Market liquidity decreased compared to the previous trading session, with the matching trading volume of VN-Index reaching over 494 million shares, equivalent to a value of more than 12 trillion VND. The trading volume of HNX-Index reached over 39.6 million shares, equivalent to a value of more than 839 billion VND.

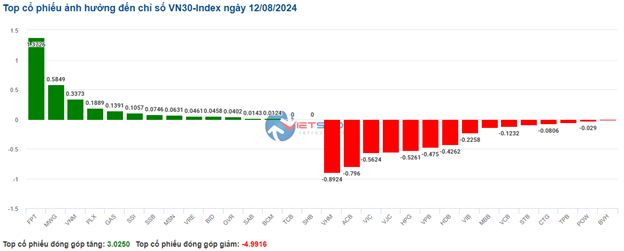

Although the afternoon session started on a less favorable note due to selling pressure causing the index to fall below the reference level, a surprise emerged as buying interest increased, helping VN-Index recover and maintain its green status at the end of the session. In terms of impact, FPT, HVN, GVR, and GAS were the most positive influences on VN-Index, contributing more than 3 points to the index. On the other hand, VHM, VIC, HPG, and VNM had the most negative impact, taking away more than 1.7 points from the overall index.

| Top 10 stocks impacting VN-Index on August 12, 2024 (in points) |

HNX-Index also witnessed a positive performance, influenced by stocks such as PVS (+1.55%), SHS (+1.96%), NTP (+2.49%), and IDC (+0.84%), among others.

|

Source: VietstockFinance

|

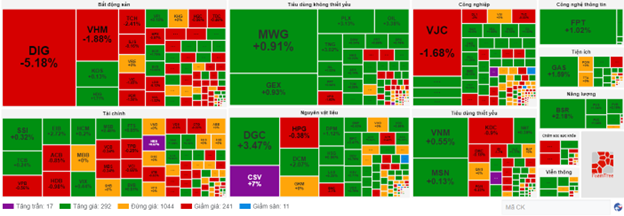

The information technology sector witnessed the strongest growth, with a 4.49% increase, mainly driven by FPT (+2.44%), CMG (+1.97%), CMT (+7.91%), and ITD (+0.39%). This was followed by the telecommunications services sector and the industrial sector, with increases of 1.66% and 1.24%, respectively. On the other hand, the real estate sector experienced the most significant decline in the market, falling by -0.73%, mainly due to losses in VHM (-1.88%), VIC (-1.46%), and VRE (-0.57%).

In terms of foreign investors’ activities, they continued to be net buyers on the HOSE, with a net purchase value of more than 58 billion VND, focusing on stocks such as HDB, FPT, MWG, and CTG. On the HNX, foreign investors net bought over 34 billion VND, mainly investing in PVS, TNG, IDC, and VGS.

| Foreign Investors’ Net Buying and Selling Activities |

Morning Session: Buyers Temporarily Take the Lead

Investors adopted a cautious approach, with buyers and sellers maintaining a tug-of-war around the reference level in the early Monday session. Before the lunch break, buying interest strengthened in the large-cap stocks, helping buyers temporarily gain the upper hand. By the end of the morning session, VN-Index stood at 1,227.38 points (+0.31%), while HNX-Index edged up 0.02% to 229.43 points.

The market breadth tilted in favor of buyers, with 329 stocks rising and 272 stocks declining. The VN30 basket, after a relatively quiet morning, started to bounce back, with 13 stocks advancing, 13 declining, and 4 remaining unchanged.

The trading volume on the VN-Index reached over 225 million units, equivalent to a value of more than 5.5 trillion VND in the morning session. On the HNX-Index, the trading volume reached over 19 million units, with a value of over 457 billion VND.

Source: VietstockFinance

|

In terms of impact, FPT, GAS, and VCB were the top three positive contributors to VN-Index, adding more than 2.5 points to the index. Conversely, VHM, VIC, and VPB traded less favorably, taking away more than 1.2 points from the index.

