The stock market closed the trading week of August 4-9 with a quick decline and a strong rebound. Despite a recovery after a sharp plunge early in the week, the VN-Index still ended the week with a total loss of 12.96 points (-1.05%), closing at 1,223.64. Liquidity also remained low, with the average matching value on HOSE just below VND15 trillion.

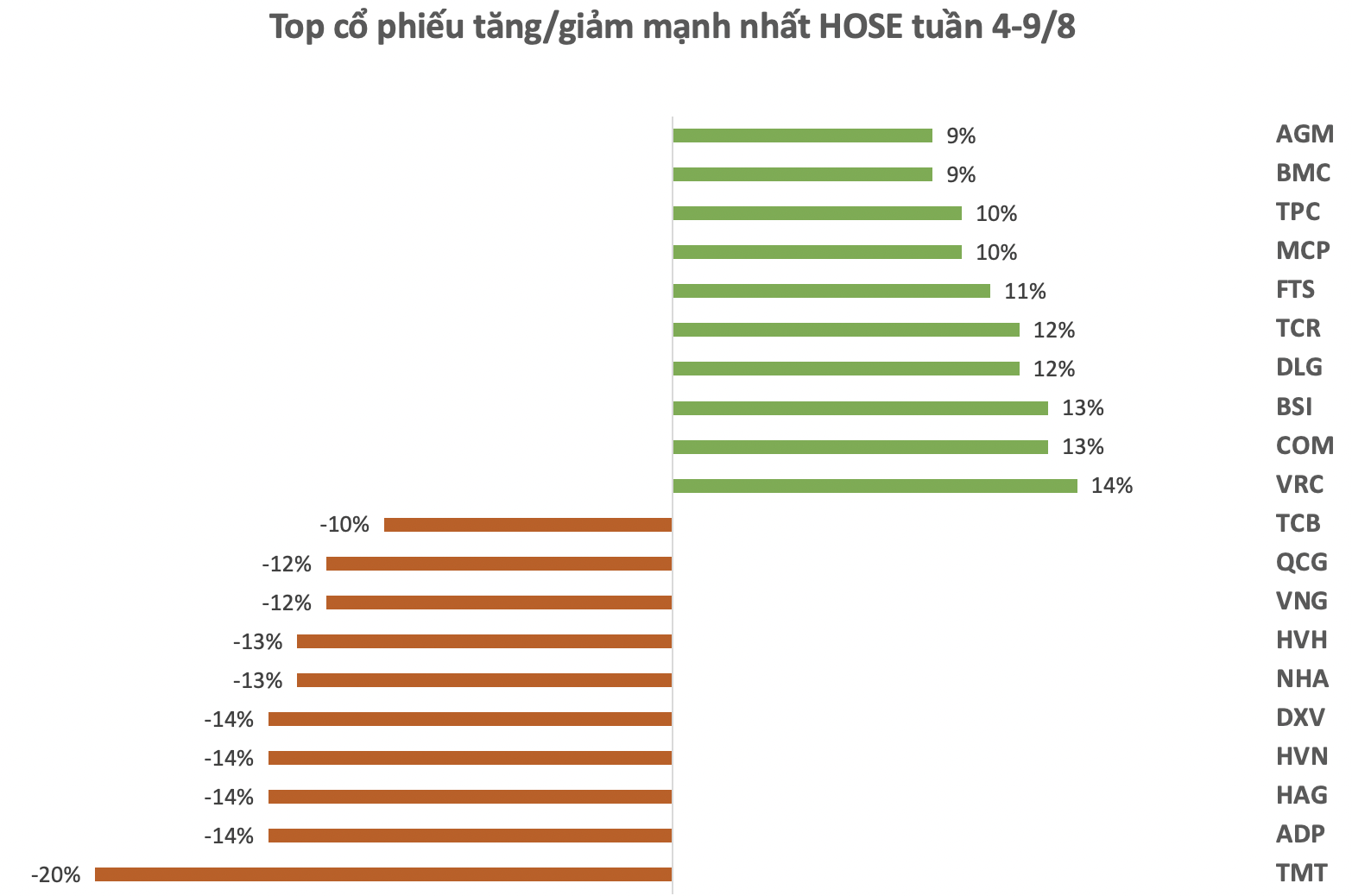

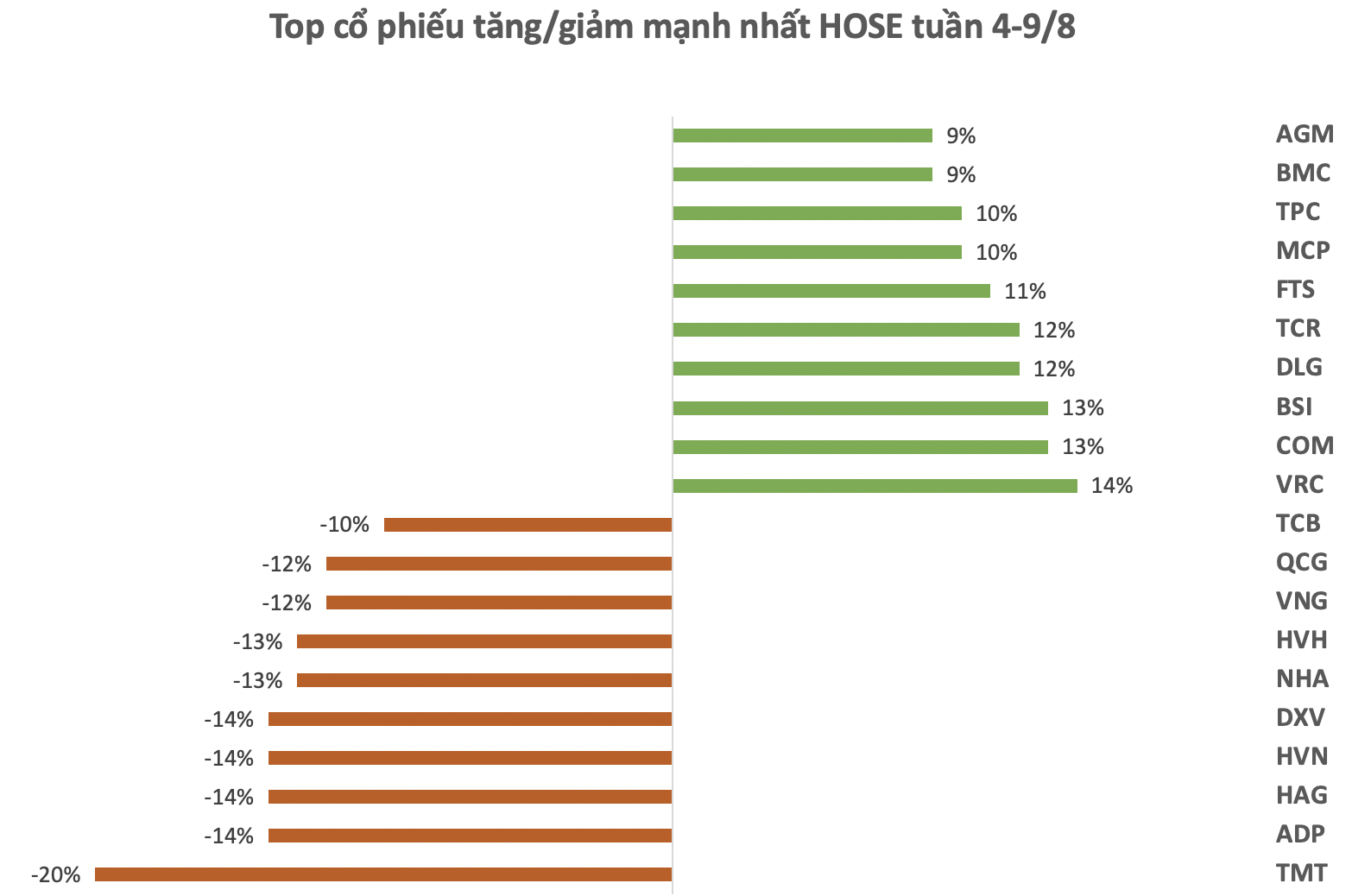

On HOSE, VRC shares topped the list of biggest gainers. After four consecutive breakout sessions, the share price rose 14% to VND9,360. However, trading volume for this stock was only a few tens of thousands of shares matched in the session.

According to our research, VRC was formerly known as the Special Zone Construction Company Vung Tau – Cong Dao, established in August 1980, and was one of the earliest construction companies in Ba Ria – Vung Tau Province. In 2017, the company changed its name to VRC Real Estate and Investment Joint Stock Company, focusing its business on real estate and investment.

Also in the real estate sector, DLG surged with three ceiling-hitting sessions after announcing that it had received a decision from the People’s Court of Gia Lai Province not to initiate bankruptcy proceedings.

Two securities stocks, BSI and DTS, also made it to the list of top gainers, rising 13% and 11%, respectively, over the week.

