The latest strategic report from KBSV Securities reveals that July 2024’s macro figures maintained a positive recovery trend, largely driven by production and exports. The PMI index reached 54.7 in July, marking the fourth consecutive month of new order growth, indicating sustained growth in the manufacturing sector.

Traditional growth drivers such as retail goods revenue, tourism, public investment, and FDI remain stable. While July’s CPI surged 0.48% from the previous month, inflationary pressures are mostly temporary. Thus, KBSV maintains its forecast for 2024’s average CPI at around 4% YoY, below the government’s target, while currency pressure continues to ease.

Looking at the mid to long-term picture, maintaining low-interest rates will be the primary supportive factor for domestic production, industry, investment, and consumption to recover sequentially.

From a technical perspective, the KBSV Analytics team predicts that in a positive scenario, the VN-Index will continue its downward momentum and could start to recover when the index retreats to the near-term support area of around 1,150 (+-10).

In a negative scenario, if the index breaks down below the 1,150 support level, it will lose its medium-term uptrend and may enter a sideways phase on the monthly chart, forming a triangle pattern from the peak at the beginning of 2022 to a deeper support area around 1,080 (+-15) before having a chance to recover.

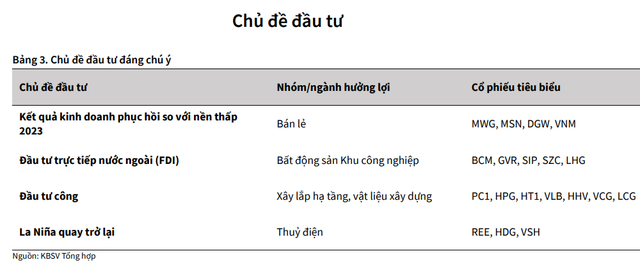

Regarding investment strategies, KBSV identifies four key themes that are expected to offer positive prospects for corresponding stock groups. These include business recovery, FDI, public investment, and the return of La Nina.

Firstly, KBSV highlights the retail sector as beneficiaries of recovering business results compared to the low base of 2023, with key stocks being MWG, MSN, DGW, and VNM.

Secondly, analysts anticipate that the Industrial Real Estate sector will benefit from foreign direct investment, with a focus on stocks like BCM, GVR, and SIP.

Thirdly, public investment remains a bright spot for infrastructure construction and building materials companies, such as PC1, HPG, HT1, and VLB.

Lastly, the return of La Nina is expected to boost the performance of hydropower companies, including REE, HDG, and VSH.

KBSV believes that the current short-term market correction presents a good opportunity for investors to build or increase their positions. They emphasize, “The current low price range of the VN-Index offers a good entry point for strategic stock groups towards the end of 2024.”