The Ho Chi Minh City Stock Exchange (HOSE) has recently notified Dong A Plastic Joint Stock Company (stock code: DAG) regarding the suspension of trading of DAG shares.

Specifically, DAG shares are currently restricted from trading according to Decision No. 262 dated May 17, 2024, as the listed company delayed the submission of its 2023 audited financial statements by more than 45 days beyond the regulatory deadline.

On August 2, HOSE issued a notice to the company for its delay in disclosing information about an event that impacted its production and business operations.

Based on the regulations, securities are subject to a trading suspension if any of the following occurs: the listed company continues to violate information disclosure regulations after being placed under trading restrictions.

As a result, HOSE will proceed to suspend trading of DAG shares.

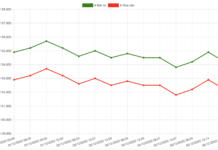

DAG share price movement over the past 6 months Source: Fireant

Previously, in a clarification sent to HOSE on July 31, 2024, regarding the special treatment of DAG shares, Dong A Plastic stated that they were working with UHY Audit and Consulting Company Limited to finalize the necessary accounting figures for the 2023 audited financial statements. However, due to the large volume of work and the need to ensure high accuracy, the company required additional time to align the figures with the auditing firm.

Additionally, Dong A Plastic also needed more time to reorganize its personnel and find suitable candidates for the Board of Directors and Supervisory Board for the term 2020 – 2025, aligning with the company’s governance requirements. The enterprise is also in the process of restructuring.

On July 31, 2024, Dong A Plastic held its 2024 Annual General Meeting of Shareholders.

Regarding business performance, in the first half of 2024, the company’s net revenue stood at only VND 55.3 billion, a significant decrease compared to the beginning of 2024.

After deducting expenses, Dong A Plastic recorded a net loss of VND 66.6 billion for the period. In contrast, at the beginning of 2024, the company reported a net loss of VND 606 billion due to selling products below production costs. From the first quarter of 2023 until now, the company has consistently incurred losses amounting to tens of billions of VND.

As of the end of June 2024, owner’s equity stood at VND 27.2 billion, a nearly threefold decrease compared to the beginning of 2024. Meanwhile, payables increased slightly to VND 1,367 billion, 50 times higher than equity. This indicates the company’s weak financial position.

In the stock market, DAG shares are under warning status and are only allowed to be traded in the afternoon session. Currently, the share price is at VND 1,670 per share, a 6.18% decrease from the reference price and a decline of over 47% compared to the beginning of 2024.