State Capital Investment Corporation (SCIC) has released its consolidated financial statements for Q2 2024, reporting a 36% year-on-year decrease in net revenue to VND 1,264 billion.

Despite the decline in revenue, SCIC’s gross profit increased to VND 2,718 billion due to a significant increase in the reversal of impairment losses on investments. After deducting expenses, SCIC’s tax profit for the quarter stood at VND 2,352 billion.

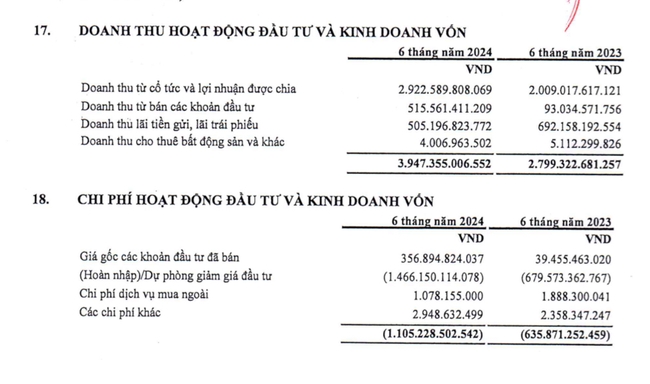

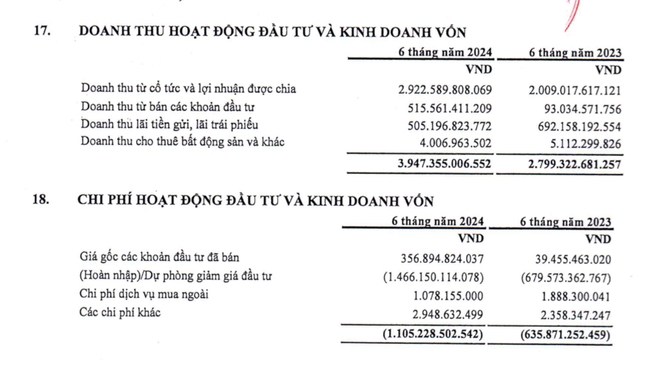

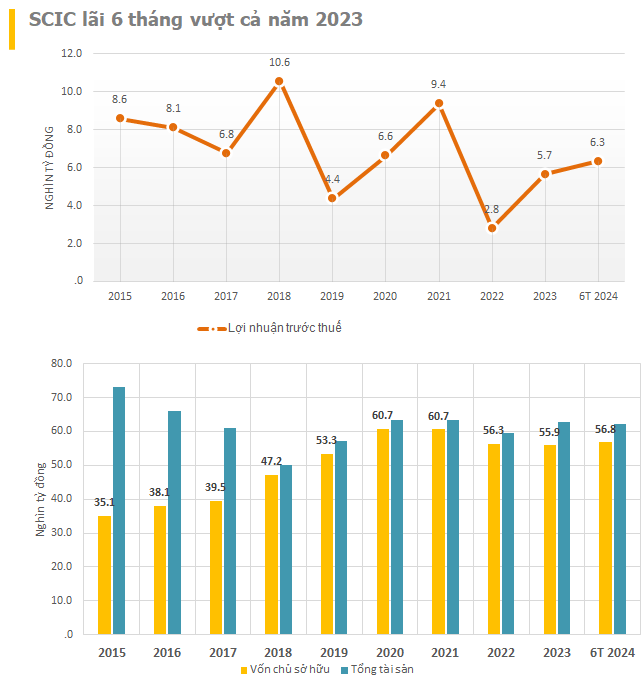

For the first half of the year, the company recorded a 41% increase in revenue to VND 3,947 billion and a 95% surge in net profit to VND 5,917 billion compared to the same period last year. This figure has already surpassed SCIC’s full-year profit for 2023.

As of June 30, 2024, SCIC’s total assets amounted to VND 62,310.5 billion, with equity standing at VND 56,792 billion. The company holds VND 7.5 billion in cash and cash equivalents, along with nearly VND 27,893 billion in short-term bank deposits and over VND 4,000 billion invested in stocks.

The company’s management also noted that at the time of preparing the consolidated financial statements for Q2 2024, SCIC had not yet obtained the financial statements for the same period from Vietnam Television Tower Joint Stock Company and Vietnam Airlines Corporation Joint Stock Company.

Currently, SCIC has one subsidiary, State Capital Investment Corporation Limited Company (100%), and five associated companies: Laos-Vietnam International Port Joint Stock Company (27%); State Capital Investment Corporation – Bao Viet Joint Stock Company (50%); Vietnam Television Tower Joint Stock Company (33%); Vietnam Investment Consulting and Investment Joint Stock Company (30%); and Vietnam Airlines Corporation Joint Stock Company (31.14%).

Photo: SCIC’s six-month profit surged by 95%, surpassing the figure for the entire 2023.

In the first half of the year, SCIC received approximately VND 3,000 billion in dividends and profit sharing.

Leading the way in terms of dividend payments to SCIC was Saigon Beer, Alcohol and Beverage Joint Stock Company (Sabeco, stock code SAB) with nearly VND 693 billion, followed by Vietnam Dairy Products Joint Stock Company (Vinamilk, stock code VNM) with VND 677 billion. Vietnam Investment Consulting and Investment Joint Stock Company contributed VND 600 billion.

The combined contribution of these three companies totaled nearly VND 2,000 billion, accounting for almost 63% of SCIC’s total dividends and profit sharing for the period.

According to SCIC’s capital divestment plan, the company aims to divest from 58 enterprises in 2024, including both listed and unlisted companies.

The recently published divestment lists feature prominent names on the stock exchange, such as NTP Plastic Joint Stock Company (stock code NTP), FPT Corporation (stock code FPT), Seaprodex Vietnam Joint Stock Company (stock code SEA), Vietnam Electronics and Informatics Corporation (stock code VEC), Vietnam Water and Environment Investment Joint Stock Company (stock code VIW), and Domesco Health Import-Export Joint Stock Company (stock code DMC), among others.

However, divestment from these companies has not yet been realized in the first half of 2024. Among them are much-anticipated transactions like the divestment from NTP and FPT.