Alongside their investments in business development, which contribute to the country’s economic growth and job creation, companies’ social activities and tax contributions are also important measures of their impact on the nation. Private enterprises, alongside state-owned enterprises, play a significant role in contributing to the state budget.

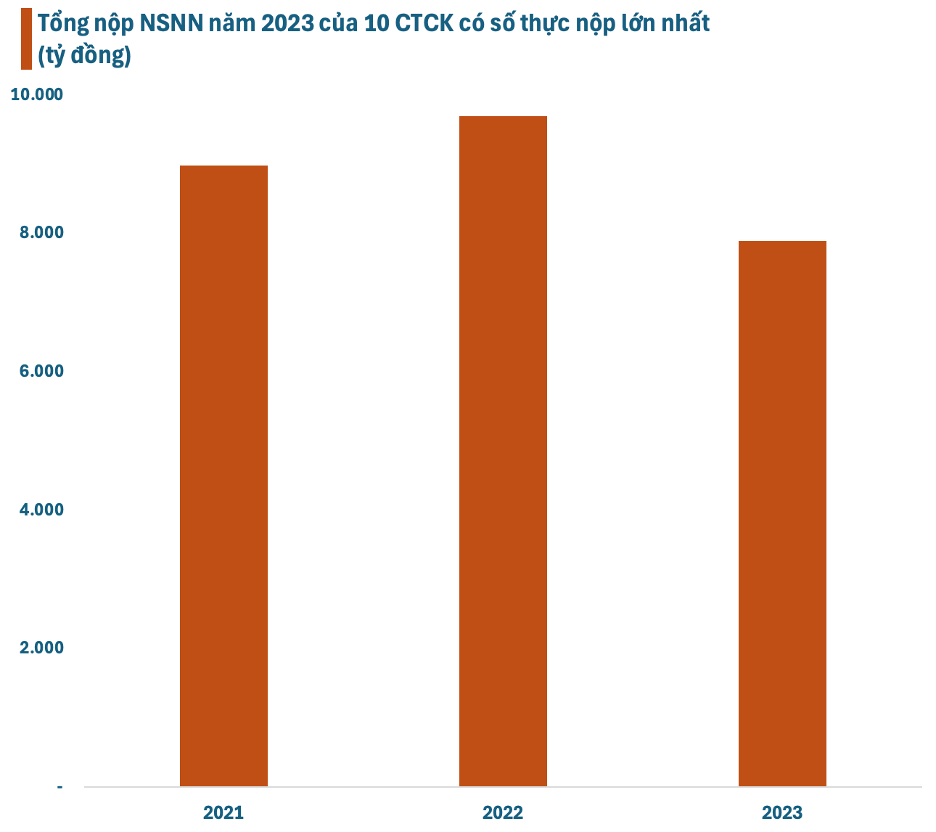

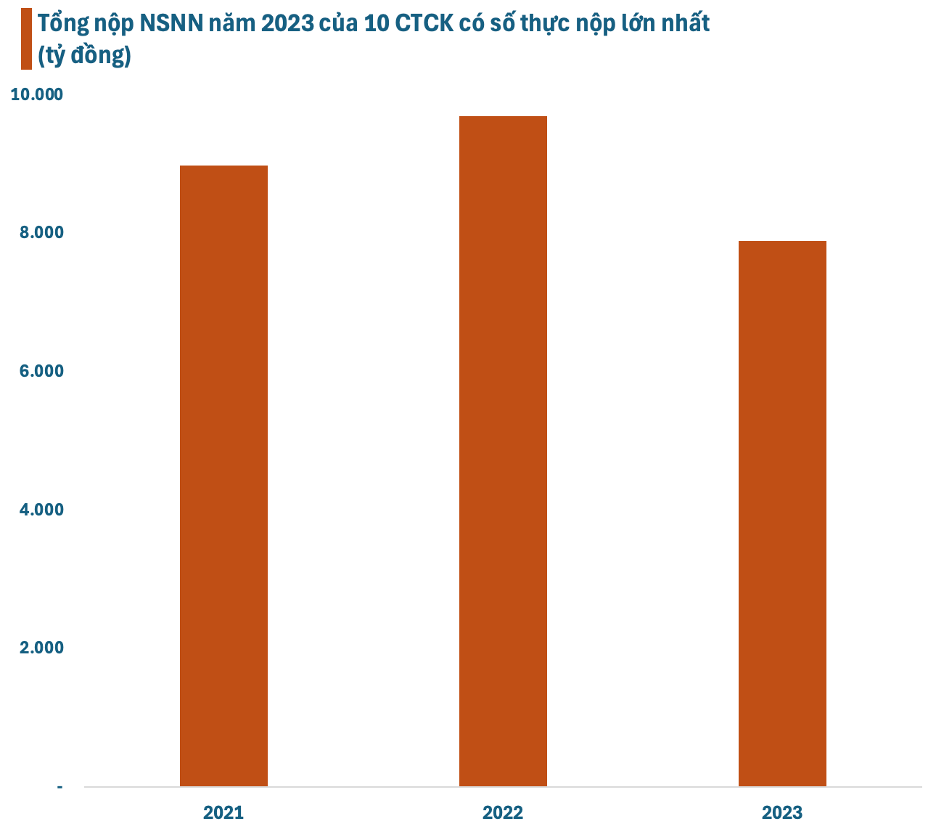

As one of the key drivers of the economy, securities companies, with their dynamic market development, are making increasingly significant tax contributions. According to consolidated data from securities companies’ reports, in 2023, the top 10 securities companies in terms of tax contributions paid a total of nearly VND 7,900 billion to the state budget.

2023 was a year of great fluctuations in the stock market, and securities companies also faced many challenges due to unpredictable external factors. However, with their agility and correct business orientation, securities companies overcame these difficulties and achieved remarkable results.

In 2023, the total pre-tax profit of securities companies was estimated at nearly VND 22,000 billion, an increase of 40% compared to 2022. Thus, the state budget contributions (including corporate income tax, personal income tax, VAT, and contractor tax) of the top 10 securities companies with the largest actual payments accounted for nearly 36% of the total profit of the industry.

In the PRIVATE 100 list voted by CafeF, the securities sector also recorded a large number of representatives with 15 members, of which the top three contributed over VND 1,000 billion each. SSI has been in the top position in the securities industry for the third consecutive year in terms of budget contributions. Over the past three years, this securities company has contributed more than VND 4,000 billion to the state budget.

This result is not surprising, as SSI has maintained its leading position in the securities industry in many aspects over the years. SSI is currently the most valuable securities company on the market, with a market capitalization of nearly USD 2 billion. It is also the only representative of the securities group in the list of billion-dollar capitalization companies.

With more than 15,000 billion VND in charter capital (1.5 billion shares outstanding), SSI is the second-largest securities company in terms of charter capital. Its owner’s equity is close to USD 1 billion, also ranking at the top of the industry. Financial potential is an extremely important factor for securities companies to expand important business segments, especially margin lending.

To get ahead of the “prefunding” trend and act as an intermediary for non-margin foreign investors, a wave of capital increases has been and is taking place strongly among securities companies. SSI is no exception, with plans to sell and issue shares to increase capital from 15,000 billion to over 19,600 billion VND, thereby regaining its position as the largest in terms of charter capital.