In contrast, TMT, ADP, HAG, and HVN faced profit-taking pressure, falling more than 14% this week.

Among these, TMT suffered the biggest loss on the HOSE after reporting the heaviest loss in its operating history. Specifically, for Q2 2024, TMT Motors reported a post-tax loss of VND95 billion, while it made a profit of over VND2 billion in the same period last year.

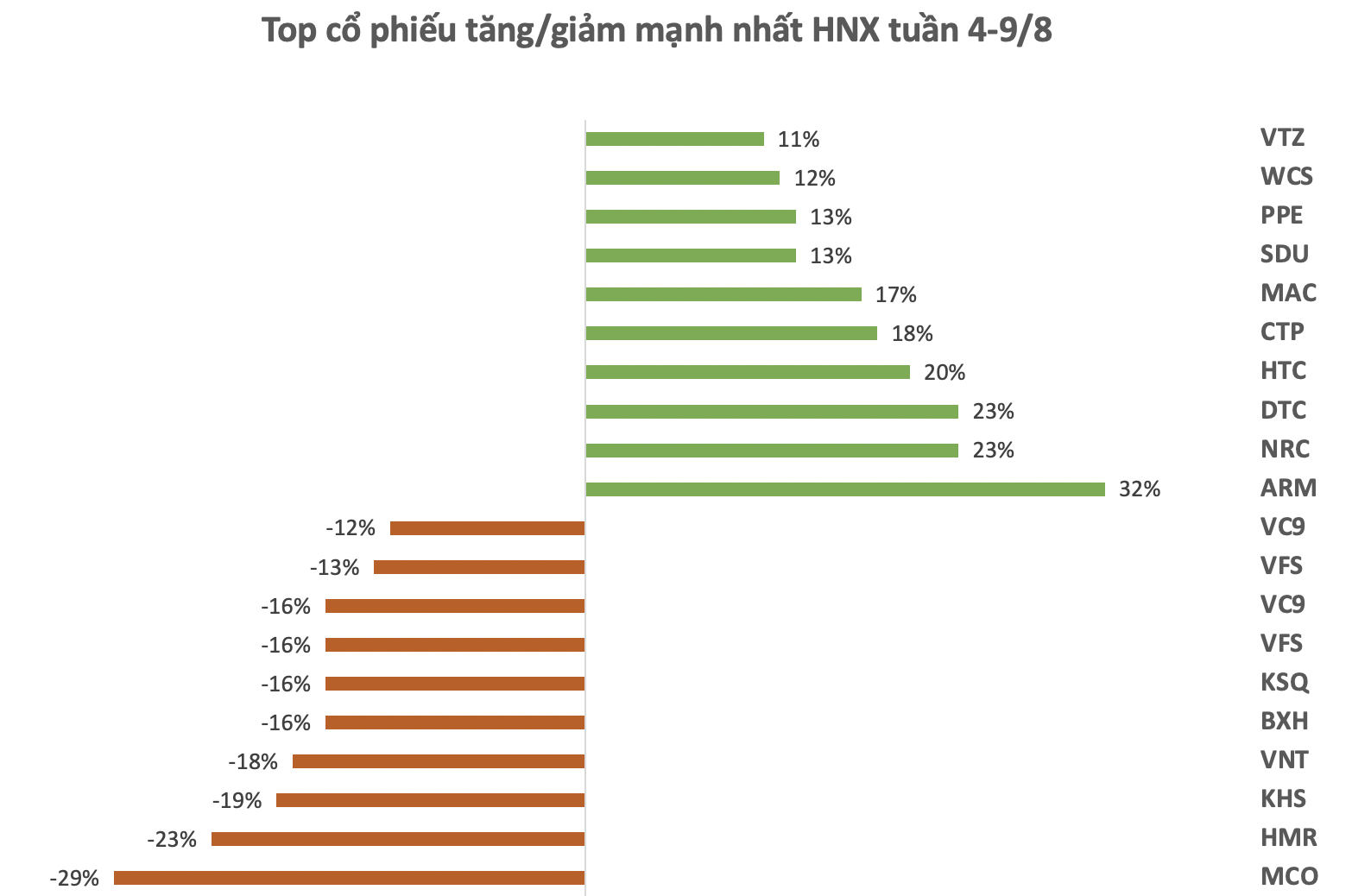

On HNX, the gainers were mostly small-cap, illiquid stocks such as ARM, NRC, DTC, and HTC.

On the losing side, MCO, HMR, and KHS faced profit-taking pressure, falling more than 19% last week.

