In the latest weekly session ending August 9, the VN-Index surged more than 15 points (+1.32%) to 1,223.6 points, yet compared to the previous week, the index still fell over 1%. Similarly, the HNX-Index dropped by 0.9% to 229.4 points, and the Upcom-Index fell by 1% to 92.8 points.

While weekly liquidity increased, it remained low with transaction values of just over VND 17,000 billion per session. Foreign investors continued to net sell nearly VND 4,000 billion on all three exchanges.

Mr. Barry Weisblatt David, Director of Analytics at VNDIRECT Securities Corporation, predicted that the upcoming rate cuts by the US Federal Reserve (Fed) could push the US Dollar Index (DXY) below 100 points. This would provide the State Bank of Vietnam with more flexibility in injecting liquidity into the market, with expected credit growth of about 14% for the year.

“A positive scenario for the VN-Index to close 2024 above the 1,400-point mark, corresponding to a P/E ratio of 14.8, is feasible,” said Mr. Barry.

VN-Index forecast to be mixed…

In this context, many sectors are expected to offer attractive investment opportunities for the remainder of 2024, especially in banking and steel. Regarding banks, VNDIRECT experts believe that while asset quality has deteriorated, it will recover as the economy improves. Banks are currently trading at an attractive P/B (price-to-book) ratio of 1.7 times, lower than the five-year average.

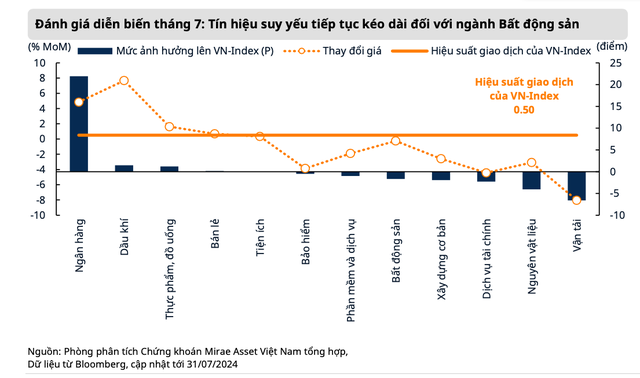

In its August 2024 strategy report, Mirae Asset Securities Vietnam stated that the trading sessions at the beginning of August reflected investors’ risk aversion, especially among domestic individual investors. The downside risk remains as the downward pressure on major global stock markets could negatively affect the VN-Index.

“In a less optimistic scenario, the market will find buying support at attractive valuation regions for the VN-Index – the P/E ratio averaged over the past 10 years is around 1,050 – 1,150 points. The expectation for this support region is based on Vietnam’s improved macroeconomic performance over the past seven months and the trend of recovering corporate profits in the first half of this year,” Mirae Asset experts commented.

Banking sector witnessed positive price movements in July

Meanwhile, according to experts from the Analysis Center of ACBS Securities Company, the VN-Index’s ability to hold the support zone of 1,150 – 1,160 points is considered a challenge for the market in maintaining its medium- and long-term uptrend. Excluding the possibility of a US economic recession, the appropriate scenario for the VN-Index from now until the end of the year is to continue fluctuating within the range of 1,150 – 1,300 points, given the stable macroeconomic situation, positive growth, and relatively attractive overall valuation.

The August 2024 strategy report by Rong Viet Securities Company forecasted a reasonable P/E range of 14-15 times in the third quarter, corresponding to a balanced trading range for the VN-Index of 1,237 – 1,325 points. From now until the end of the year, based on the 14-18% profit growth expectation for listed companies, the market’s reasonable zone is expected to be 1,236 – 1,420 points.

“Selected investment opportunities in the second half of the year include businesses that maintain their recovery and profit growth trends in consumer goods, steel, banking, industrial parks, and seafood sectors. Additionally, the textile industry is a sector that investors can consider revisiting if there is a significant discount in stock prices during market corrections, as the profit trend in this industry is promising,” analyzed Rong Viet experts.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.