Along with the capital increase, SSI has planned for continued business growth. In 2024, SSI set a target of VND 8,112 billion in consolidated revenue and VND 3,398 billion in consolidated pre-tax profit, an increase of 13% and 19%, respectively, compared to the previous year. After the first half of the year, the company had completed 54% of its revenue plan and 59% of its profit plan.

In the second quarter alone, SSI’s revenue is estimated at VND 2,368 billion, and pre-tax profit reached VND 1,060 billion, up 41% and 50%, respectively, compared to the same period in 2023. This is the highest profit in 10 quarters for SSI. Cumulative pre-tax profit for the first six months reached over VND 2,000 billion, up 51% over the same period last year. Nearly VND 400 billion was contributed to the state budget in corporate income tax.

For securities companies, in addition to transaction fees from investors, profit is a significant contributor to the state budget. For many years, SSI has consistently been at the top of the securities industry in terms of profit, with pre-tax profit regularly exceeding VND 1,000 billion. As a result, SSI also contributes hundreds of billions of VND in corporate income tax to the state budget each year.

In addition to its growth targets, SSI has set several directions for its operations in 2024, including accelerating digital transformation to innovate its business model and target customers with specific needs, and leveraging its capital scale to provide unique products to customers…

With a modest number of investors participating in the market, the securities industry is expected to have significant room for growth in the future. In addition, the process of upgrading the market is also making positive progress thanks to the efforts of management agencies and market members. The upgrade is expected to open a new chapter for the Vietnamese securities industry, creating a boost for securities companies to grow strongly and contribute even more to the state budget in the future.

PRIVATE 100 – Top 100 Private Enterprises Contributing the Most to Vietnam’s State Budget is a list compiled by CafeF based on publicly available sources or verifiable data, reflecting the actual budget contributions of enterprises, including taxes, fees, and other payments. Enterprises with budget contributions of VND 100 billion or more in the latest fiscal year are eligible for inclusion in the list. Some notable enterprises in the 2024 list, reflecting their contributions in the 2023 fiscal year, include ACB, DOJi, HDBank, LPBank, Masan Group, OCB, PNJ, SHB, SSI, Techcombank, TPBank, Hoa Phat Group, VNG, VPBank, VIB, VietBank, and VPS (listed in alphabetical order).