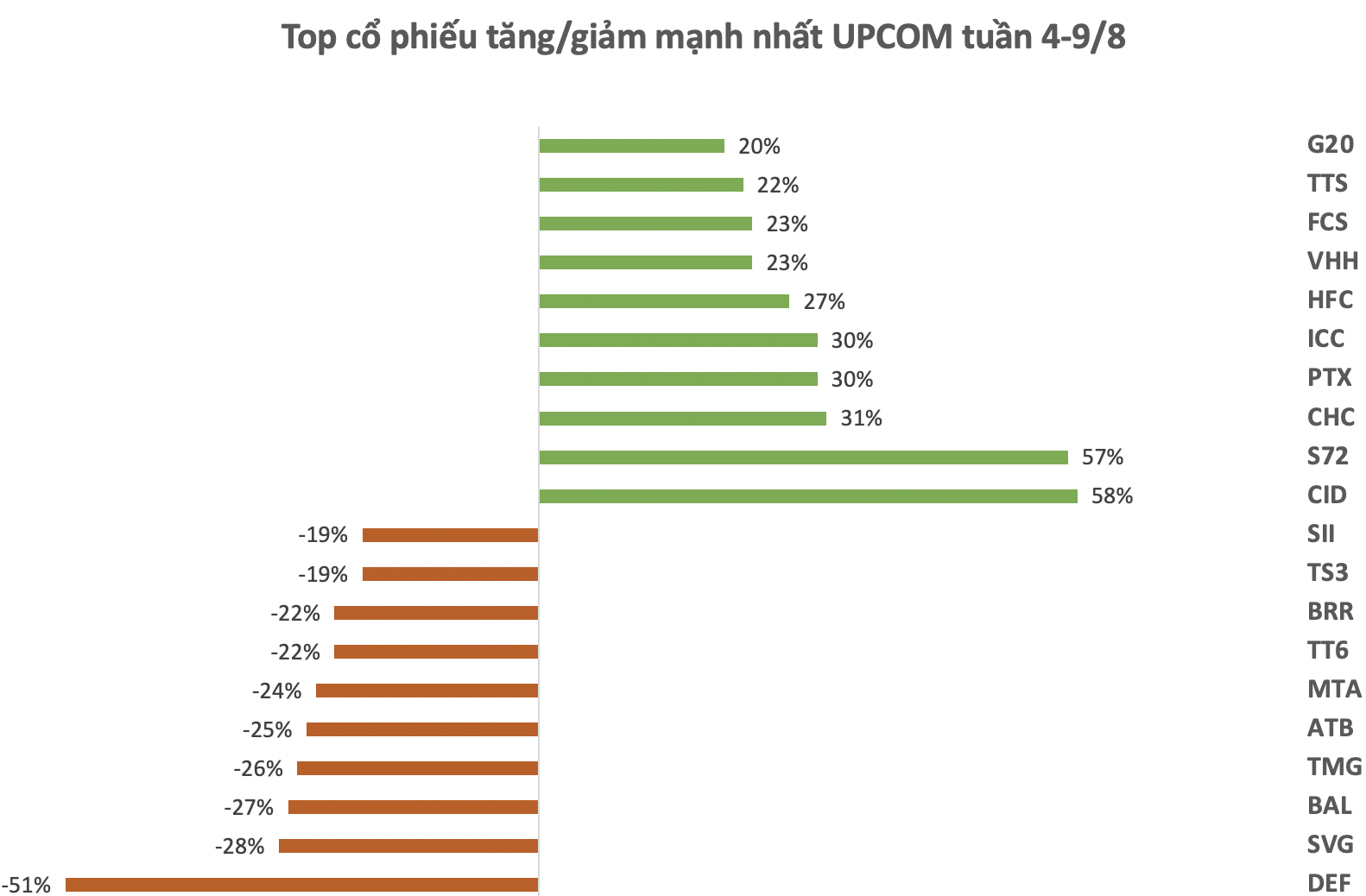

On UPCOM, CID led the gains, hitting the ceiling for three sessions this week, pushing the share price to VND53,000. Overall, the stock still recorded a nearly 58% gain for the week. Despite the strong increase, the trading volume for this stock was only a few hundred to a few thousand units.

In contrast, many stocks on UPCOM also recorded losses of between 19% and 51% last week. Notably, DFF of Fat Racing Group Joint Stock Company has fallen sharply in consecutive sessions since the beginning of July. The share price plunged 51% last week to VND3,100, with an average trading volume of over 150,000 units in 10 sessions. Looking at a broader period, this stock has lost more than 68% in the past month.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”