Green dominated most sectoral indices, with the information technology sector leading the gains with a 2.13% increase, mainly driven by two large-cap stocks, FPT (+2.13%) and CMG (+2.56%).

The energy sector followed closely with a 1.6% increase in the morning session. Green engulfed oil and gas stocks, notably BSR (2.18%), PVS (+1.04%), PVD (+0.75%), PVC (+0.77%), and PVB (+1.46%), among others. The utilities and non-essential consumer goods sectors also traded positively, with gains of over 1%.

On the flip side, the real estate sector was the only sector to be engulfed by red, declining by 0.71%. Stocks within the sector exhibited mixed performances. Specifically, large-cap stocks such as VHM (-1.34%), VIC (-1.09%), BCM (-0.14%), VRE (-0.29%), KDH (-0.56%), NVL (-0.88%), and DIG (-4.97%) dragged the sectoral index down. Meanwhile, several stocks managed to retain their positive momentum, notably KBC (+0.79%), SSH (+0.58%), HDG (+1.52%), SIP (+1.13%), NTC (+2.75%), and TIG (+2.34%), among others.

Foreign investors net sold over 181 billion VND on the HOSE in the morning session, with the selling pressure concentrated mainly on VJC (over 241 billion VND). On the HNX, they net bought nearly 12 billion VND, with the highest net purchase in TNG.

10:30 AM: Tug-of-War Around the Reference Level

The balance between buying and selling forces in the market prevented the indices from breaking out. As of 10:40 AM, VN-Index edged up 1.4 points, hovering around 1,225 points, while HNX-Index gained 0.17 points, trading around 229 points.

Stocks within the VN30 basket painted a mixed picture, with VHM, ACB, VIC, and VJC being the top negative contributors, taking away 0.89 points, 0.8 points, 0.56 points, and 0.55 points from the index, respectively. Conversely, FPT, MWG, VNM, and PLX witnessed strong buying interest and contributed over 2.5 points to VN30-Index.

Source: VietstockFinance

|

The real estate sector was a major drag on the market, with residential real estate stocks declining by 1.03%. Large-cap stocks such as VHM (-2.02%), VIC (-1.09%), KDH (-0.7%), and NVL (-0.88%) led the decline. Notably, DIG witnessed a sharp drop of more than 4% following the news of the passing of Nguyen Thien Tuan, Chairman of DIC Corp, which was announced over the weekend.

Additionally, the financial sector exerted pressure on the market, although the decline was not significant due to mixed performances within the group. Selling pressure mainly came from banking stocks such as VPB (-0.28%), ACB (-0.64%), VCB (-0.11%), and HDB (-0.78%).

On the upside, the energy sector displayed robust growth, providing support to the market. This sector’s performance was driven by BSR (+1.75%), PVS (+1.04%), PVD (+0.56%), and PVB (+2.19%), among others.

The telecommunications services sector also witnessed a positive performance, with notable gains in VGI (+1.76%), FOX (+1.92%), CTR (+0.08%), ELC (+2.14%), and FOC (+0.71%).

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 1,000 stocks unchanged and buyers slightly gaining the upper hand. There were 292 stocks that advanced (17 of which hit the ceiling price) and 241 stocks that declined (11 of which hit the floor price).

Source: VietstockFinance

|

Opening: Cautious Start to the Session

At the start of the August 12 session, as of 9:30 AM, VN-Index fluctuated around the reference level, reaching 1,225.19 points. HNX-Index also edged higher, trading around 230 points.

Green slightly outnumbered red in the VN30 basket, with 10 declining stocks, 12 advancing stocks, and 8 unchanged stocks. Among them, VJC, VIC, and VIB were the top losers, while PLX, MWG, and GAS were the top gainers.

The telecommunications services sector stood out as one of the most vibrant sectors in the market, with stocks such as VGI, TTN, MFS, TPH, SGT, and SBD painting a positive picture.

Conversely, the real estate sector plunged into red territory right at the opening bell. Selling pressure was concentrated in residential real estate stocks, including DIG, VHM, PDR, NVL, DXG, VIC, NTL, and BCM.

Ly Hoa