the session up 0.5% at $8,831 a tonne, after touching a four-and-a-half-month low of $8,714 earlier in the week due to concerns about the impact of a potential U.S. recession.

Data showed the number of Americans filing new claims for unemployment benefits fell more than expected last week, suggesting fears about the labor market have been overblown.

Traders said inflation data showing China was emerging from deflation also bolstered the improved sentiment in equity and commodity markets.

Inventories of copper in ShFE warehouses have fallen 15% over the past two months to 286,305 tonnes.

Prices of lead rose 3.6% to $2,036 a tonne, while zinc added 3.3% to $2,734. Aluminum gained 0.9% to $2,293.50, and nickel climbed 0.1% to $16,155. Tin recently rose 2.3% after touching a three-week high of $32,050.

Iron ore rebounds on China’s inflation data

Iron ore futures rebounded on better-than-expected inflation data in China, although persistent concerns about demand and ample supply kept prices lower for the week.

The January 2025 iron ore contract on China’s Dalian Commodity Exchange (DCE) rose 0.27% to 741.5 yuan ($103.43) per tonne, but fell 2.6% for the week.

The September iron ore contract on the Singapore Exchange climbed 1.05% to $101 per tonne but posted a 2.7% weekly loss.

Official data showed China’s consumer prices rose faster than expected in July as Beijing stepped up support for its ailing consumer sector amid an uneven economic recovery, although producer price deflation persisted.

On the Shanghai Futures Exchange, steel rebar fell 0.27%, hot-rolled coil dropped 0.72%, wire rod lost 1.39%, and stainless steel declined 0.32%.

Corn and soybean futures hit four-year lows, wheat rises

Chicago corn and soybean futures closed near four-year lows and posted weekly losses, while wheat rose on expectations of a poor crop in France.

A survey of analysts predicted that U.S. corn and soybean production would show a slight increase in the USDA report, which would add to global supply gluts.

The September corn contract on the Chicago Board of Trade (CBOT) closed down 2 cents at $3.95 per bushel, the lowest since October 2020.

Soybeans closed down 5-3/4 cents at $10.02-1/2 a bushel, the lowest since September 2020. Soybeans initially rose after the USDA reported sales of 132,000 tonnes to China for the 2024/25 marketing year, and as an oilseed strike in Argentina slowed shipments.

Wheat closed up 5 cents at $5.42-1/2 per bushel, ending the week higher, boosted by poor crop conditions in France. France’s Farm Ministry on Friday lowered its estimate for the country’s 2024 soft wheat crop, now expected to fall 25% from last year’s level.

NY cocoa rises 10% on tight supplies; coffee slips

Cocoa prices surged on tight supplies and reports of crop deterioration in Ghana, while arabica coffee extended losses from the previous session’s one-month high.

New York cocoa for December delivery jumped $676, or 10.1%, to $7,390 a tonne. The contract rose 13% for the week.

Brokers said supplies remained very tight despite a positive outlook for the upcoming 2024/25 crop, while also citing disease issues for crops in Africa. Recent data showed Ghana, the second-largest grower, was unable to halt the spread of disease.

London cocoa for December delivery rose 7.5% to £5,657 a tonne. London cocoa gained 8% for the week.

September arabica coffee fell 11.25 cents, or 4.6%, to $2.3405 per lb, retreating from Thursday’s one-month high of $2.5175. September robusta coffee lost 2.5% to $4,326 per tonne.

Brokers said the market was supported by a lower-than-expected harvest in Brazil, while tight robusta supplies could boost demand for lower-quality arabica. Commerzbank said in a daily update that there had also been buying ahead of new EU deforestation rules.

Raw sugar for October delivery fell 0.09 cents, or 0.5%, to 18.48 cents per lb. White sugar for October was unchanged at $526.00 a tonne.

Japanese rubber rises for the fourth day as U.S. data eases recession worries

Japanese rubber futures rose for the fourth straight session, posting their first weekly gain in four, as lower-than-expected U.S. weekly jobless claims eased recession fears while a weaker yen also provided support.

The January 2025 rubber contract on the Osaka Exchange (OSE) closed up 0.16% at 322 yen ($2.19) per kg. It touched 325.7 yen earlier in the session, its highest since July 22. For the week, the contract rose 2.13%, its biggest gain since early June.

The most-active rubber contract on the Shanghai Futures Exchange (SHFE) for January delivery gained 65 yuan, or 0.45%, to 15,920 yuan ($2,219.77) per tonne. The contract rose 1.79% for the week, its second straight weekly gain.

Rubber inventories in warehouses monitored by the SHFE rose 2.3% from last Friday, the exchange said on Friday.

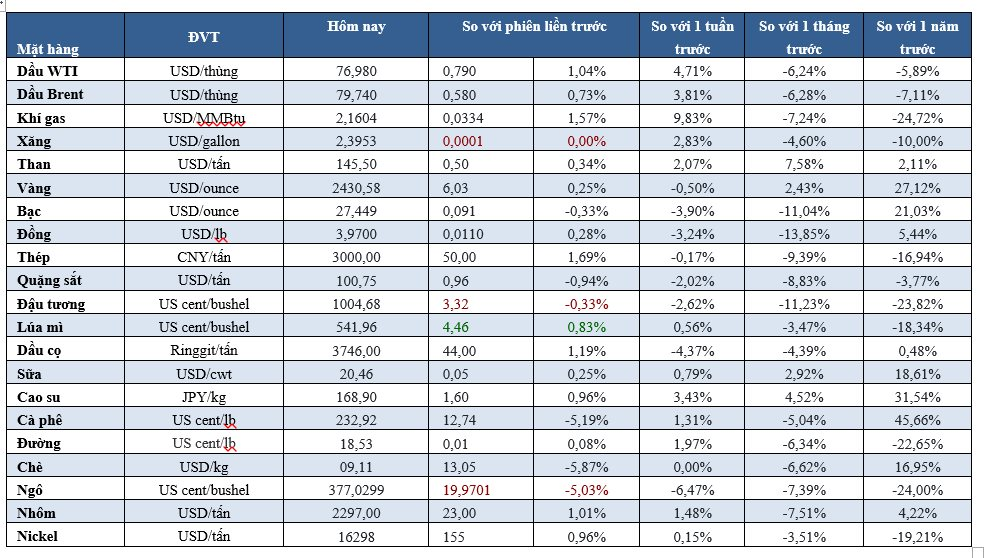

Prices of some key commodities on August 10, 2024