According to the writer’s understanding, in the first quarter of this year, the position of Chairman of the Board of Directors of Vina Dai Phuoc changed from Mr. Lin, Yi Huang (Taiwan, China) to Mr. Nguyen Khanh Trung, while Mr. Vu Hoai became the General Director. It is understood that Mr. Lin, Yi Huang also previously held the position of head of the executive board. With this new change, Mr. Trung and Mr. Hoai are the newest legal representatives of Vina Dai Phuoc.

Joint Stock Company Vina Dai Phuoc, headquartered in Dong Nai, is a joint venture between DIG and VinaCapital (through two member funds), established in 2007 with a charter capital of nearly VND 1,654 billion, to implement the Hoa Sen Dai Phuoc project. In August 2016, DIG held 28% capital, while the two foreign shareholders were VinaCapital Pacific Limited – Singapore holding 54% and Allright Assets Limited – Singapore holding 18%.

After more than 10 years of establishment, the founding shareholders of Vina Dai Phuoc have successively withdrawn capital, including: VinaCapital withdrew in 2017 and DIG in 2019. The transferee of VinaCapital’s capital is China Fortune Land Development (CFLD) – a Chinese industrial real estate development corporation. The project, after changing to a new investor, also changed its name from Hoa Sen Dai Phuoc to SwanBay Dai Phuoc.

By the end of 2021, Vina Dai Phuoc announced that SNC Investments 27 and SNC Investments 28 – two subsidiaries of CFLD (headquartered in Singapore) were no longer in the company’s shareholder structure. In 2023, the position of Chairman of the Board of Directors of the Company was still held by Mr. Lin, Yi Huang, a Taiwanese national (China), in addition to adding another legal representative, Mr. Vu Hoai – General Director. By the end of 2023, early 2024, some market moves indicated that foreigners were gradually withdrawing from the Dai Phuoc project, but no replacement has appeared yet.

The new Chairman of Vina Dai Phuoc, Mr. Nguyen Khanh Trung, is currently a member of the Board of Directors of Dong Do Petroleum Joint Stock Company (UPCoM: PFL). Meanwhile, General Director Vu Hoai (also known as Vu Hoai Nam) is a member of the Board of Directors of Saigon Vina Real Estate Joint Stock Company (UPCoM: LSG). Notably, the two new leaders of Vina Dai Phuoc both hold management positions at a large real estate corporation associated with a female billionaire in Vietnam.

A glimpse of the Dai Phuoc project.

|

DIG and the Dai Phuoc Project

At the end of 2023, DIG announced the resolution of the Board of Directors on the decision to terminate the capital contribution to Dai Phuoc Thien An Limited Liability Company and Dai Phuoc Thien Minh Limited Liability Company. Instead, the Company authorized the Chairman of the Board of Directors/Permanent Vice Chairman of the Board of Directors/General Director to continue selecting capable and experienced investors to cooperate in implementing the project.

Dai Phuoc Thien An has a charter capital of nearly VND 1,134 billion, in which DIG owns 99.96%. The company is headquartered in Sub-divisions 1, 2, and 3 of the Dai Phuoc eco-tourism urban area.

On November 27, 2020, the DIG Board of Directors decided to approve the plan to transfer the entire capital contribution of DIG at Dai Phuoc Thien Minh to another party to implement the investment, construction, and business exploitation of the 14.4ha land plot in Sub-division 7.1 of the Dai Phuoc project. The transfer price is not lower than the capital contribution value of VND 759 billion.

|

Mr. Bui Nguyen Thanh Long is also a founding shareholder of Vietnam Challenge Joint Stock Company, which specializes in sports activities. The company was established in September 2023 with a charter capital of VND 20 billion, in which Tan An Development Investment Joint Stock Company (a company closely related to DIG) contributed 1%, Mr. Nguyen Hung Cuong 98%, and Mr. Long 1%. |

Dai Phuoc Thien Minh was only established on November 9, 2020, about two weeks before the DIG Board of Directors announced its divestment plan. The company is headquartered in the same location as Dai Phuoc Thien An, in Sub-divisions 1, 2, and 3 of the Dai Phuoc eco-tourism urban area. With a charter capital of VND 760 billion, DIG contributed VND 759 billion, or 99.868%, calculated by the right to use land; the remaining VND 1 billion, or 0.132%, was contributed by Mr. Luu Van Bang. The enterprise is chaired by Mr. Bui Nguyen Thang Long, who is also the General Director and legal representative. In 2020, DIG announced that it had completed the capital contribution and transfer of this capital contribution at Dai Phuoc Thien Minh, however, the transferee was not disclosed.

In the middle of 2023, Thaiholdings Joint Stock Company (HNX: THD) expressed its interest in cooperating with DIG in investing in the Dai Phuoc eco-urban project. Thaiholdings stated that it was looking for Sub-division 8 and the eco-tourism urban area of Dai Phuoc belonging to Sub-divisions 2 and 3 of the project, and hoped for a chance to cooperate with DIG. However, up to now, the two sides have not publicly announced any new moves after this declaration.

Master plan of the Dai Phuoc project subdivisions.

|

The Dai Phuoc super-project covers an area of 464.5 hectares, with a total investment of VND 7,506 billion, according to DIG. As of the end of 2023, DIG stated that it had completed the investment in the main technical system for the second-level projects, roads, power supply, and water supply and drainage; completed the legal procedures for investment, and obtained confirmation from the Department of Natural Resources and Environment and the Department of Construction on meeting the conditions for transferring the right to use land and future houses in Sub-divisions 1, 2, and 3; and is in the process of adjusting the detailed planning at a ratio of 1/500 and adjusting the project implementation progress.

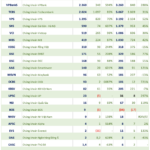

As of the middle of this year, DIG‘s production and business investment in progress at the project was VND 2,142 billion, an increase of 62% compared to the beginning of the year. At the same time, DIG recorded an investment in Vina Dai Phuoc valued at VND 1.6 billion, equivalent to 0.1% of capital.

Vina Dai Phuoc transfers nearly 25,000 square meters of land to a Singaporean company