The market breadth tilted towards buyers with 329 gainers and 272 losers. The VN30 basket also started to bounce back after a quiet morning, regaining its positive momentum with a balanced breadth of 13 gainers, 13 losers, and 4 stocks trading flat.

The VN-Index witnessed a trading volume of over 225 million shares, equivalent to a value of more than VND 5.5 trillion in the morning session. Meanwhile, the HNX-Index recorded a trading volume of over 19 million shares, with a value of over VND 457 billion.

Source: VietstockFinance

|

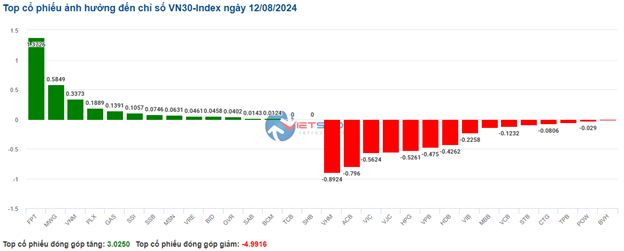

In terms of impact, FPT, GAS, and VCB were the three pillars with the most positive influence on the VN-Index, contributing over 2.5 points to the index’s gain. On the other hand, VHM, VIC, and VPB traded less favorably, taking away more than 1.2 points from the index.

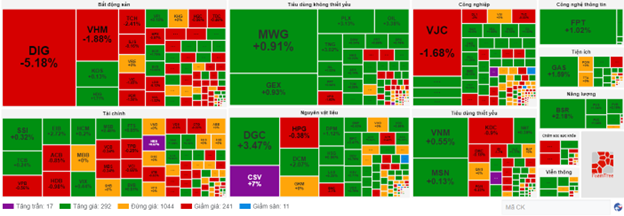

The majority of sectors were painted green, led by the information technology group with a 2.13% increase, mainly driven by the two largest stocks in the sector, FPT (+2.13%) and CMG (+2.56%).

Following closely was the energy sector, which rose by 1.6% in the morning session. Green dominated the oil and gas stocks, with notable performers including BSR (2.18%), PVS (+1.04%), PVD (+0.75%), PVC (+0.77%), and PVB (+1.46%), among others. The utilities and non-essential consumer sectors also traded positively, rising by more than 1%.

On the flip side, real estate was the only sector that witnessed a red dominance, declining by 0.71%. The stocks within this sector exhibited some differentiation, with most of the large-cap stocks dragging down the overall index, such as VHM (-1.34%), VIC (-1.09%), BCM (-0.14%), VRE (-0.29%), KDH (-0.56%), NVL (-0.88%), and DIG (-4.97%). However, several stocks managed to maintain their positive momentum, including KBC (+0.79%), SSH (+0.58%), HDG (+1.52%), SIP (+1.13%), NTC (+2.75%), and TIG (+2.34%), to name a few.

Foreign investors net sold over VND 181 billion on the HOSE in the morning session, with the selling pressure continuing to focus mainly on VJC (over VND 241 billion). On the HNX, they net bought nearly VND 12 billion, concentrating their purchases on TNG.

10:30 AM: Market Hovering Around Reference Level

As buying and selling forces remained balanced, the main indices struggled to break out. As of 10:40 AM, the VN-Index gained 1.4 points, hovering around 1,225 points. Meanwhile, the HNX-Index rose by 0.17 points, trading around 229 points.

Stocks within the VN30 basket displayed a relatively balanced performance, with 13 gainers, 13 losers, and 4 stocks trading flat. Specifically, VHM, ACB, VIC, and VJC took away 0.89 points, 0.8 points, 0.56 points, and 0.55 points from the index, respectively. Conversely, FPT, MWG, VNM, and PLX were among the most bought stocks, contributing over 2.5 points to the VN30-Index.

Source: VietstockFinance

|

The real estate sector was one of the main factors weighing on the market. Within this sector, residential real estate stocks faced the most pressure, declining by 1.03%. Notable losers included VHM, which fell by 2.02%, VIC by 1.09%, KDH by 0.7%, and NVL by 0.88%. Additionally, DIG witnessed a significant drop of over 4% following the news of the passing of DIC Corp’s Chairman, Nguyen Thien Tuan, which was announced over the weekend.

The financial sector also contributed to the market’s pressure, although the decline was not as pronounced due to the mixed performance within the group. The main selling pressure came from banking stocks, such as VPB, which fell by 0.28%, ACB by 0.64%, VCB by 0.11%, and HDB by 0.78%.

On the upside, the energy sector displayed strong momentum and provided support to the market, led by oil and gas heavyweights. These included BSR, which rose by 1.75%, PVS by 1.04%, PVD by 0.56%, and PVB by 2.19%.

Following closely was the telecommunications services sector, which also witnessed a decent increase. Specifically, VGI rose by 1.76%, FOX by 1.92%, CTR by 0.08%, ELC by 2.14%, and FOC by 0.71%.

Compared to the opening, buyers and sellers were engaged in a tight tug-of-war, with over 1,000 stocks trading flat and buyers slightly gaining the upper hand. There were 292 gainers (including 17 stocks that hit the ceiling price) and 241 losers (including 11 stocks that hit the floor price).

Source: VietstockFinance

|

Opening: Cautious Start to the Session

On August 12, as of 9:30 AM, the VN-Index hovered around the reference level, reaching 1,225.19 points. Meanwhile, the HNX-Index also witnessed a slight increase, trading around 230 points.

The VN30 basket displayed a slightly positive performance, with 12 gainers, 10 losers, and 8 stocks trading flat. Among the decliners, VJC, VIC, and VIB were the most notable, while PLX, MWG, and GAS were the top gainers.

The telecommunications services sector stood out as one of the most active industries in the market. Stocks such as VGI, TTN, MFS, TPH, SGT, and SBD all traded in positive territory.

On the other hand, the real estate sector plunged into the red territory right from the start of the session. The decline was driven by stocks such as DIG, VHM, PDR, NVL, DXG, VIC, NTL, and BCM.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.